-

The Asian-American bank agreed to buy SWNB Bancorp for $77 million.

May 22 -

On the first day of the 2018 CUNA CFO Council conference, futurist Mike Walsh gave credit unions a hint of the world to come from both a consumer and business point of view.

May 21 -

State Bank popped up on the Houston company’s radar eight years ago, but management waited until now to strike.

May 14 -

The Houston company had been an interested, but selective, acquirer before announcing this year's biggest bank deal.

May 14 -

Local 142 Federal Credit Union officially became part of Air Force FCU at the end of April.

May 2 -

Three corporate credit unions now fund the check-processing services LLC.

May 2 -

Spirit of Texas Bancshares plans to raise $40 million to fund organic growth and acquisitions.

April 27 -

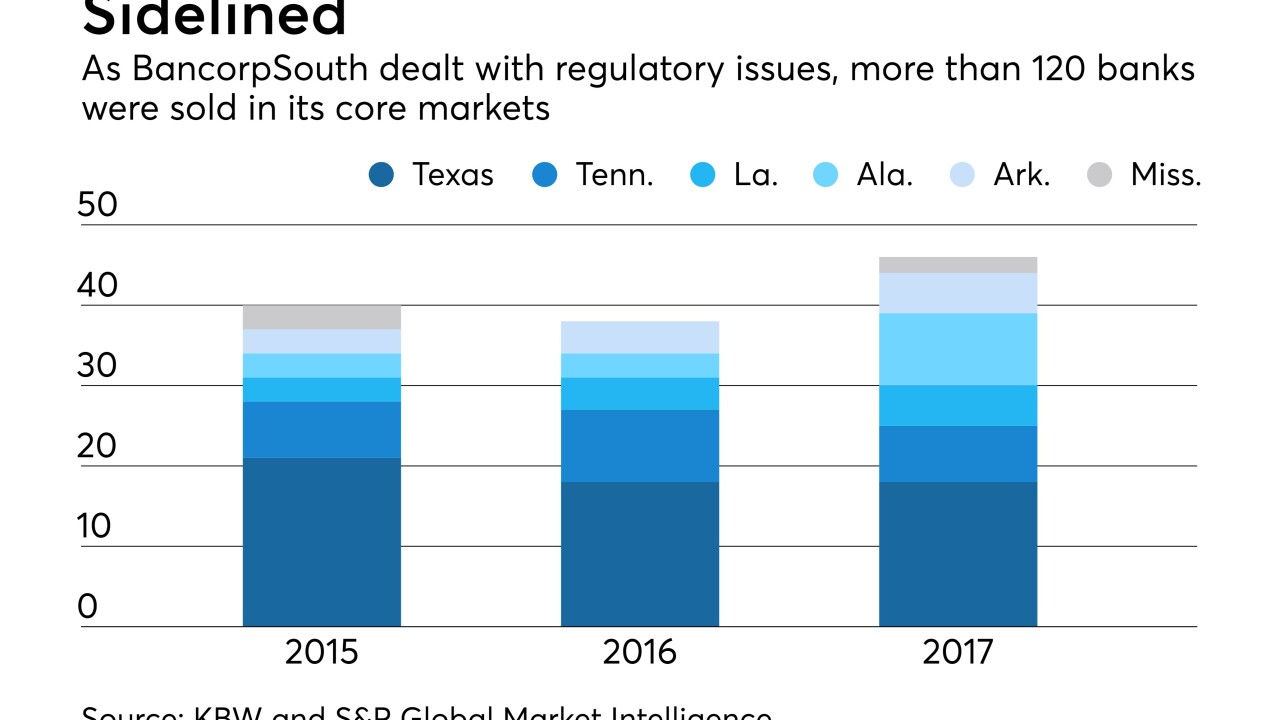

Dan Rollins engineered nearly a dozen deals while at Prosperity Bank. Now CEO at BancorpSouth, he has returned to M&A after spending four frustrating years dealing with compliance issues.

April 26 -

BancorpSouth, which had two prior deals delayed over BSA and CRA issues, has agreed to buy a bank in the Houston area.

April 19 -

However, mortgage growth and servicing income weren't the only reasons profits rose by double digits at the Dallas bank.

April 18 -

The credit union changed its name to reflect a wider field of membership.

April 12 -

Credit unions have seen a slew of legal victories in lawsuits claiming CUs' websites violated the Americans with Disabilities Act, but there are fears attorneys pursuing those cases may be changing their strategy.

April 5 -

The Arlington, Texas-based credit union now has more than $1.2 billionin assets and serves more than 114,000 members. The merger was first announced last spring.

April 3 -

The $10.6 million-asset credit union has selected Credit Union Resources, Inc. to conduct a search for CEO Cecil Barker's replacement.

March 21 -

Independent Bank Group said the firms had become shareholders after it bought Carlile Bancshares last year.

March 16 -

Experts say that despite having a few suits thrown out, the matter won't be settled until the Department of Justice provides clarity. But there are steps CUs can take to protect themselves until then.

March 15 -

Banks and payment companies have long been wary of the political and reputational risks of supporting gun sellers. But gun sellers know their customers better than most other merchant categories.

March 13 -

The name change is tied to a field-of-membership expansion, as the credit union moved from a SEG-based institution to a community charter.

March 5 -

Newly expanded Justice Federal Credit Union now has 27 branches in 8 states, plus D.C.

March 2 -

Plaintiff voluntarily dismisses lawsuit 8 days after CU trade associations file amicus briefs.

March 2