Paul Murphy patiently waited for the right time to buy State Bank Financial and enter a crowded Atlanta market.

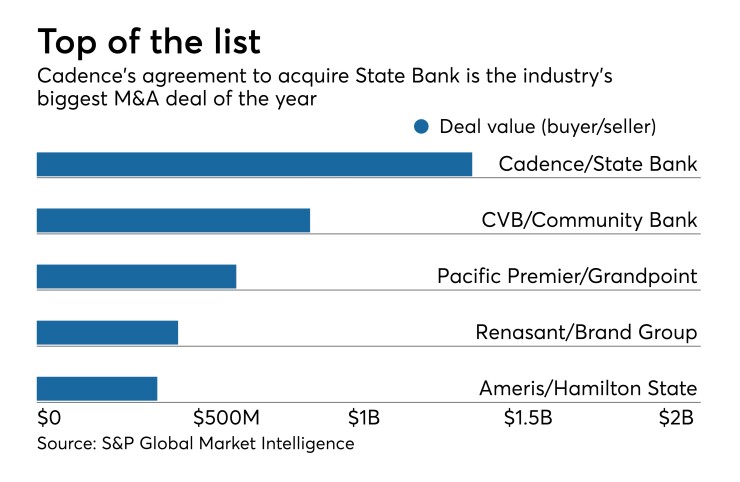

Murphy, chairman and CEO of Cadence Bancorp. in Houston, struck a deal over the weekend to buy the $5 billion-asset State Bank

It took some time to the deal to come together: Murphy first met Joe Evans, State Bank's chairman, in 2010. That meeting sparked Murphy's interest in State Bank. Evans even traveled to Houston in 2012 to meet executives at the $11 billion-asset Cadence.

“I’ve tracked their progress and compared notes with them often over the past eight years,” Murphy said during a Monday conference call to discuss the deal.

“This relationship started a long time ago,” Evans added during the call. “We’ve spent a lot of time together ... comparing notes, comparing philosophies and [we] believe this combination is going to result in a really powerful regional bank.”

The transaction shows how showing restraint can benefit a disciplined acquirer. Cadence's last bank acquisition closed in September 2012.

It also continues what an analyst called the

“It’s a big move for Cadence into a new geography,” Brady Gailey, an analyst at Keefe, Bruyette & Woods, wrote in a note to clients. “Earnings accretion is material at 6% to 7%, and Cadence will earn back the tangible book value dilution in roughly three years, which is attractive.”

“All in all, we view the deal positively,” added Michael Rose, an analyst at Raymond James.

Georgia is a natural expansion for Cadence, which already has branches in Alabama, Florida and Mississippi.

Sam Tortorici, CEO of Cadence Bank, said his company is enthusiastic about several Georgia markets, including Macon, Augusta and Savannah. Still, gaining access to Atlanta’s huge banking market, with its $163 billion in deposits, was the big draw.

“Atlanta is home to almost 6 million people, more than 220,000 businesses, and is the 10th- largest economy in the United States,” Tortorici said during the conference call. “So you can see the nice upside potential.”

Atlanta is the second major market that Cadence has recently announced plans to enter. Last month, the company said it had opened a loan production office in Dallas, hiring veteran banker Todd Cornelius to lead its team there.

Cadence plans to move its bank's headquarters to Atlanta from Birmingham, Ala., once the deal closes. The company plans to eliminate about 30% of State Bank's annual noninterest expense, with most of the cuts taking place by mid-2019. While Cadence excluded revenue gains from its financial assessment, Murphy said those opportunities could be significant.

Cadence, for instance, will have a chance to test its prowess as a middle-market commercial-and-industrial lender in Atlanta, while State Bank will allow it to start making asset-based and Small Business Administration loans. And Murphy isn't waiting until the deal closes to leverage those new businesses.

“I’ve got a prospect for AloStar,” Murphy said, referring to the asset-based lender that State Bank bought in October. "We’re getting started today on a great potential new piece of business for them. There will be more and more of that.”