-

Prodigy, a fintech focused on mobile solutions for credit unions, has a new CEO in the wake of a retirement.

March 4 -

All but a handful of states now allow a gamified way for consumers o save money, and some credit unions have adopted these programs to help boost deposits.

January 7 -

Organizers of Bank of St. George still need to raise $18 million before opening.

December 30 -

The company, which plans to become Altabancorp, said the initiative removes brand confusion and puts its size and scale on display.

November 12 -

More details have surfaced about Interactive Brokers' planned bank. It would accept deposits and originate loans through an online channel only, its application says.

November 7 -

A group affiliated with Interactive Brokers Group has filed an application with the FDIC to form Interactive Bank.

November 5 -

There are opportunities to make loans for strip malls and regional distribution centers but executives need to put the right risk management in place.

August 9 -

The group behind Bank of St. George is looking to bring in up to $22 million in initial capital.

June 7 -

Michael Ward, a former CEO at Mrs. Fields Famous Brands, has been a Prime Alliance director for 14 years.

June 4 -

The institution had considered a merger of equals that was never finalized before deciding to change its name to Elevate Credit Union.

April 25 -

Organizers of the Bank of St. George have filed an application with the FDIC and state regulators and plan a public stock offering.

April 11 -

FNB Bancorp in Utah, which is being sold to Glacier Bancorp, decided that the Montana bank's decentralized model would save jobs and give its management team more autonomy.

March 1 -

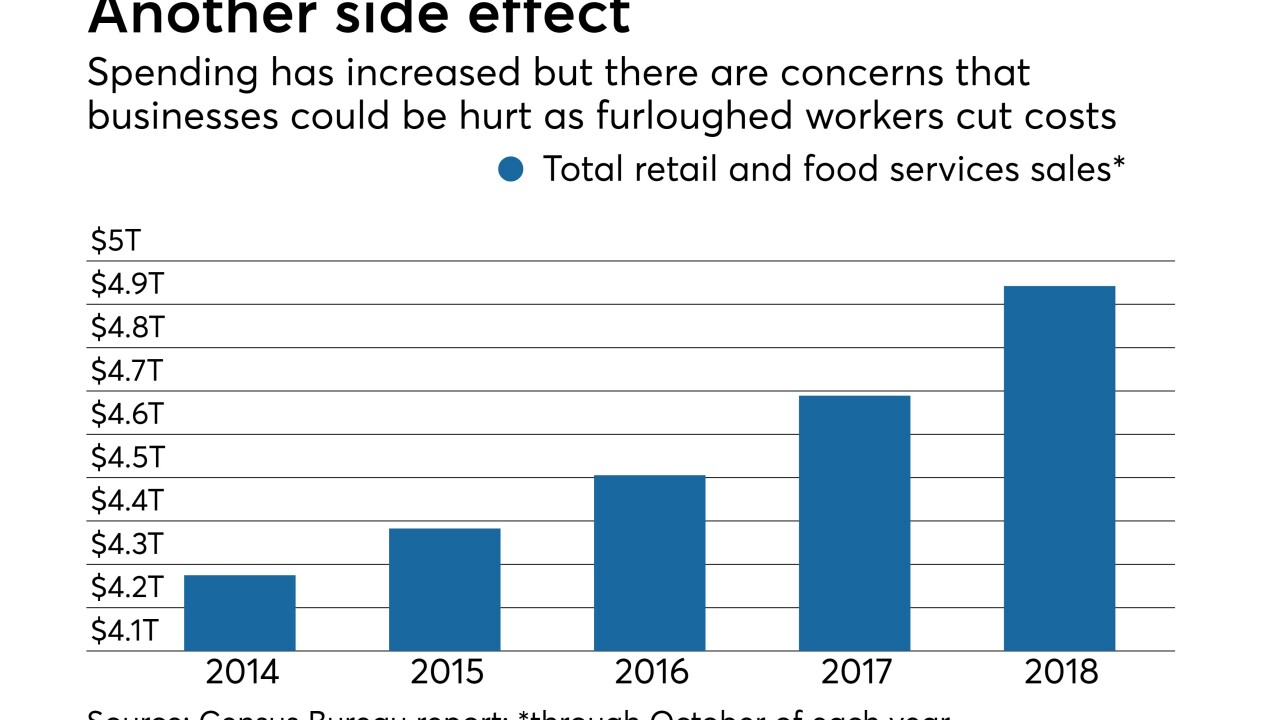

Credit union and bank executives say the federal work stoppage hasn’t hit business lines yet, but that could change if things drag on much longer.

January 18 -

The Montana company will more than double its assets in Utah when it buys FNB Bancorp.

January 17 -

Shane Knighton, who previously worked at Member Business Lending, will take over for the retiring Gordon Dames, who served as interim CEO.

January 9 -

The Utah-based CU is issuing a nearly $2 million rebate for 2018 and has returned $13 million to members over last 15 years.

November 30 -

The name change comes after the company recently won "Best in Show" at the annual CUNA Tech Council conference.

November 2 -

The Salt Lake City bank said consumer loans rose 7% from a year earlier. That was one of its several quarterly highlights.

October 22 -

The student loan servicer called the move a "temporary step back" in what it had expected to be a lengthy process.

September 26 -

Zions is streamlining its 500 deposit products as part of a massive core conversion, and its female executives are leading the effort.

September 23