-

Financial institutions and authorities could better track money launderers if legalized-marijuana-related businesses were not included in SARs.

September 24 North Bay Credit Union

North Bay Credit Union -

The future of Fannie Mae and Freddie Mac, the Fed’s supervisory regime for the biggest financial institutions, reform of the Community Reinvestment Act and a host of other industry-related issues are on the ballot this November.

September 17 -

Legislation favorable to the industry would be unlikely to pass in a divided Congress, but the biggest benefit for banks and credit unions of Republicans' retaining control of the chamber would be defending against the disruption of a Democratic blue wave.

September 14 -

The Democrats’ presumptive presidential nominee called for a public credit reporting agency and for the Postal Service to offer financial services, among other proposals issued through a unity task force with Bernie Sanders. But analysts suggest the recommendations are more about electoral politics than pushing for real reforms.

July 9 -

Bankers have become more uncertain about how to serve marijuana businesses owing to confusion about which states deem them essential.

June 4 FS Vector

FS Vector -

Several Senate Banking Committee members from both parties are facing tough reelection challenges in a year when control of the entire chamber — and the banking policy agenda — may be up for grabs.

May 29 -

Bankers have become more uncertain about how to serve marijuana businesses owing to confusion about which states deem them essential.

May 27 FS Vector

FS Vector -

If Democrats retake both the White House and Senate in the 2020 election, analysts see threats to the industry from the appointment of new regulators and possible reversal of Trump-era deregulation. But legislation imposing new rules on financial institutions would face long odds.

May 21 -

The proposal would give a safe harbor to financial institutions that work with cannabis companies in states where the substance is legal. But the bill, which would direct $3 trillion in aid to struggling households, businesses and local governments, faces long odds in the Republican-controlled Senate.

May 12 -

The NACUSO annual gathering and a new event focused on cannabis banking for the industry have both been shuttered.

March 18 -

Financial institutions’ legislative agenda was already a low priority in Congress. Lawmakers’ efforts to stabilize the economy have shifted attention even farther away from bills that would benefit the industry.

March 16 -

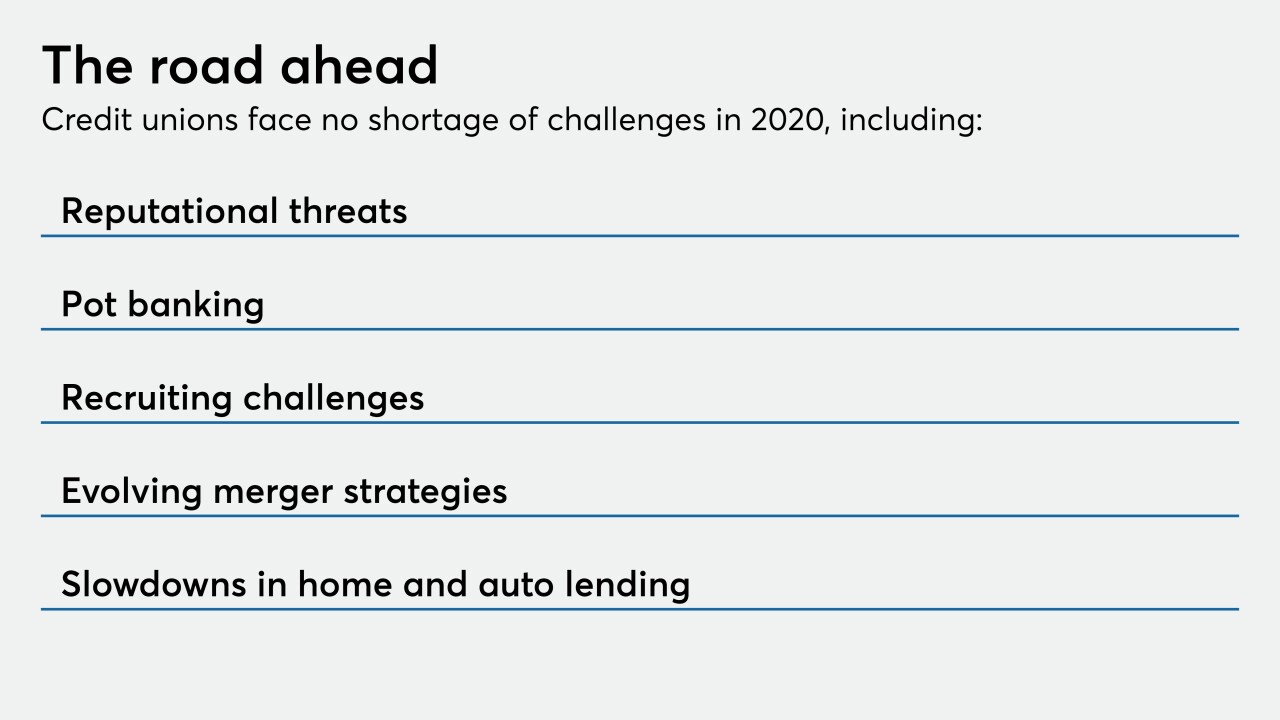

A look back at CU Journal's latest special report on the challenges the industry could face in the year ahead.

February 3 -

Lawmakers are close to solving one of the financial services industry's biggest headaches. It's in the public's interest for them to do so.

January 28 Bressler, Amery & Ross P.C.

Bressler, Amery & Ross P.C. -

The pot banking bill is a long shot after recent criticism by the Senate Banking chairman, but some groups are trying a new argument in a last-ditch effort to sway lawmakers.

January 27 -

The pot banking bill is a long shot after recent criticism by the Senate Banking chairman, but bankers are trying a new argument in a last-ditch effort to sway lawmakers.

January 26 -

President Trump's impeachment trial could get underway in the Senate this week, making it even harder for the movement's legislative priorities to gain traction.

January 13 -

From the presidential election to Supreme Court cases, growth strategies and more, these are the issues that could define the next 12 months.

January 9 -

The SAFE Banking Act is on hold after Sen. Mike Crapo announced his opposition to it. One observer suggested that could have a "chilling effect" on CUs looking to enter the pot banking space.

January 6 -

The window to change beneficial-ownership rules or pass other measures will be narrow, but some legislative efforts from 2019 will carry over and House Democrats will resume inquiries of certain industry CEOs and Trump-appointed regulators.

January 1 -

Sen. Mike Crapo delivers a crushing blow to pot banking efforts; the CFPB draws notice for its lack of fair lending enforcement; Rep. Maxine Waters says she will call on Wells Fargo board to testify next year; and more from this week's most-read stories.

December 20