-

Lawmakers will hear from a credit union executive on cannabis banking while also considering issues such as the use of alternative data in underwriting.

July 22 -

Readers react to House lawmakers attempting to overhaul the credit bureaus, express sarcasm to the Senate Banking Committee eyeing cannabis banking, criticize Sen. Elizabeth Warren's plans to overhaul Wall Street and more.

July 18 -

Only one CU in West Virginia wants to enter the pot banking space, but they're going against the grain not just of the state's credit union league but an industry where fewer than 1% of institutions are serving that market.

July 3 -

The fast-growing data company, which says its mission is to help banks be better consumer advocates, will use its cash infusion for hiring, software development and new partnerships.

June 25 -

The House passed a spending bill amendment aimed at providing further clarity to banks looking to provide services to cannabis businesses.

June 20 -

Credit union executives discussed serving the legal marijuana and hemp businesses during NAFCU's annual conference in New Orleans, including vastly different motivations for serving the industry.

June 20 -

Hard sell ahead for BB&T-SunTrust as ‘Truist’ lands with a thud; Citizens looks to poach BB&T-SunTrust talent; what the Senate AML bill means for banks; and more from this week’s most-read stories.

June 14 -

With campaigning for the 2020 presidential election already underway, it could become increasingly difficult for the industry to move meaningful legislation through Congress.

June 12 -

Recent legislation zeros in on letting financial institutions serve cannabis businesses in states where the substance is legal, but banks may stay on the sidelines if the federal ban on pot remains in place.

June 11 -

Nominated for a full term at the central bank, Michelle Bowman told senators that bankers should not fear repercussions for servicing hemp growers after the crop was legalized.

June 6 - cuj bulletin lead

From data privacy to robocalling, industry leaders chime in on the biggest regulatory and congressional issues at stake for the remainder of the year.

June 5 -

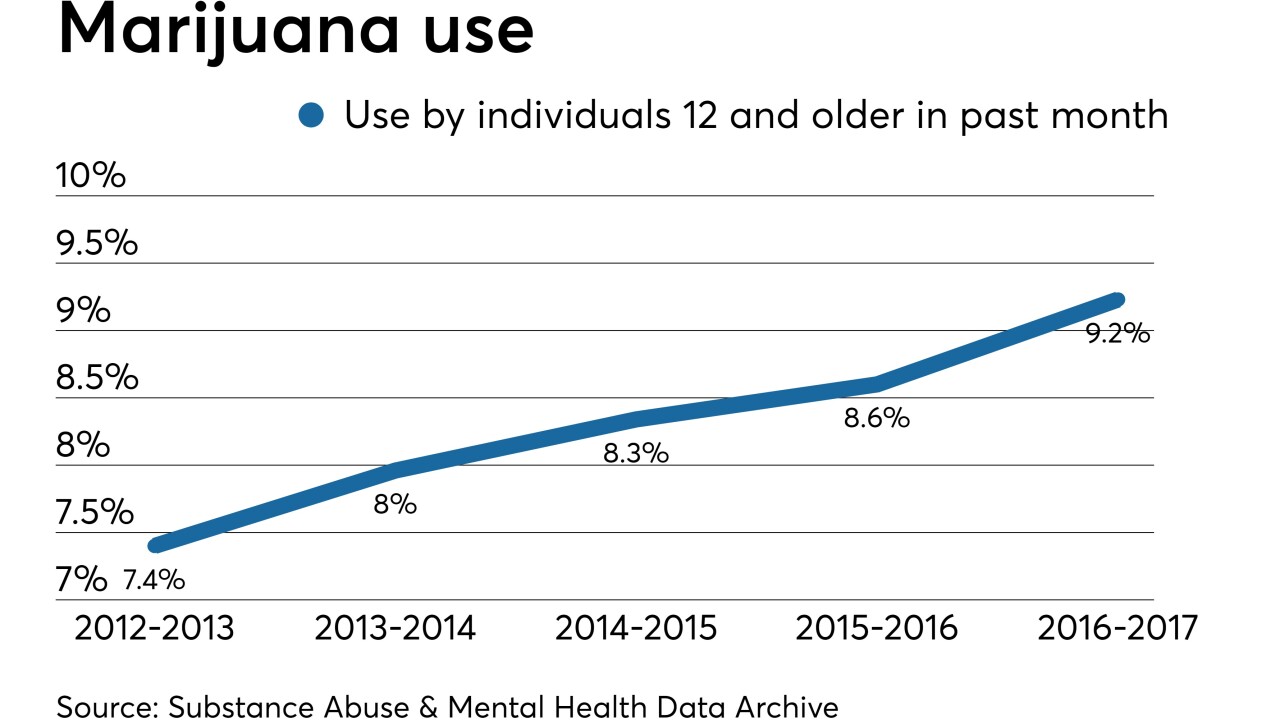

It's a multibillion-dollar industry in a state of payments-regulation limbo and as a result, the U.S. cannabis business has mainly operated on a cash basis.

May 31 -

As Democrats keep the heat on the German bank over allegations that it suppressed reporting tied to Trump businesses, the Treasury secretary said he will direct the Financial Crimes Enforcement Network to look into the matter.

May 22 -

The legislation faces a tougher path in the Senate where GOP leaders are reluctant to ease restrictions on what is still a banned narcotic.

May 21 -

Ask 453 bankers their forecasts on loan demand and the economy, or their feelings about the BB&T-SunTrust merger, pot banking as well as other hot issues, and a clear picture emerges. Promontory Interfinancial Network recently did just that, and here our five takeaways from the results.

May 15 -

Eileen Murray has talked about leaving Bridgewater; A deal with Roger Ng could lead to charges against Goldman and its employees.

May 7 -

Two attorneys told a credit union audience the growing wave of marijuana legalization could have just as big an impact on financial institutions that don't serve the cannabis industry as those that do.

May 3 -

In a roundtable discussion, the heads of four banks called on Congress to move on CRA modernization and address the cannabis conundrum, while dismissing arguments that midsize banks need to merge to stay competitive.

April 11 -

The attorney general told lawmakers that exempting states that have legalized marijuana from the federal ban is better than the current system where state and federal laws are in conflict.

April 11 -

The attorney general told lawmakers that exempting states that have legalized marijuana from the federal ban is better than the current system where state and federal laws are in conflict.

April 11