-

CommonBond, a New York firm that makes student loans through an online platform, said Tuesday that it has raised more than $275 million in debt funding from Barclays and others.

January 5 -

Opportunities abound, in affordable housing, capital raising, consumer lending and more. We aim to get you thinking about how new developments on many fronts could affect your business as you plan for the coming year and beyond.

January 3 -

Once billed as a safer alternative to traditional finance, the new crop of tech-powered lenders is starting to resemble previous generations of finance companies whose fortunes rose and fell with each economic cycle.

December 29 -

Everyday investors provide marketplace lenders a cushion in case institutional buyers find greener pastures. But regulatory hurdles and an addiction to fast growth are making it difficult for the platforms to lure those coveted savers.

December 28 -

A year ago we asked BankThink contributors to make bold predictions about how the financial industry would evolve in 2015. Here's a look back at their forecasts and the actual outcomes.

December 24 -

Lending Club, the nation's largest marketplace lender, announced Tuesday that it has raised interest rates on its new loans by an average of 0.25% in the wake of the Federal Reserve Board's recent rate hike.

December 22 -

IMGCAP(1)]

December 18 -

The Consumer Financial Protection Bureau has ordered payday and pawn lender EZCorp Inc. to pay $10.5 million for alleged illegal debt collection tactics.

December 17 -

Ally Financial, seeking new sources of customers, will finance used cars sold through Beepi, an 18- month-old website that lets people buy vehicles with a few clicks and no test drive.

December 17 -

The $933-million asset institution said in a press release Tuesday that the technology, provided by Louisville-based R.C. Giltner Services, will enable consumer and small-business customers to complete the loan application process in minutes.

December 16 -

California regulators on Monday identified 14 companies that the state is targeting as part of its recently announced inquiry into the marketplace lending industry.

December 14 -

Relations between banks and fintech companies are starting to thaw as the two sides begin to acknowledge the advantages of scale that exist when they join forces.

December 14 -

The Irvine, Calif.-based company plans to offer subprime borrowers the ability to get an auto loan online or through a smartphone.

December 14 -

The first state inquiry into marketplace lending is seeking information from a broad mix of companies, including consumer lenders, small-business lenders, and firms that are not primarily in the lending business.

December 11 -

News that two suspected terrorists took out a loan with a prominent marketplace lender has fueled fears online lending is more susceptible to terrorist financing. Yet experts said that the criticism directed at the industry appears unfounded. Here's why.

December 11 -

California officials have opened a broad inquiry into the marketplace lending business, seeking data from industry participants that will be used to assess the effectiveness of the state's current regulatory regime.

December 11 -

The Dec. 2 mass shooting has shone a light on the sector's vulnerability to borrowers who, exploiting the absence of face-to-face contact on the Internet, lie on their loan applications.

December 10 -

Despite their own vast resources, some large banks are partnering with fintech startups to help them meet the needs of one of their trickiest market segments: small businesses

December 10 -

Washington Federal is the latest bank to partner with a tech company in an effort to streamline online loan applications.

December 9 -

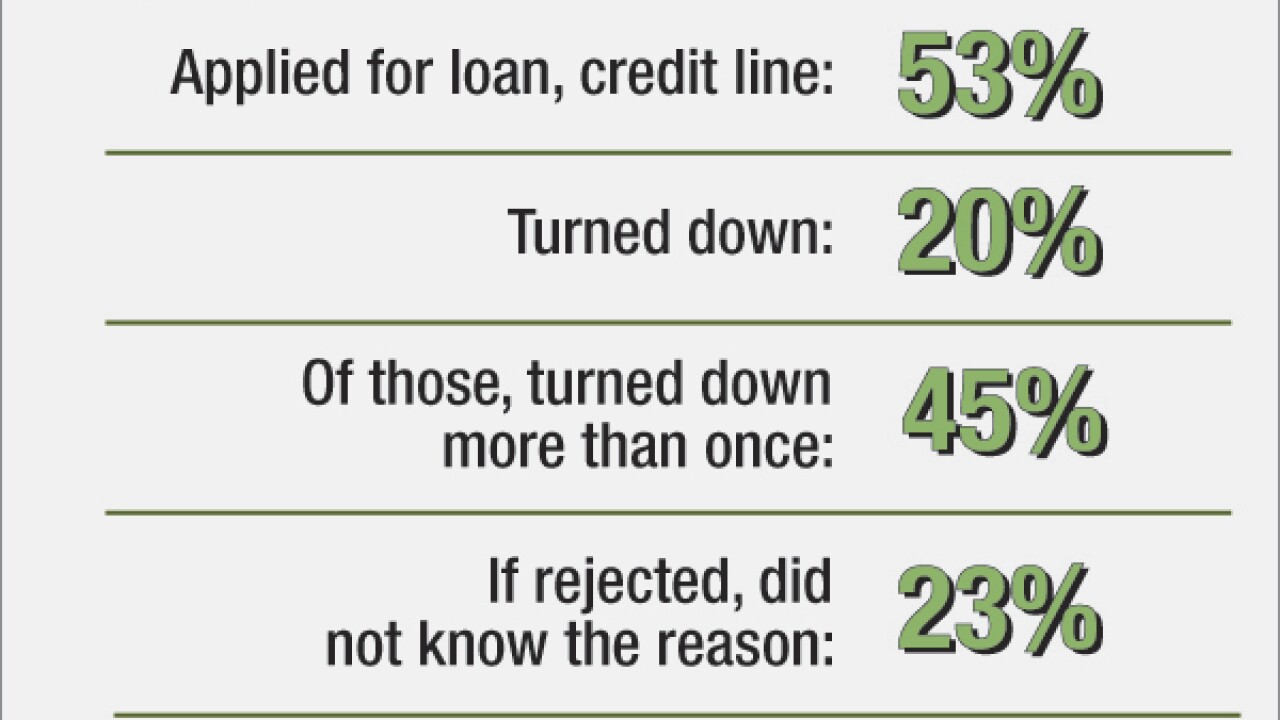

Small-business owners' optimism about the economy is dwindling, which casts a dark cloud over banks' lending efforts, according to a new survey conducted by Wells Fargo and Gallup.

December 8