M&A

M&A

-

M&T had long coveted the Connecticut regional but couldn't make a deal work. Their merger is the latest example of regional banks joining forces to compete in an industry undergoing rapid transformation.

February 22 -

The five-year pledge, tied to the company's pending acquisition of CIT Group, earmarks nearly $6 billion for small-business lending and $3.2 billion for affordable housing.

February 22 -

The Office of the Comptroller of the Currency issued a prompt corrective action directive to First National Bank and Trust in January, requiring it to hire a forensic auditor and provide the OCC with access to documents and records.

February 22 -

The deal for the $63 billion-asset People's United would create a company with more than $200 billion of assets and a branch network stretching from Maine to Virginia. Buffalo, N.Y.-based M&T has not made an acquisition since buying Hudson City Bancorp in late 2015.

February 22 -

The company has agreed to pay $32 million for a bank with six branches and $256 million of assets.

February 18 -

The Houston-based lender is working with financial advisers to solicit interest from potential buyers, according to people familiar with the matter.

February 18 -

Acquiring AmeriHome would provide the fee revenue the Phoenix company seeks to compensate for low interest rates and tepid commercial loan demand. The deal also would allow it to reinvest billions of dollars of excess liquidity.

February 17 -

The Arizona company will pay $1 billion for the parent of AmeriHome Mortgage, which manages a $99 billion mortgage servicing portfolio.

February 16 -

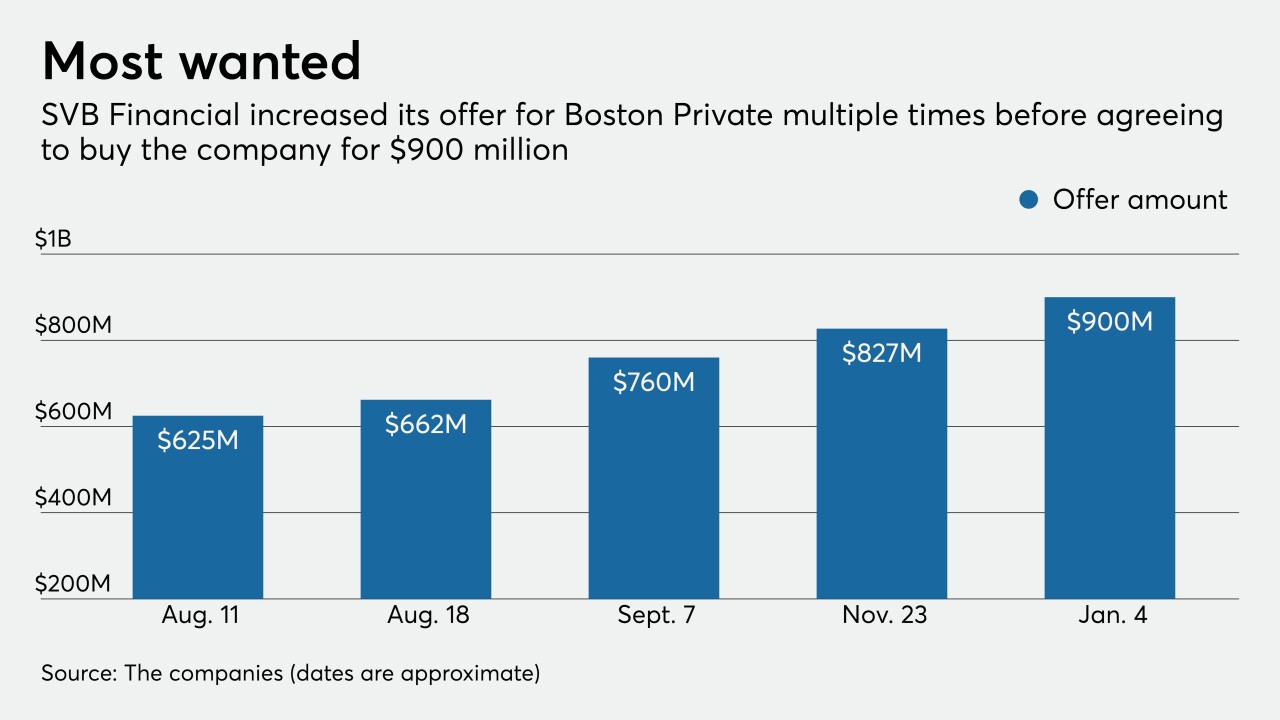

The leadership at Boston Private Financial Holdings wanted to establish a wealth management partnership with SVB Financial Group — but ended up striking a deal to sell the company to SVB instead.

February 16 -

Gov. Michelle Bowman said the agency's analysis of certain deals should weigh the competitive threats posed by technology companies and nonbanks.

February 16 -

A planned combination with Premier Federal Credit Union in Greensboro, N.C., will expand the Charlotte-based credit union's reach in the Tar Heel State.

February 16 -

A deal to merge with First General Credit Union in Norton Shores, Mich., will extend the Detroit-area institution's reach across the state.

February 12 -

Mike Cagney’s blockchain lending startup Figure Technologies plans to raise $250 million through a new blank-check company, according to an SEC filing.

February 12 -

ATG Trust, which has $387 million of assets under management, handles land trusts and administers court-supervised guardianships.

February 10 -

The blank-check company will hunt for deals in the financial services industry in both developed and emerging markets.

February 10 -

HoldCo Asset Management wrote in a letter to the Boston company's chairman that it also wants the board to consider share repurchases to improve shareholder value.

February 9 -

The combined institution will hold assets of more than $335 million and serve over 20,000 members across eight counties in Oregon.

February 9 -

Wells Fargo is opting to keep its private-label credit card unit after reaching out to potential buyers last year, according to a person with knowledge of the matter.

February 9 -

The tech giant says it will benefit heavily from its 2019 purchase of Worldpay as it seeks to provide digital payment services to merchants.

February 9 -

When its proposed sale to Suncoast Credit Union fell through, Apollo Bank decided to step up commercial lending and revamp its digital offerings in anticipation of an economic rebound in South Florida.

February 8