M&A

M&A

-

The company said it has concerns about a large amount of accounts receivable it bought in July.

August 10 -

Prior to the merger, First Castle was the nation's second-oldest existing federally chartered credit union.

August 7 -

Spinning off its digital bank will allow Pennsylvania-based Customers to beef up its commercial lending and buy other banks. BankMobile, meanwhile, plans to pursue more white-label relationships and perhaps explore its own acquisitions.

August 6 -

Just eight loans had been made as of late July, six of them through a single community bank in Florida, according to new data on the federal rescue program for small and midsize companies hurt by the pandemic.

August 6 -

The digital bank would be sold to Megalith Financial, allowing Customers to focus on commercial lending and letting BankMobile expand more aggressively.

August 6 -

The company will pay an undisclosed amount of cash for Marshall Financial, the parent of Citizens Bank.

August 5 -

Delmar Bancorp will lose its regionally associated brand when it becomes Partners Bank.

August 5 -

Payment processor Elavon purchased Sage Pay four months ago, completing the acquisition on March 11. Two days later, Elavon's entire workforce was operating remotely as the coronavirus forced it into lockdown.

August 4 -

With its acquisition of Montreal-based Mobeewave, Apple has placed a long-term bet on where it sees the payments industry headed.

August 3 -

The New York companies plan to move ahead with their proposed deal despite challenges created by the coronavirus pandemic.

August 3 -

The major card networks have heavily invested in broader services as transaction processing loses its luster, a strategy that’s provided a ray of hope as retail and travel industries remain sidelined.

August 3 -

Apple Inc. has acquired Mobeewave Inc., a startup with technology that could transform iPhones into mobile payment terminals, according to people familiar with the matter.

August 1 -

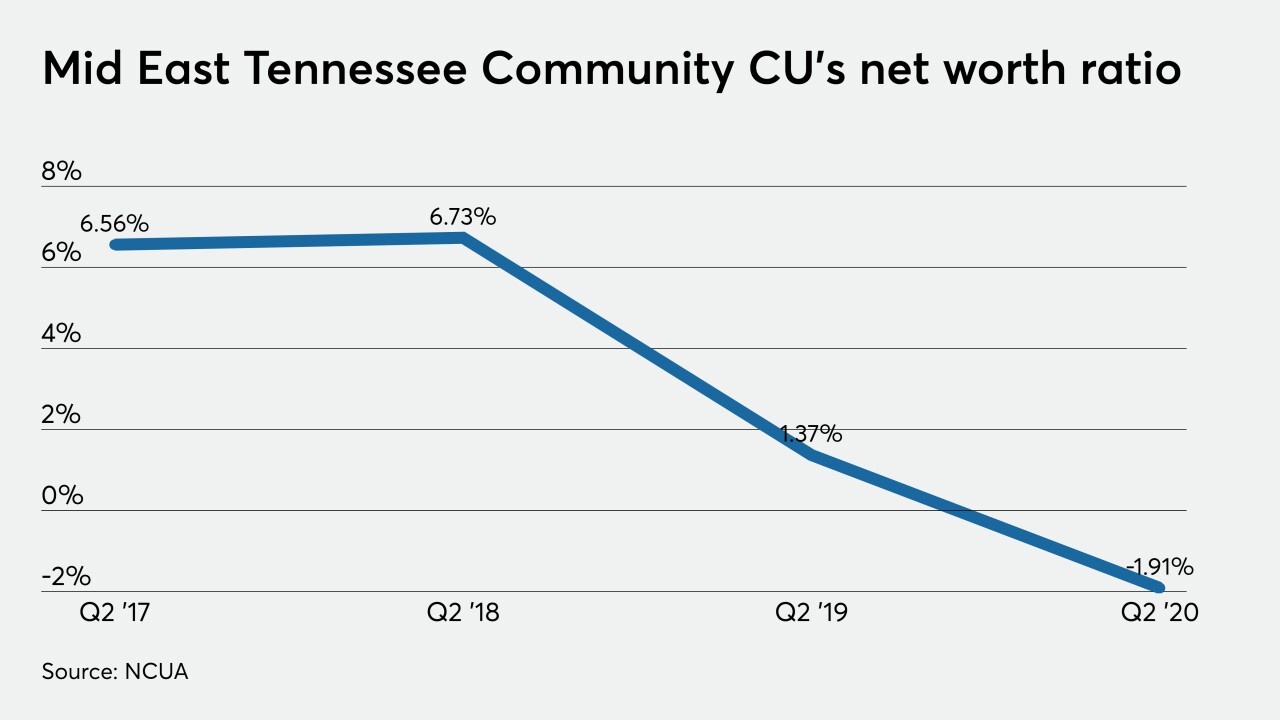

The deal will give ORNL access to three additional counties in the region.

July 31 -

Now that its deal with Texas Capital has been called off, Independent Bank in McKinney plans to scale back or exit some commercial lines and will seek to duplicate its retail banking successes in Colorado.

July 30 -

Webster Federal Credit Union and Finger Lakes FCU plan to join forces before the end of the year, though the deal still needs approval from regulators and members.

July 30 -

The pioneering online lender had long struggled to live up to the hype that drove its early growth, even before the pandemic pushed it to the brink.

July 29 -

The Nashville bank had sued Gaylon Lawrence in 2017 over allegations that he was pursuing an illegal takeover, but the two sides announced terms of a settlement.

July 24 -

With the coronavirus pandemic intensifying and hopes for a quick economic recovery fading, banks large and small are reducing headcounts, shuttering branches, shedding office space and generally trying to trim expenses wherever they can.

July 24 -

Cadmus Credit Union agreed to merge into Chartway Federal Credit Union after one of its select employer groups said it would shutter the facility where its only branch was located due to business issues that arose from the coronavirus.

July 23 -

The Dallas company, which in May terminated a deal to merge with Independent Bank, set aside $100 million for worrisome loans and incurred severance costs after cutting an undisclosed number of positions.

July 22