-

The guarantor has for the first time proposed a risk-based capital requirement for companies not subject to other federal regulation. The industry says the plan, which would impose a heavy charge for servicing portfolios, could drive lenders away from government-backed programs.

July 26 -

The plan aims to cut monthly payments by roughly 25% for homeowners in government-backed mortgages who are negatively impacted by the pandemic.

July 23 -

The Consumer Financial Protection Bureau issued a temporary final rule that allows mortgage servicers to initiate foreclosures on abandoned properties and certain delinquent borrowers, but it also outlined additional measures that shield distressed homeowners.

June 28 -

Ginnie Mae is allowing lenders to securitize modified home loans with this extended term as the Biden administration works to make more housing options available for struggling borrowers.

June 25 -

Most of the activity covered vacant and abandoned properties or commercial loans, according to Attom Data Solutions.

May 12 -

The Consumer Financial Protection Bureau disputes a district court ruling that misconduct claims against the company were already covered by a previous settlement.

April 22 -

The Dallas company agreed to sell MSRs tied to $14 billion of mortgages to PHH Mortgage.

April 21 -

The consumer bureau is proposing to give companies until January 2022 to comply with one rule regarding communications from collectors and another clarifying disclosure requirements.

April 7 -

One official at the bureau said this fall could be an “unusual point in history” for the mortgage market as delinquent borrowers exit forbearance plans. The agency proposed new steps for servicers to help consumers stay in their homes.

April 5 -

The FHFA’s forbearance extension to September is forcing nonbank servicers to buy out more delinquent loans. It's also upended loss estimates for investors and made racial and income disparities in the mortgage market worse.

March 25 -

The agency will allow an additional three months of forbearance for loans backed by Fannie Mae and Freddie Mac, giving homeowners up to 18 months to suspend payments due to the pandemic.

February 25 -

The decision provides more clarity to noteholders in the state about when the six-year statute of limitations to bring a foreclosure action begins.

February 23 -

While loan performance is improving in aggregate, some borrowers remained unaware of the relief available or were unable to access it, according to the Research Institute for Housing America.

February 8 -

The legislation would let banks postpone the start date of the Current Expected Credit Losses accounting standard and delay categorizing pandemic-related loan modifications as troubled debt restructurings.

December 23 -

The Consumer Financial Protection Bureau has taken a hands-off approach to servicers during the pandemic. But with forbearance plans set to expire and President-elect Biden likely to appoint new CFPB leadership, companies lacking aggressive plans to help borrowers could face tougher enforcement.

December 8 -

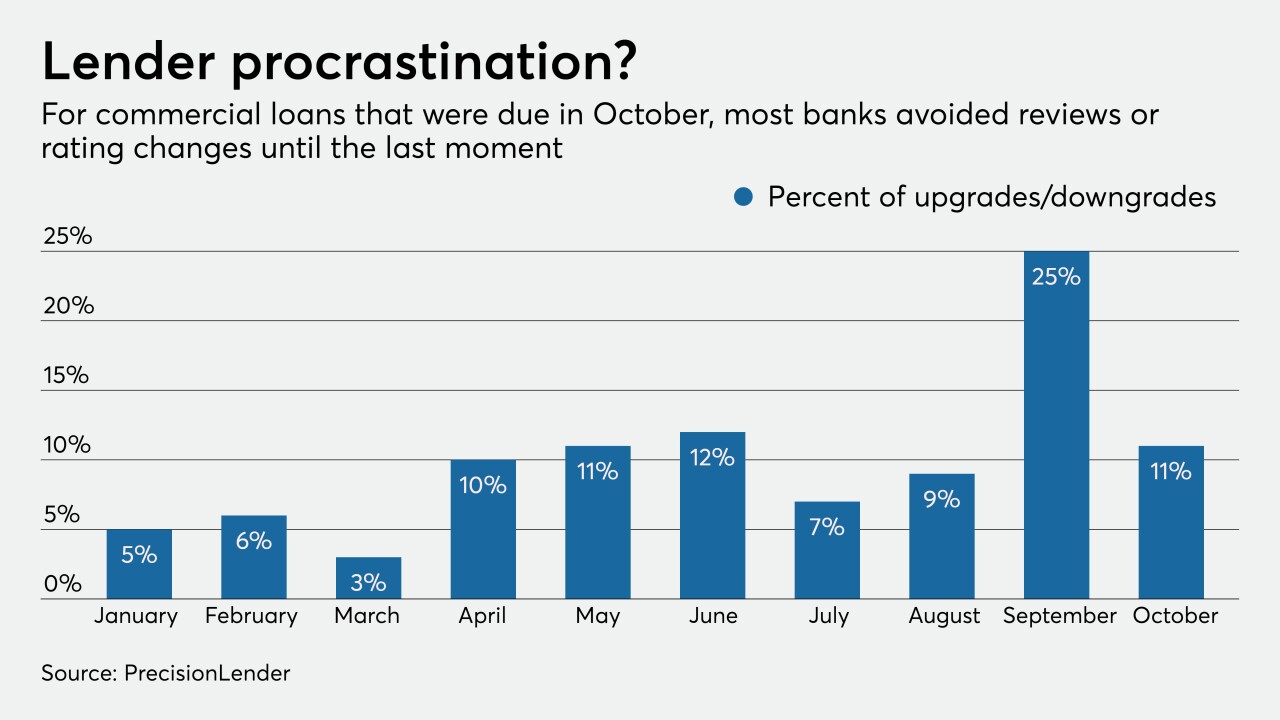

Some lenders are poring over commercial portfolios more frequently than normal — perhaps as often as once a month — to uncover problems hidden by payment deferrals and government stimulus before it's too late.

December 8 -

On the same day that Mr. Cooper announced a settlement with state and federal authorities over its servicing practices, the Dallas company, U.S. Bank and PNC reached separate agreements with DOJ regarding bankrupt borrowers.

December 7 -

The economic fallout from COVID-19 has highlighted systemic concerns about commercial real estate exposure, business debt and short-term wholesale funding, the Financial Stability Oversight Council said in an annual report.

December 3 -

Default risks soar in minority neighborhoods during challenging economic times because, data shows, homes there are overpriced relative to incomes. Zoning and other changes could make loans more affordable by boosting housing stock and driving down prices.

November 25 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center -

The Federal Housing Administration said in its annual actuarial report that the capital reserve ratio on its mutual mortgage insurance fund increased to 6.10% in fiscal year 2020, up from 4.84% a year earlier.

November 13