Want unlimited access to top ideas and insights?

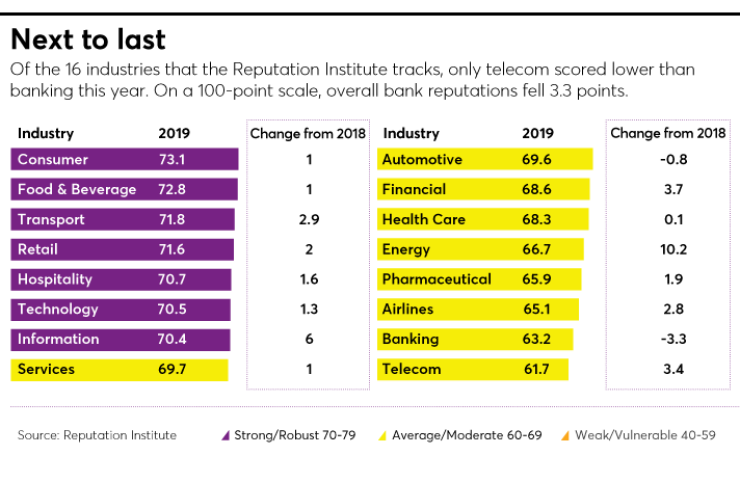

Last year corporate America took a reputational hit across many industries, as public trust broadly eroded. This year as other industries started to improve, the banking industry is falling further.

"I think the leading theme here is that of a missed recovery," says Sven Klingemann, director of research at the Reputation Institute.

Of the 40 banks evaluated in the 2019 American Banker/Reputation Institute Survey of Bank Reputations, only two earned an "excellent" reputation with customers, down from six last year.

Five had "average" scores, up from two.

The number of banks that have "weak" scores with noncustomers doubled, to more than half of them.

The decline in reputation translates into less willingness to buy a bank's products and to recommend others do so, the research shows.

It also means people are less likely to give a bank the benefit of the doubt if something goes wrong.

But banks can counteract the negative sentiment. The research indicates the most effective way to do that is by demonstrating ethical behavior and good citizenship, Klingemann said.

"This is a strategy that banks can use consistently to turn things around," because it improves perceptions regardless of the bank type and regardless of whether someone is a customer, he said.

Focus on governance

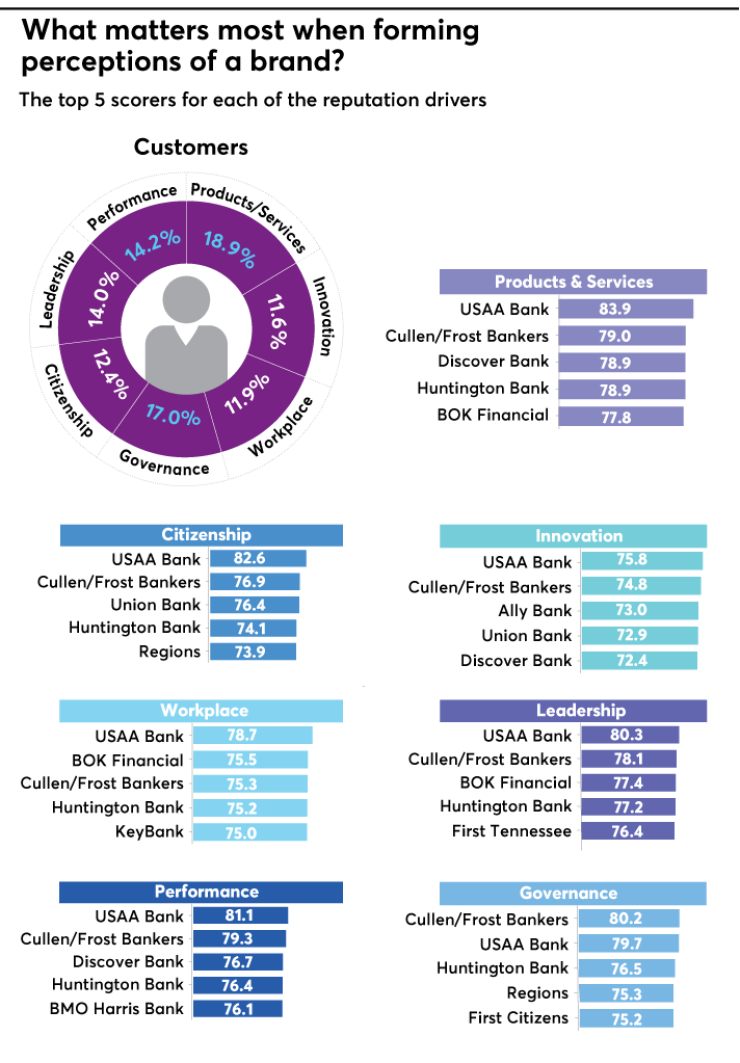

The survey rates banks in seven categories: products and services, innovation, leadership, workplace, performance, citizenship and governance. Which categories most heavily influence people's perceptions of banks can shift from one year to the next.

Citizenship remains one of the top three drivers of reputation for noncustomers, though dropped in importance among customers, who now put more emphasis on financial performance.

But governance is in the top three with both customers and noncustomers again this year. This is a gauge of whether people perceive the bank as fair, ethical and transparent.

Compared with the large and nontraditional banks, regional banks as a group experienced the biggest drop in the governance category, losing three points on the 100-point scale, Klingemann said.

One exception is the $161.3 billion-asset Citizens Bank in Providence, R.I., which held steady in that category with its customers.

And on the overall reputation scores, Citizens is one of only two banks that did not lose ground with either customers or noncustomers.

Klingemann said customers consider Citizens' brand personality appealing. The survey shows that they perceive it as technologically advanced and modern. It is also perceived as one of the least self-serving among all the banks evaluated.

Beth Johnson, Citizens' chief marketing officer, said it's not any one thing that has made the difference, but a commitment to improving the way the bank does business overall. She cited a list of recent initiatives, both internal and external, that is improving Citizens' standing with employees and customers.

One, called "Simple, period" (or "Simple."), launched about a year and a half ago. It is focused on the customer experience and created a mechanism that allows employees to make suggestions and collaborate to drive improvements.

Another initiative called Community Connect encourages local branch staff to participate in random acts of kindness. It started in 2017 as a grassroots effort in Connecticut and expanded bankwide in February 2018. Citizens encourages employees to share their acts of kindness on social media, to magnify the effect.

The most risky behavior

Facebook misusing personal information, Volkswagen skirting environmental regulations, and Wells Fargo opening phony accounts all registered with the public in a big way. Each of those companies is still facing fallout for their breaches in trust; Wells Fargo remains at the bottom of the bank rankings, and is the only one with a "poor" reputation among noncustomers.

In studying what events can damage bank reputations most, Klingemann found that risks related to privacy and data security are becoming more important to people.

Read more about the Survey of Bank Reputations:

Bank reputations fall for first time in five years: 2018 survey Banks avoid the Wells Fargo drag: 2017 survey

But the risks that had the biggest potential negative impact all related to ethical behavior. Of the 19 risks assessed, deceptive sales practices and unequal pay by gender ranked at the top, each one having the potential to drag down reputation scores by a whopping 17.2 points.

It's worth bearing in mind that treatment of employees matters in an outsize way, with bias related to race, gender and sexual orientation coming in second (-16.2), followed by incidents of sexual harassment (-15.8) and firing or punishing whistleblowers (-15.7).

Klingemann said the data shows that avoiding reputation trouble comes down to one principle: "Do the right thing."

The political minefield

This is particularly useful insight given a new set of data in the study this year that focuses on political dynamics.

These day banks have to navigate tricky public policy positions and hot-button socioeconomic issues in a politically divided country, Klingemann said.

And with 2020 national elections looming, banks are

The Reputation Institute gauged how party affiliation correlates with opinions of bank reputations, and found that Republicans had the most favorable views, and Independents the worst, with Democrats falling in the middle.

But the key drivers of reputation for all three groups are the same, regardless of political persuasion. "We see that on average, for each one of the affiliations, governance is the most important driver, followed by products and services, and citizenship," Klingemann said. "These three dimensions taken together are especially important for Independents, who view banks in the most skeptical way."

The only bank with a strong score among all three political groups was USAA.

The $87 billion-asset San Antonio bank, which serves only current and retired military personnel and their families and operates almost entirely online, has been at or near the top of the rankings for several years, a streak that continues this year.

USAA is at the top of the customer ranking with a score of 88.2, which is considered "excellent," and the noncustomer ranking with a score of 70.2, just high enough to qualify as "strong."

Klingemann said that, with hedging against political risk expected to become especially important in the coming year, a focus on reputation will go a long way.

"Good reputation will boost your performance, but also offer protection in times of risk. It's what we call an insurance policy," he said.

What Huntington is up to

Despite slipping a little — to 80.4 — Huntington Bank in Columbus, Ohio, is the only one besides USAA to get an "excellent" score with customers this year.

The $108 billion-asset Huntington attributes this in part to initiatives that it started in the midst of the Great Recession — particularly Fair Play Banking, which features 24-hour overdraft grace periods and Asterisk-Free checking.

"This is not an overnight thing," said Sandra Pierce, a senior executive vice president in private banking and regional banking director at Huntington. "This is part of who we are."

She also cited Huntington's new digital banking platform, called The Hub, as a likely factor. It helps customers better manage spending and keep financial goals top of mind.

The Hub, which began rolling out late last year, was shaped by insights gleaned from what Pierce calls a series of candid "kitchen table conversations" Huntington executives had in customers' homes during a two-year listening tour that entailed visits across the Midwest. The feedback is also informing a new branding campaign.

The fact that Huntington was the top Small Business Administration lender by volume in 2018, and the largest originator in its footprint for the 10th year in a row, also has an impact on how the bank gets perceived, Pierce said. So is its decision to be one of the first companies to voluntarily raise its minimum wage to $16 an hour and improve health care and family leave benefits for employees.

"I think it's all of that, not one thing," Pierce said.

The same message recurs in the survey repeatedly: Managing reputations is about doing the right thing, not just in a few areas, but as many as possible.

And this becomes particularly important with regard to some of the most vocal stakeholders: influencers.

The outsize impact of influencers

Every year, the Reputation Institute polls C-level executives about what is top of mind when it comes to managing reputation risk. This year, influencers emerged as a central topic.

Though the term has become synonymous with social media, this study adopts a broader definition. "An influencer could be in the category of the general public or an employee," Klingemann said. Basically, it's anyone who is an active communicator, whether on social media, via word of mouth with friends and family, or by directly reaching out to regulators, politicians and banks.

"We asked them about their activities and involvement specific to the banking industry and then we selected the subset of people that were most active. And we're really talking about 10% of our overall sample who are these very passionate and active people who are making their voices and opinions heard," Klingemann said.

He described them as "ordinary people with authentic credibility and extraordinary influence and impact on reputation."

They tend to be highly active on social media, but make their voices heard in multiple ways. They can create a movement, and shape the narrative around company- or industry-specific topics.

Influencers have the same top three priorities as the non-influencers when rating reputations — governance, citizenship and products and services — but they are more demanding in what they expect of banks. For example, excellence in leadership and workplace conditions are disproportionately more important for influencers in the banking industry, products and services less so.

"Talking about how great your products are makes some difference — it's top three — but what you really need to focus on here is governance," Klingemann said. "So convincing influencers that you go above and beyond the call of duty when it comes to fairness and transparency and ethical behavior is really the way to go."

But that's not all. "You also need a bit more of a balanced approach" when it comes to targeting influencers, he said. "So just focusing on one thing is definitely not going to cut it here."

Citizens hired a social media manager in late 2017 and started ramping up influencer efforts last year through partnerships with personal finance experts, such as Jean Chatzky, financial editor of NBC's "Today Show." The goal was not to push products, but to educate parents and students on how to tackle paying for college. The campaign involved efforts on Facebook, Twitter and Instagram, including a Facebook Live interview between Chatzky and Christine Roberts, Citizens' head of student lending.

It's perhaps not surprising, then, that influencers rate Citizens' reputation three times more positively than that of the average regional bank.

Of the three types of banks, influencers score regionals most favorably and large banks most negatively by a wide margin. So at least for regional banks, influencers are a bright spot.

"Despite the fact that regional banks are kind of the loss leaders in reputation, they're still viewed more positively by influencers. Imagine if the influencers were on their bad side what would happen," Klingemann said.

Survey methodology

Company selection:

- Companies drawn from the Federal Reserve's list of large commercial banks, with final selections by American Banker based on total assets and deposits

- Only those with significant retail brands were considered

Ratings:

- Ratings were collected via online questionnaire in March and April 2019

- At least 100 customers and 100 noncustomers rated each company, with more than 12,000 respondents overall

- Each respondent was very or somewhat familiar with the companies they rated