-

Hancock Holding in Gulfport, Miss., has raised the ire of analysts and investors in an unusual way — by unveiling a plan to cut costs over the next two years.

April 26 -

Revenue is expected to strengthen at least a little in the second quarter, but cost-cutting is here to stay until the economy really improves.

April 19 -

Columbia Banking System (COLB), Prosperity Bancshares (PB), Crescent Financial Bancshares (CRFN) and Bell State Bank & Trust completed acquisitions Monday.

April 1 -

Community banks are reporting first-quarter declines in net interest income despite increased lending. Low rates and competition are to blame.

April 25 -

A number of community banks reported higher noninterest expenses in the first quarter as they sought out ways to book more loans and charge more fees.

April 24

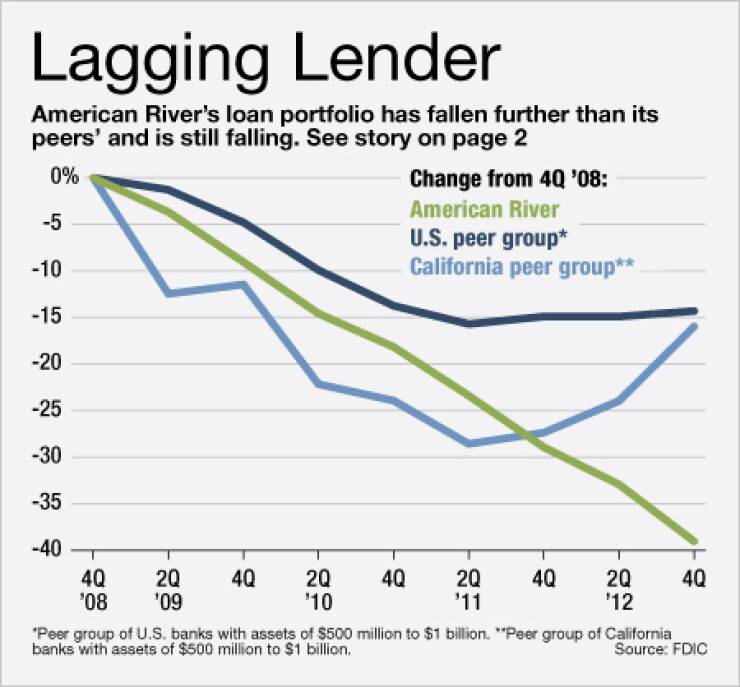

American River Bancshares (AMRB) and one of its hedge fund investors have decidedly different opinions of the Sacramento, Calif., company's future.

The tension was palpable during a quarterly conference call this month, and crystallized the frustration mounting among investors as bank after bank reports anemic loan growth.

Executives of the $587 million-asset American River vowed this will be the year when its loans begin to grow, whereas MFP Investors seems to have concluded from first-quarter results -- a 14% decline in loans, and a 12.6% decline in earnings, year over year -- that American River needs to sell itself.

"At what point do you stop the franchise destruction and put the company up for sale while it still has value?" Henchy Enden, an analyst with MFP Investors, asked the management team during its April 18 call. "Trends are not going in the right direction in any line item, and time is just not on your side."

MFP's principal Michael Price has a 2.76% stake in the company.

David Taber, the chief executive of American River, said he shared Eiden's frustration but did not directly address the call for a sale. The company has been working diligently to find new loans and that this year its efforts would pay off, Taber said. Moreover, its pipeline of loans was at his highest point ever, executives said.

"Time is in fact on our side," Taber said. "While it is not showing up in the numbers, the activities -- what we are doing in the marketplace -- are providing us with the opportunities we need. We are not losing clients, and we do see 2013 as a year where we will be successful in generating positive loan growth."

However, Enden persisted, arguing that the industry is recovering while American River lags.

"I haven't seen results like this," Enden said. "Everyone for quarters now has been putting on loans — people in your area, in your state. American River is not worth today what it was two or three years ago versus your peers. Time is not on your side. Your board should consider putting this up for sale."

Though the general economy has improved, weak revenue and lending performances

For that reason, more confrontations like the one on the American River call are expected.

"Investors intuitively understood that the downturn of the recent few years has set the performance of these community banks back," says Rick Levenson, the president of Western Financial Corp., a broker-dealer and investment banking firm in San Diego that specializes in small banks. "But now the sun is coming out, and the birds are starting to chirp, and it is time to get some returns going here."

The feeling among investors — especially institutional ones with large, illiquid stakes — is that if a bank appears to be "dragging its feet" and failing to offer a realistic, detailed plan for producing returns on their money within a specific time period, then "it ought to be sold," Levenson said.

American River's stock was trading at $7.84 Friday, down 1.6%; three years ago it traded at $8.60.

Calls to MFP's Enden and American River's Taber were not returned.

Enden has firsthand knowledge of bank M&A. MFP was part of the 2009 recapitalization of West Coast Bancorp in Lake Oswego, Ore. Enden was appointed to the board of West Coast in December 2011 and in September 2012 it announced it would

American River has the capital to be a buyer, but its currency makes a stock deal — the most popular type with current valuations — unattractive for sellers. It is incredibly overcapitalized, with a tangible common equity ratio of 13.4%, nearly double the 7% baseline that analysts prefer to see. However, the stock trades at a discount to its $8.39 tangible book value price.

Analysts asked the company about potential acquisitions during the call, but executives said a deal is unlikely.

"The highest and best use of our capital is the buyback," Taber said in the call. The M&A market "is something we are paying close attention to, but we are not seeing much activity."

In the meantime, American River says it is eyeing organic growth through a recently opened loan production office in San Jose. It is also on the hunt for an additional lender in the East Bay of San Francisco.

The company is taking advantage of its below book value price to buy back shares. It bought back 221,000 shares — a very similar level to the size of MFP's stake — in the quarter.

Though Enden was alone in calling for the company to immediately explore a sale, other analysts expressed their frustration with its performance.

"We were disappointed but not all that surprised that loan balances and production volumes were sequentially lower given the season and persistent cyclical dynamics," said Tim O'Brien, an analyst at Sandler O'Neill, in a research note.

Taber and the other executives said multiple times that they do not give guidance. Enden's challenge, however, prompted them to declare when loans would grow. Investors like MFP will likely hold them to that.

"Management was challenged by an unhappy investor and in response drew an effective line in the sand in saying that the company will generate net loan growth in 2013," O'Brien said in his note. "While that is as low as a bar can be set, it is still meaningful given the company's recent track record."

Dean Anason contributed to this article.