-

Credit card customers are the most satisfied they've been since the financial crisis, according to an annual survey that partly credits a government crackdown on industry practices.

August 18 -

Issuers of retail credit cards sought to exit the business en masse during the downturn. Now the industry's appeal is on the rise, along with a dramatic improvement in its performance.

August 17 -

As credit card use slows in certain sectors because of tightened budgets and risk avoidance, many issuers may find they lack consistent retention strategies, according to a study from Celent LLC.

June 20 -

Most credit card industry professionals believe social media will become a "significant factor" in customer service, with Twitter and Facebook outpacing blogs as the most popular methods for card brands to connect with consumers, a survey found.

June 3 -

Banks should capitalize on the resurgent use of credit cards by reinvigorating their cards business with more attractive and innovative offerings.

June 1

What's the secret to American Express Co.'s customer satisfaction success?

The New York credit card company once again beat out its top competitors in J.D. Power's

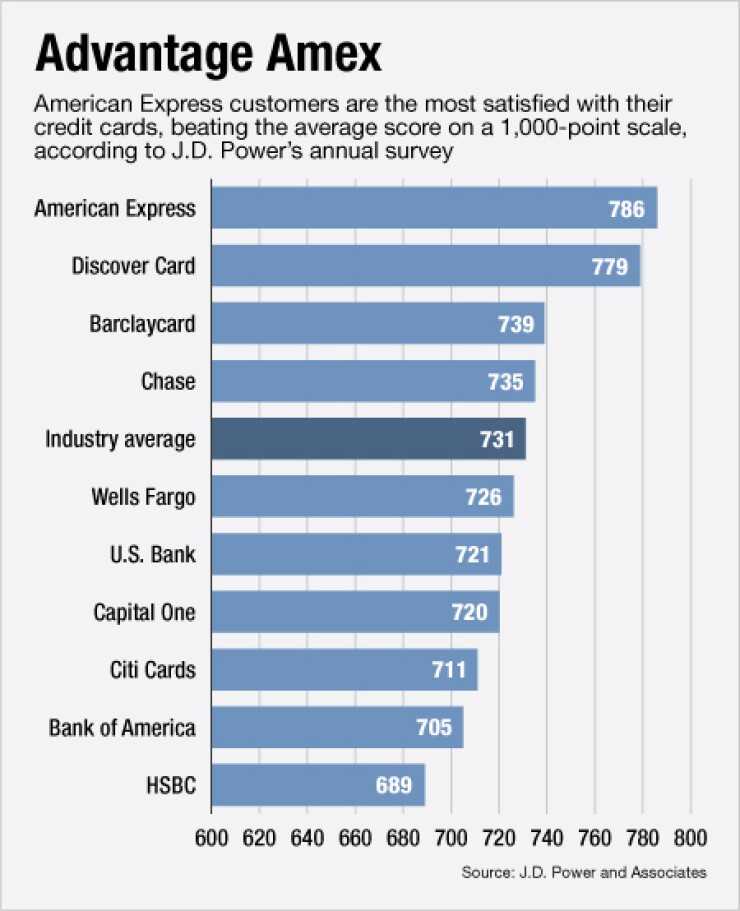

It was hardly a surprising victory — American Express has won the top spot in the annual ranking every year since J.D. Power started it in 2007. This year the company earned a score of 786 on a 1,000 point scale, beating the industry average of 731 (see graphic).

American Express, which lends mostly to the wealthy, has long relied on its vaunted customer service and expansive rewards programs to attract business and buzz. Since the worst of the financial crisis forced it to retreat from broader consumer lending, the company is also hoping its forays into online and mobile payments will

J.D. Power said in a press release that American Express's customer satisfaction score this year got a special boost from the company's "benefits and services, credit card terms and rewards factors."

Some of the other top performers were less obvious. Discover Financial Services appears to be the most underrated credit card service provider; it nearly matched American Express with a score of 779. According to J.D. Power, the Riverwoods, Ill., card company is particularly good at interacting with customers.

"Discover has narrowed the gap with American Express," says Michael Beird, director of banking services at J.D. Power.

Both companies "know the needs of their customer base. ... Their communications are ongoing, they utilize multiple channels, their customers have a higher level of understanding of the programs they're in," Beird says.

Barclaycard was another surprising outperformer, scoring slightly better than the average with 739. The U.S. credit card arm of Barclays is not the most prominent consumer brand and

The biggest U.S. banks did not fare as well. JPMorgan Chase & Co was slightly above the average, and Wells Fargo & Co. was slightly below it. But the long-suffering Citigroup Inc. and Bank of America Corp. are still struggling to convince their customers that their service levels have improved after the financial crisis.

Beird attributed some of those lower scores to negative publicity about the banks that barely survived the crisis, adding that Citigroup "saw a notable lift in its brand image" over the past year. (Vikram Pandit is probably sending daily flowers to Brian Moynihan for

And the worst performer probably won't be on this list next year. HSBC, which has long specialized in lending to riskier U.S. borrowers and to retail partners' customers, came in at the bottom of the list with a 689 score.

Let's see if Capital One Financial Corp. — which is paying HSBC a