-

Richard Davis, whose U.S. Bancorp reported a quarterly revenue slowdown, says the threat of higher rates actually would stir complacent corporate borrowers to seek more credit. But when that would happen is anybody's guess.

April 16 -

Mortgage lending activity was weaker than expected in the first quarter and the result is likely to be slimmer profit margins for a number of banks, according to Paul Miller, a managing director at FBR Capital Markets.

April 5 -

All mortgage lenders should prepare themselves for a minimum decline in refinance activity of 75% and make sure their capital plan, liquidity plan and budget all reflect this.

March 21

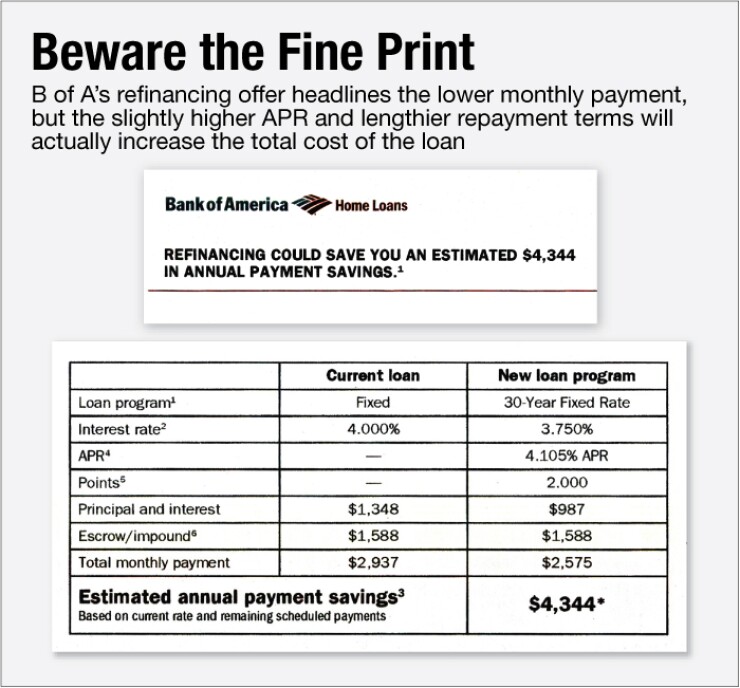

Bank of America's (BAC) recent attempts to get some existing mortgage customers to refinance sounds eerily like a sales pitch from the bubble days of 2005.

"See if refinancing could save you an estimated $4,344 in annual payment savings," reads the pitch in boldface on a direct mail advertisement sent to a New Jersey borrower last month.

The ad compared the borrower's current mortgage payment on a 20-year fixed-rate loan with an interest rate of 4% to B of A's "new loan program" that offers a 30-year fixed-rate at 3.75%. B of A showed a breakdown in which the borrower would be paying two points on the new loan, adding an estimated $8,977 in fees and closing costs. That would increase the overall interest rate to 4.1%, excluding taxes and insurance.

In short, B of A's pitch, with its focus exclusively on lowering the borrower's monthly payment, implied that the deal was in the consumer's best interest, even though the borrower would end up paying a higher interest rate and would be adding 10 more years to the overall life of the loan.

"This is like an old school subprime pitch," says Brian Koss, a managing partner at Mortgage Network, a Danvers, Mass., mortgage bank. "The emphasis is on the word 'payment,' not the rate. They're not hiding anything, it's just the spin of it. If they said something like: 'Are you up to your ears in debt looking to consolidate your debt into one lower manageable payment,' the pitch would be cleaner."

The ad includes a page of footnotes in small type with several disclaimers and a short list of frequently asked questions. One states: "What kind of new loan will I have if I refinance?" B of A's answer: "The loan that's right for you."

The sales pitch comes at a time when interest rates are on the rise and refinancing activity, which has largely driven bank earnings in recent quarters, is starting to slow. The refinance share of mortgage activity fell to 68% in the week through June 5, down from 71% a week earlier, and bringing it to the lowest level since July 2011, according to the Mortgage Bankers Association. Interest rates for a 30-year, fixed-rate home loan rose to 4.07% for the week of June 5, up from 3.9% a week earlier, the largest single-week increase since July 2011, the MBA said.

Observers say that other lenders are making pitches similar to B of A's in an effort to generate more refinancing business though they were unable to provide specific examples. Such tactics are not in a borrower's best interest and fly in the face of efforts by the Consumer Financial Protection Bureau to make consumer products more transparent, simpler and easier to understand, consumer advocates added.

Andrew Pizor, a staff attorney at the National Consumer Law Center, examined B of A's letter and calculated that the new refinance offer would add $37,188 more in interest over the life of the loan compared to the borrower's current mortgage.

"This ad clearly implies that this refinancing is right for this borrower," says Pizor. "I think the pitch is kind of deceptive because it boldly mentions 'save' and 'savings,' repeatedly, and of course it refers only to the higher interest rate and overall loan amount in the footnotes. Marketers know those details will be overlooked."

The list of frequently asked questions also gives borrowers the impression "that B of A is looking out for the borrower's best interest," Pizor says. "If I was representing this borrower, I'd argue that Bank of America has assumed a fiduciary duty to the borrower by making this promise. But I'm sure the bank wouldn't agree."

Asked about whether the refinance pitch was in the best interest of the borrower, a B of A spokesman said the ad was intended to simply illustrate potential monthly savings from one possible refinance scenario.

"If lowering monthly payments interests the customer, the next step would involve discussing his or her mortgage situation with a Bank of America mortgage loan officer," said B of A spokesman Terry Francisco.

"The possibility that the refinance offer would result in a change in terms and an increase in overall interest rate charges was also clearly disclosed in the communication," Francisco says. "If the borrower chose to apply for the refinance transaction after speaking with a loan officer, the borrower would receive follow-up documents that would specify the overall costs involved in that transaction well ahead of making the decision," to refinance, he said.

Larry Platt, a partner at K&L Gates LLP, who represents major banks, argues that the B of A pitch is not deceptive and that it is the borrower who needs to take responsibility by reading disclosures.

"It may not be the best deal, but it discloses everything," Platt said after being shown the pitch. "The fact is that many borrowers shop based on monthly payment and some borrowers find that 15-year loans tie up too much cash over time."

Bottom line: consumer advocates and banking industry officials appear to differ over whether ads such as B of A's rise to the level of making false or misleading claims. Mortgage lenders are currently under no obligation to look out for the borrower's best interest. However, starting in January, the CFPB's Qualified Mortgage rule will require a lender to ensure that a borrower has the ability to repay his mortgage.

Regulators already appear to be on high alert.

In November, the CFPB and the Federal Trade Commission

At the time, the CFPB announced it had launched formal investigations of six companies that may have violated the 2011 Mortgage Acts and Practices Advertising Rule, which prohibits misleading claims concerning government affiliation, interest rates, fees, costs, payments associated with the loan and the amount of cash or credit available to the consumer. The CFPB declined to comment on the B of A ad.

That law states that advertising is deceptive if there is "a representation, omission of information, or practice that is likely to mislead consumers acting reasonably under the circumstances," and if it is "material to consumers," meaning the consumer is "likely to have chosen differently but for the claim."

Legal or not, Mortgage Network's Koss says B of A should know better.

"You don't expect to see this from B of A," says Koss. "Usually you get this kind of pitch from other lenders that no one would recognize."