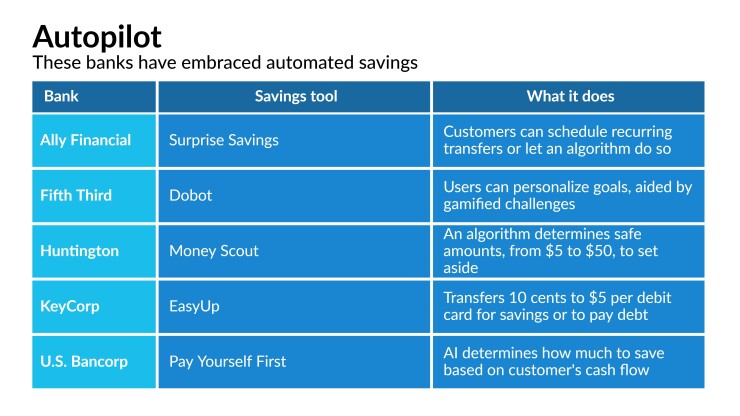

Traditional banks are offering and building upon a type of digital banking tool fintechs made popular: automated savings. This technology gives consumers myriad ways to put money aside without having to think about it or do anything.

Huntington Bancshares in Columbus, Ohio, accelerated its product’s time to market in direct response to the pandemic. Other banks are tweaking their tools: Ally Financial in Detroit and KeyCorp in Cleveland introduced new features in 2020. Fifth Third Bancorp in Cincinnati, which created the stand-alone personal finance app

They aren't the first banks to use technology to help customers become better savers. Fifteen years ago Bank of America started a program called Keep the Change, which rounded up purchases and automatically put the change in a savings account.

But now more banks are creating dedicated tools with catchy names that will inspire their customers to save consistently. According to Javelin Strategy & Research, eight of the top 25 financial institutions it surveys offer at least one of three automated savings features it examined: an algorithm, round-ups (typically a strategy that rounds up each transaction to the nearest dollar and saves the difference) or rules that trigger a transfer from checking to savings. And interest is likely to grow in 2021, as customers who have been hit hard financially by the pandemic need to recover, and even those whose finances remained steady became more conscious of preparing for the unexpected.

At the same time, homegrown tools can keep customers saving at their banks rather than turning to nonbank apps for such features.

Because many staple features, including peer-to-peer payments and mobile deposits, are identical across banks, automated savings features can help banks can stand out from their peers, said Mark Schwanhausser, director of digital banking at Javelin.

Schwanhausser still sees plenty of opportunity for banks to round out their tools with financial guidance, encouragement and education in the vein of nonbank apps.

“The banks are not yet doing what the fintechs are doing, which is turning a collection of tools into a service,” said Schwanhausser. “When you combine different tools like round up the change, algorithms and direct deposit, and put those together with gamification and alerts and personalization, you’ve created a service that says, ‘We’ll help you save over your lifetime.’ ”

Round-ups and rules

The fintech

“Most people don’t have the time or the desire to look at their finances every day and determine the right amount to save,” said Ethan Bloch, founder and CEO of Digit. “On the flip side, a generic rule-based savings approach doesn’t maximize a person’s savings potential.”

Huntington Bank does some of this work for its customers with

“You don’t have many customers set up automatic transfers for $5 at a time — it’s more when they realize they have a big chunk they want to move each month — so this lets them save in smaller and more customized increments,” said Holly Hynes, director of brand innovation and strategy at Huntington.

The company hopes to reach customers who don’t feel they can afford to save by ferreting out palatable amounts, but it also sees a purpose for customers who have already set up recurring transfers.

“It’s almost a game we hear from customers — can the system find more money for me?” said Hynes. “They’re shocked when it does.”

The bank was already testing Money Scout with colleagues before the pandemic, but decided to accelerate production in the spring of 2020.

KeyBank wanted to take a simple approach with

“It’s a simple way for clients to save and a fundamentally different way than I think a lot of our peer banks go to market,” said Christopher Manderfield, head of consumer product management at KeyBank, which has $170.4 billion of assets.

In 2020, KeyBank added the option for customers to direct these funds toward debt, which could be useful for customers who have already accumulated a healthy cushion. If customers want to pay down debt, KeyBank will transfer the designated funds from the customer’s savings account to the credit provider of their choice at the end of every month.

Manderfield said that client research showed that the percentage of people willing to switch over from their primary bank was five times higher if Key were to offer the debt payment feature.

Fifth Third, which has $204.7 billion of assets, has taken an imaginative approach with its rules-based features. The Dobot app, which lets customers schedule or automate savings, offers regular challenges, such as skipping takeout and texting a pizza emoji to Dobot to sock away $20 instead.

Customers of Fifth Third’s Momentum program will be able to set goals and schedule transfers in the regular mobile app starting this month. Later this year, the app will start intelligently allocating small amounts from checking to savings.

Ally Financial is trying to appeal to a range of savings styles. The $185.3 billion-asset company introduced its

But new features that debuted in December add more flexibility. Bucket Transfers lets customers shift money back and forth between digital envelopes, and Round Ups lets customers pocket the difference between any withdrawal, including debit card use and bill payments, and the nearest dollar. Ally is currently rolling out Bucket Goals, where customers can pin a dollar amount and date to their goals, then visualize their progress.

In its initial research, “we realized there wasn’t going to be a magic pill for everyone,” said Emily Shallal, who leads Ally’s innovation lab, TM Studio. “If you don’t like recurring transfers or don’t feel comfortable with Surprise Savings, maybe you feel comfortable with roundups.”

Shallal reports that more than one in three new Ally customers adopt one or more of the savings tools as soon as they open their account.

Taking automated savings further

Schwanhausser finds that fintechs are generally more encouraging and educational than banks, which may simply present an array of tools.

“Fintech are taking approach that ‘You’re not dumb, we understand this is complex, and we will try to make it more understandable and not talk down to you,’ ” he said.

MoneyLion’s automated feature directs money to investments rather than savings. It lets customers determine how much they want MoneyLion to set aside in investment portfolios made up of exchange-traded funds that cater to a range of risk tolerances.

“The trick is to get people a rich dashboard or set of tools where they can build out an investment or savings plan right for them,” said Jon Stevenson, head of wealth management and banking at MoneyLion. The MoneyLion app also delivers personalized financial advice, financial wellness and credit tracking, alerts for overspending and daily tips.

Digit is also venturing into investments. In 2020, the app introduced features to help customers transfer recommended amounts to invest for the long term, including for retirement.

Schwanhausser also finds that fintechs are likelier to embrace behavioral finance. For example, the app Qapital has a “Guilty Pleasure Rule” where customers can choose to auto-save toward their goals when they shop at a merchant they are trying to resist.

As banks become more proactive and encouraging, they will stand out for their automated savings program, said Schwanhausser.

Ally is one institution thinking about ways it can strengthen its relationship with its users through these tools.

“Everything we’re working on now is to build that emotional connection so customers don’t log on to Ally and see a savings account, but see their life laid out in a very organized way,” said Shallal, “and feel we are here to help support them in their journey to accomplish their goals.”