Ally Financial has joined the small but growing ranks of financial companies — mostly challenger banks like Digit, Chime and Qapital but also Bank of America — that give people tools to help them save without having to think about it or do anything.

Diane Morais, president of consumer and commercial banking products at the online-only Ally, stopped by American Banker's New York office this week to explain why the new automated savings product is good for consumers.

To be sure, deposit gathering is crucial to Ally's business plan and long-term health. Its ratio of loans to core deposits was nearly 128% at Sept. 30, compared with about 90% for the whole industry, according to Federal Deposit Insurance Corp. data.

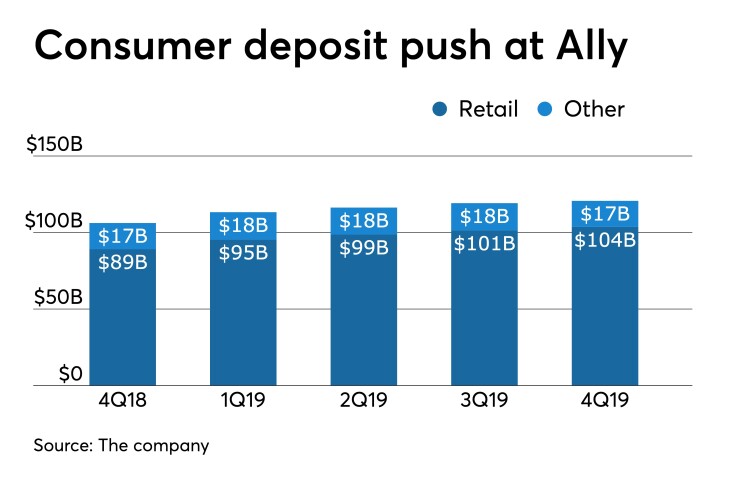

CEO Jeffrey Brown said in the company's fourth-quarter earnings call last month that the bank has made strides in adding deposits, especially consumer deposits, which rose 16% year over year to $103.7 billion at Dec. 31.

"Our deposit portfolio is now within the range of our core funding financial objective, representing an important milestone for us," he said. However, "this should not imply we take our foot off the gas with respect to deposit inflows. Deposits are essential for funding."

But the savings tool is good for business in a broader sense, too, Morais said. It is a product consumers are clamoring for, it deepens Ally's relationships with its customers, and a stronger consumer is more interested in home loans and other products, she said. Here is an edited transcript of her remarks.

What motivated Ally to create automated savings tools for customers?

DIANE MORAIS: We have a very strong discipline around the voice of the customer, customer research. We serve a broad swath of consumers across all demographic groups. We do a lot of what we call human-centered design, getting at the heart of where are people struggling, where can we as Ally come in with additional solutions.

There's a segment of the population who are employed, but they're not really progressing in their financial picture. When we talked to them, we found out that they feel stuck and overwhelmed. One woman we talked to started fanning herself. It was anxiety inducing. She knew she needed to be doing more. She really didn't know where to start, and she just felt completely overwhelmed.

That really was the genesis behind the idea of the smart savings tools.

Have you found among your customers that they are overspending and being irresponsible with their money? Or is their income so low that they just can't make ends meet?

Sometimes there's an unexpected health issue or car accident or something that sets people back. They don’t have enough of a cushion to be able to buffer any kind of unexpected expenses. There's so much stress and anxiety and uncertainty and friction around all of it. If we can flip it and make it gratifying, encouraging, fun, exciting to save — you're seeing your balances grow, you're feeling like you're getting yourself organized, how great would it be if it became a positive type of habit.

How do the tools work?

We provide 10 prepopulated names of savings “buckets” that people can save money in, and then one you name yourself. So far, “wedding” and “engagement ring” are the most-used buckets.

Then we have two types of savings boosters we offer to try to take friction out of saving. For people that can but may not be setting up any type of regular habit to safely save $50 or so from their paycheck every week, we're using recurring transfer to let them set it and forget it, to make it a habit. If you don't see the money you're not tempted to spend the money, and it automatically moves into your savings account.

The other is a surprise savings booster. For a customer who has a checking account at Ally or at an external institution that’s been linked to Ally, we use an algorithm to analyze the pattern in that account. Do they have upcoming outflows, [and] when is money coming into the account? And through this science behind the algorithm, we identify what we call a safe-to-save amount. And that can be automatically swept into the customer's savings accounts.

Three to four trillion dollars in our system is making less than 25 basis points in interest. So there's this vast amount of lazy money, not really working hard for people. And probably many people aren't really sure of what's truly safe to save, so they keep money in a less profitable instrument. This surprise savings booster helps make that easy and gives the consumer more confidence.

We know we've hit a nerve with consumers. We sent a teaser email to all existing Ally customers at the end of November with some videos that said, here are some new capabilities coming soon from Ally. We've been getting an increasingly loud drumbeat from customers around, "When am I getting the buckets I need?"

Throughout the holiday season, through all of the onslaught of information that people have coming at them from every which direction, people have continued asking for buckets. Which is really remarkable when you think of it, that a teaser email from pre-Thanksgiving resonated that much.

I think everybody feels like they need help. They need to simplify their life. Consumers say they're doing this mental math, they're trying to figure out how much is in their savings account and mentally trying to earmark how much can be used for different purposes. So this just takes it down to a more clear and basic level that puts the consumer in control.

How might this benefit Ally?

We'll be able to see what people are actually saving for. And then that's going to be a whole new avenue of really natural conversation to have with consumers. If we know someone is saving for a down payment on a house, we can begin talking to them about tips and tools on things you need to know when you're preparing to either purchase a new home or refinance a home. It’s early days, but there's going to be great interaction very naturally based on what we see customers doing.

Some providers to automated savings have found that they sometimes run into an issue where customers have a big bill that they get hit with that the algorithm didn’t predict. So then this money has been socked away, but they need it to be able to pay bills. Companies like Digit have developed a way of very quickly moving money back into your checking account.

That was a huge focus for us. We never want to inadvertently put someone into an overdrawn status, and we have the ability to move money pretty seamlessly, certainly within the Ally family. We're really mindful about that.

There are people who think people who haven’t saved money are spending beyond their means. Why should a bank worry about it?

At the core of Ally, we are customer-obsessed. We've been built around this customer obsession for the last 10 years. Over those 10 years we've grown to over $100 billion in deposits, over 2 million consumers with 96% retention rates. So we believe that we have an obligation to continue to serve consumers and we serve a broad swath of them. And so we're not trying to be judgmental. We're not trying to scold people for not doing something that they might intrinsically know they should be doing. We're just trying to provide ways and advice and content that really can help people and give them more confidence.

Some people say alerts reinforce negative messages: You didn't make your goal this week, or you’re $10 short. Who wants to be slapped in the face like that?

We learned a lot about that in our research, and we tested certain things with people. We try to infuse positivity along the way, because people know if they're not making progress, and it becomes more of that self-fulfilling negative cycle.

Is this all part of a bigger push toward financial wellness or financial health or behavioral finance?

We think there's a lot of runway in this whole area of consumer solutions. We'll continue to add capabilities in the form of additional boosters or new things to tap into other customer needs and provide free technological ways to address those needs.