The idea of platform banking has generated buzz this year, but will banks embrace the idea of being recast as app stores or is it just fanciful thinking of fintech talking heads and bank futurists?

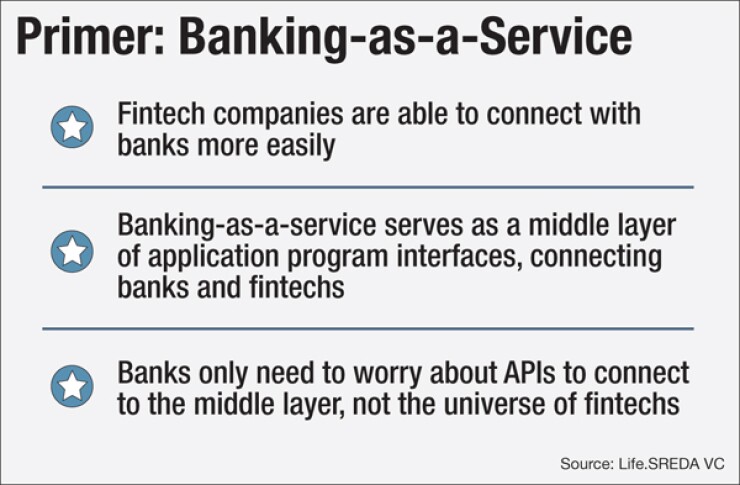

Though they use different terminology to describe what they do (banking-as-a-service, banking-as-a-platform, platform-as-a-service), several companies are betting on this concept becoming a reality.

There are forces working in their favor — more banks are experimenting with application programming interfaces and the idea of

"Open interfaces, open standards and open platforms drive faster innovation cycles," said Robin Crewe, global head of product development at Misys, which launched its "platform-as-a-service" in September.

"Platform-as-a-service models which open up core systems and bring communities together will be a game-changer for the financial software industry," he said.

However, others say there is not yet a viable business model for platform banking, and that banks need to exercise caution when it comes to opening up their systems and sharing data.

Misys is an example of an incumbent player looking in the space, but there are several startups, too. For instance, Paymency in San Diego wants to offer an API-based "banking-as-a-platform" service that would allow banks to access financial products and services developed by third parties. Its founder, Gary Lewis Evans, says APIs will inevitably power the banking industry.

"Today's banks were designed for a cash-based physical economy and a clientele with very different needs," said Evans, who has described his company as a platform for banking like Amazon is a platform for retail.

Evans envisions Paymency as an app store of sorts; banks would be able to access it to offer customers a range of financial products, which could be developed by other banks, any number of fintech companies and other partners that would be available in the store.

The Office of the Comptroller of the Currency's recent announcement that it would

"We are exploring a fintech charter on our own, or more likely, after a merger with a fintech company that needs a strong bank CEO with fintech experience," he said." The merged company will then be part of our BaaP."

(Evans

Also this year, the German startup solarisBank launched with the intent of offering fintech companies a modular banking platform to build on. The company received a German banking license with the idea of offering fintech companies that aren't banks the capability to have things like account and transaction services, compliance and trust solutions, working capital financing and online loans.

The Misys strategy is similar. The London company opens its FusionFabric platform and core systems to third parties "to drive innovation and collaboration across financial services," it said in September when it announced the project.

Misys said it will enable banks, fintechs, consultants and even students to develop, deploy and operate apps which could then be used by Misys' banking customers, either in the Misys private cloud or on-premise.

"The app economy has delivered incredible benefits to consumers and we are starting to see this mindset taking hold in financial services as banks strive to increase innovation and reduce costs," Crewe said. Examples of such benefits in the consumer world could be Uber and Airbnb spurring competition in the taxi and hotel industries.

For banks, Crewe said, the benefits of such a model include reduced costs and spurring innovation.

"Banks benefit not only by being able to differentiate their own offerings directly," he said, "but also by being able to access innovative, open solutions developed by fintechs, consultants and even enterprising student developers."

Although banks may be talking more about APIs and open banking, critics say that doesn't mean the platform banking revolution is quite at hand. For starters, there is no clear business model for this to work, said Ron Shevlin, director of research at Cornerstone Advisors.

"There is clearly a lot of movement in this area," he said, citing examples such as BBVA's experiments with open APIs or Capital One's developer exchange. "But from a business model perspective there's not a lot yet to show for this. Many of these initiatives are one-offs. The Capital One developer exchange is not yet like Amazon. So the maturity of the platform is lacking."

Shevlin also said that, given the large size of the U.S. banking market, even if some banks adopt this idea that is no guarantee thousands of others will. "Just because you build an open platform with APIs, it doesn't mean everyone will come rushing in," he said.

In order to embrace platform banking, institutions would "have to change their culture, their DNA. You just don't turn around ships that quickly," Shevlin said.

Cornerstone recently surveyed 300 CEOs of midsize banks and credit unions and found that optimism for the industry was at a five-year high, thanks primarily to the economy, the interest rate environment and the outcome of the presidential election.

Bankers tend to be optimistic during those periods when they are experimenting less, Shevlin said. “When the economy gets better and business gets good again they often revert to the old standard business models,” he said. “That could put the brakes on this BaaS concept.”

And if one entity does succeed in becoming the "Amazon of banking," Shevlin said, it may not even be a bank or financial technology company, but perhaps a more familiar name.

"Amazon is the player most likely to be the Amazon of banking," he said. "It took Amazon 20 years to build what they have; they're not starting from scratch."