In the “If you can’t beat ‘em, join ‘em” world of bank-fintech relations these days, TD Bank’s recent agreement with the online lender Avant fits right in.

Avant is expanding its efforts to license technology to traditional banks, and TD Bank in March announced it will use the Chicago company’s technology platform, called Amount, to power the bank’s unsecured loan product, TD Fit Loan. HSBC, Regions Banks and Banco Popular also use Amount.

Avant, which has originated over $6 billion in loans since 2012, intends to offer portions of its technology stack to financial institutions. It is starting with its cloud-based platform for personal loan risk management.

“We’re going to continue expanding the product line to financial institutions,” said Avant CEO Al Goldstein. “We're expanding our product suite outside personal lending.”

Alternative lenders and banks hooking up for a tech exchange is increasingly commonplace.

What attracted TD Bank to Avant was the fintech’s track record dealing with online personal loan origination, and the legwork that’s already been done to develop the underlying technology and deal with issues such as fraud.

“Avant has gained a lot of experience in not only just credit underwriting, but also in preventing fraud losses,” Mark Victoria, the head of unsecured lending at TD Bank, said in an interview.

“In addition, they’ve invested a lot time and effort in investigating the latest and greatest when it comes to cutting-edge technology,” he added.

For example, Victoria mentioned how Avant works with multiple vendors on the risk management platform, called AmountVerify.

Avant already has solidified those partnerships, meaning banks don’t need to go through that process. That opens up the bank to link with fintechs in certain areas, and then add their institutional expertise to customize the technology for their needs.

“We can leverage their expertise, and then bring in our expertise as well,” Victoria said. “What we like about Amount is that we can completely customize the strategy to our own bank specifications.”

The partnership growth comes as the online lender pays

Goldstein said the FTC settlement does not affect Amount’s bank partners. "While the underlying technology systems are based on the same infrastructure, the issues identified by the FTC were prior to us separating our technology for use by various bank partners and therefore involved prior versions of the technology," he said.

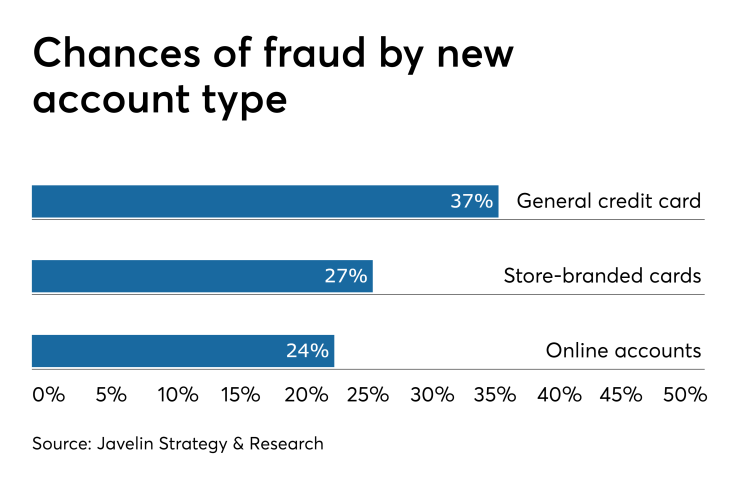

Avant’s decision to focus AmountVerify first on personal loans comes at a time when online fraud is rising in some lending areas.

Javelin Strategy & Research’s latest identity fraud study revealed mortgages, student loans, car loans and credit cards as common targets for new account fraud.

While fraudulent personal loan account openings decreased to 17% in 2018 from 19% in 2017, fraud associated with mortgages, student loans and car loans doubled over that time.

Overall, new account fraud losses amounted to $3.4 billion in 2018, up 13% from $3 billion the previous year.

Kyle Marchini, Javelin’s senior analyst for fraud management, said the digitization of the loan process has attracted criminals to lending as the EMV transition in the U.S. has put a dent in counterfeit payment cards.

“Digital account opening is great for consumers, but also great for fraudsters,” he said.

What criminals do is use scripts to target, say, 30 banks at once, Marchini said. “Maybe you only get approved for one loan, but that’s all it takes."

Banks do not realize fraud has taken place until an account is placed in collections, Marchini added.

He said banks are still playing catch-up in dealing with loan origination fraud.

“If a bank is just starting to move into the process of digitizing loan origination, I can see how it can be beneficial to pull in a fintech that already has an out-of-the-box solution that’s already pulling in a large number of fraud risk models,” Marchini added.

To that end, Avant uses a proprietary risk score for every consumer who applies for a loan, Goldstein said.

Avant compiles the score based on a number of identifiers, such as credit history, current address and government-issued identification.

“Based on that score, there will be a different pathway the customer will go through to verify themselves,” Goldstein said.

He said the score’s function is twofold: to prevent “bad actors” from gaining access to funds while making sure legit consumers have a smooth account-opening experience.

“I think where we’re unique is that we’ve been a lender dedicated to online account originations, but also the ability to verify those customers using the score,” Goldstein said.

Avant plans to expand AmountVerify to other financial products such as credit cards and deposit accounts, Goldstein said. The fintech itself has a credit card issued by WebBank.

“AmountVerify is just the first of several products we’re going to launch,” Goldstein said.