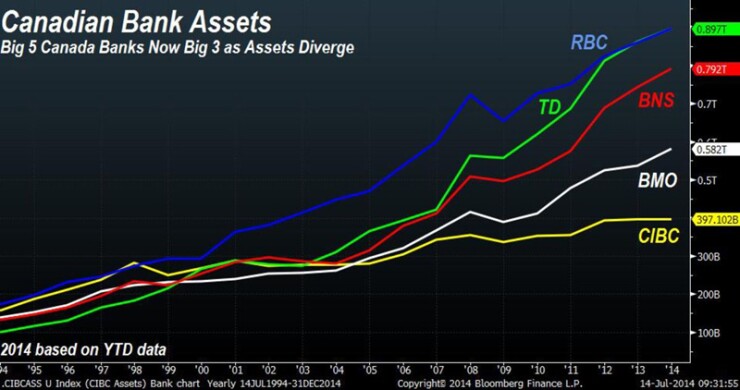

Toronto-Dominion Bank, Royal Bank of Canada and Bank of Nova Scotia have bolstered assets more than fivefold in the past two decades, as the country's three biggest lenders distance themselves from their smaller peers.

The chart on the right shows how Canadian Imperial Bank of Commerce, the nation's largest lender in 1998, fell to fifth spot while Bank of Montreal, the No. 3 lender in the mid-1990s, slipped to fourth as the pace of asset growth lagged rivals.

"Over the past 20 years, three banks have emerged as the big Canadian banks," Peter Routledge, an analyst with National Bank Financial, said. "Those three banks have separated themselves in terms of size and diversity."

Toronto-Dominion, which surpassed Royal Bank in December as Canada's largest lender, saw the biggest increase after embarking on a decade-long U.S. expansion that helped boost assets nearly ninefold. The lender ranked fifth in 1994. Royal Bank, which held top spot for most of the past century, began breaking from the pack in 2000 as it pursued a U.S. expansion. Scotiabank expanded gradually through incremental takeovers mostly in Latin America.

These Toronto-based lenders, often dubbed Canada's "Big Five" banks, were more closely clustered based on asset size in the late 1990s. During that period, the companies contemplated domestic mergers, with two sets of combinations Royal Bank with Bank of Montreal, and Toronto-Dominion joining CIBC. The deals were blocked by the government in 1998. That prompted the banks to look outside Canada for takeovers.