- Key insight: House Financial Services Committee Chair French Hill, R-Ark., is taking a wider approach to deposit insurance reform, casting doubt on a swift takeup of a bipartisan Senate bill.

- What's at stake: Hill declined to say whether he would take up a so-called "skinny" bill that only raised the deposit insurance limit for non-interest bearing accounts.

- Forward look: Hill also said he's working with the Office of Management and Budget to determine the administration's long-term "roadmap" for the Consumer Financial Protection Bureau.

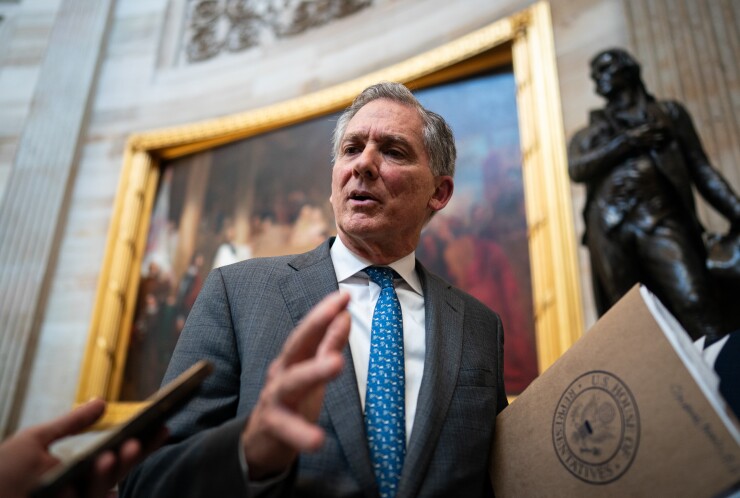

WASHINGTON — House Financial Services Committee Chairman French Hill, R-Ark., said that his committee is considering a raft of ideas that would change deposit insurance and failing banks.

The approach differs from that taken in the Senate Banking Committee, where the focus has been on

The House

Hill, answering questions from reporters a day after the hearing, continued to press that approach.

"This is a complicated area that deserves thought, and everyone who's testified acknowledges they don't have the math and the data to support making a decision that is not well considered," Hill said.

Hill said the committee wants to continue discussing waiving the least-cost resolution requirement for the Federal Deposit Insurance Corp. in selling failed banks if doing so would promote competition, as well as other modifications to the FDIC bank resolution tool kit. The panel is also talking about

"That's why I think it was a good, comprehensive hearing, instead of just cherry picking one idea out there," Hill said. "We tried to attach to the hearing all ideas that we've been hearing about over recent months."

Hill declined to say whether he would consider a so-called "skinny" bill from the Senate that would just raise the deposit insurance limit for some accounts, as the Hagerty-Alsobrooks bill would.

Hill also addressed industry concerns with the Consumer Financial Protection Bureau, and the likelihood that the bureau will run out of money in a

"Members have always expressed concerns about the CFPB's organization and its source of funding from the day it was created, but it's also subject to a law that has delegated certain responsibilities under certain statutes to that organizations, and I hear from stakeholders routinely, 'How am I going to get my new version of 1033 published? How am I going to have a new rule 1071 published? How am I going to resolve maybe a customer complaint issue that's still pending over there or some form of litigation?" Hill said. "So the House Financial Services Committee stuff has been working with OMB and the team there and to try and ask questions about how we're mapping these functions if in fact that takes place, and we're asking for this briefing, and the request is, we want to work together, but we need to have an outline of the direction the executive branch is trying to take."