-

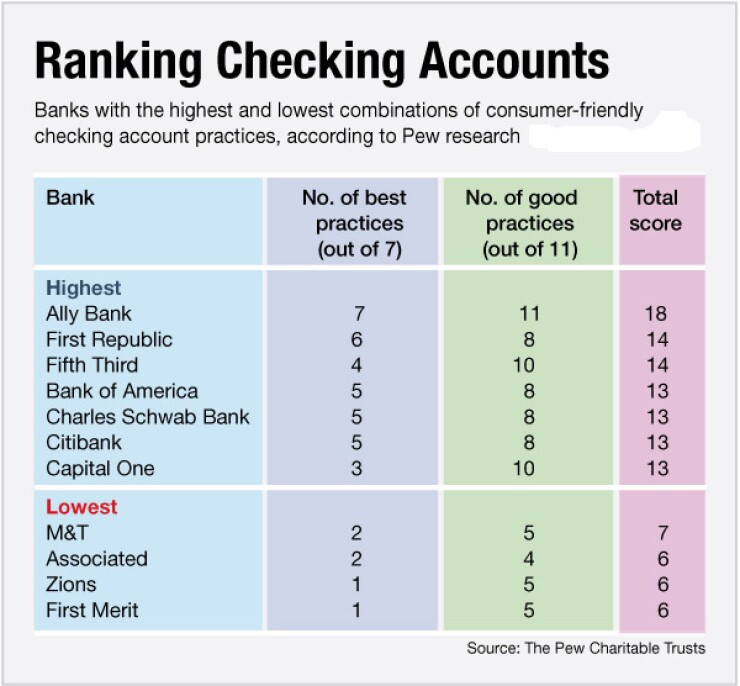

Ally Bank notched the highest number of best practices among the nation's largest banks in the areas of disclosure, overdrafts and dispute resolution, according to a report released Thursday by the Pew Charitable Trusts.

May 30 -

Banks that have been proactive in anticipating the regulatory winds might have little to fear from the rules, but others that have been slow to adapt could be forced to make significant changes that could crimp profits.

May 24

Big U.S. banks are making their overdraft policies more customer-friendly, according to a new consumer advocacy report, but in a more incremental fashion than its authors would like.

The report by the Pew Charitable Trusts compares the overdraft-fee rules at 44 of the nation's 50 largest banks. It is critical of banks that reorder transactions from high to low, tack on additional fees if the account remains overdrawn for a period of days, and engage in other practices designed to maximize overdraft fees.

Two institutions Ally Bank and Charles Schwab Bank met all 10 of Pew's recommendations on overdraft fees. Schwab is the only bank among the 44 studied that does not charge the fees at all.

Compared to one year earlier, more banks limited the number of overdraft fees that can be charged in a single day. And more of them had a minimum purchase amount most often $5 below which overdraft fees are not charged.

"There's definitely some improvement," Susan Weinstock, director of Pew's Safe Checking in the Electronic Age project, said in an interview. "But there's definitely still some ground that needs to be covered."

The report reveals that large banks are somewhat less likely than they were a year ago to reorder withdrawals from high to low. That practice can generate additional overdraft revenue and has led

But half of the 44 banks Pew analyzed still do at least some high-to-low reordering. Six banks Regions Financial (RF), SunTrust Banks (STI), TD Bank, Webster Financial (WBS), Santander Bank and BOK Financial (BOKF) were called out by Pew as having particularly bad policies on the reordering of transactions.

The report analyzed banks according to 18 different metrics, including some that do not relate to overdraft fees. Disclosure practices and dispute resolution policies, such as whether customers must agree to binding arbitration to settle claims, were part of Pew's analysis.

Several of the banks that scored highest operate mostly on the Internet. In addition to Ally and Schwab, USAA Federal Savings Bank also fared well overall. Weinstock said she doesn't know why online banks tend to have more consumer-friendly policies than some of their more traditional peers.

She noted that Bank of America (BAC), which finished near the top of the 2014 rankings, would have scored even higher if Pew's analysis had included

This is the second consecutive year that Pew has ranked big banks' checking account policies, and the public exposure in 2013 appears to have had an impact inside the banks.

In last year's report, eight out of 36 banks studied had adopted a summary disclosure box that Pew developed and encouraged banks to use. This year, 19 out of 44 banks are using the Pew disclosure box, according to the new report.

"We've moved the ball forward," Weinstock said. "After our report came out, we heard from a couple of banks, and we also saw some press reports of some banks saying that we're going to work on improving our practices."

Pew is using the report to not only put pressure on banks, but also to prod the Consumer Financial Protection Bureau, which is currently studying overdraft fees. Pew wants the consumer bureau to place new restrictions on overdraft fees, as well as to require better disclosure of checking account terms.

Asked if Pew plans to keep updating the report each year, Weinstock said: "Until we get the rules that we want from the CFPB."