-

Banks that have been proactive in anticipating the regulatory winds might have little to fear from the rules, but others that have been slow to adapt could be forced to make significant changes that could crimp profits.

May 24 -

The two U.S. bank subsidiaries of The Royal Bank of Scotland Group were hit with regulatory fines totaling nearly $14 million on Tuesday for what authorities called misleading marketing of their overdraft protection programs.

April 30 -

But large banks have narrowed the gap as they have made a more concerted effort to better explain their fee structures to disgruntled customers.

April 18

Ally Bank markets itself as being straightforward and having nothing to hide. Now a new study by a group that aims to make checking accounts safer for Americans seems to bear that out.

The Internet bank notched the highest number of best practices among the nation's largest banks in the areas of disclosure, overdrafts and dispute resolution, according to a report released Thursday by the Pew Charitable Trusts.

Charles Schwab Bank (SCHW), First Republic Bank (FRC), Citibank (NYSE:C) and Bank of America (BAC) round out Pew's list of banks that are best at providing customers with clear disclosures about checking account costs, eliminating practices that boost overdraft fees, and offering customers a meaningful way to resolve problems other than through mandatory arbitration.

The report is the third in a series by Pew, which aims to prod the Consumer Financial Protection Bureau to write rules that would that would require banks to summarize key information about checking account fees and terms and communicate clearly with customers about overdraft options.

The push by Pew comes amid efforts by CFPB to improve the quality of checking account disclosures. The agency is expected this spring to issue rules that govern overdraft practices. The rules, which the CFPB proposed on February,

No institution scored perfectly in Pew's survey of 36 of the nation's 50 largest banks. (Fourteen of the banks were omitted from the study because they failed to provide complete responses.) Ally, which topped the list, has adopted six out of seven best practices and nine of 11 good practices, according to Pew.

Susan Weinstock, director of Pew's Safe Checking in the Electronic Age Project, says that a key takeaway from the results is that banks have plenty of room for improvement.

"We surveyed as if we're a consumer reading the disclosures and figuring out what it is banks do based on them," Weinstock says. "What we found is they're long and dense and they're hard to read and they're complicated, and we think there certainly is a way for CFPB to take action to make sure these things are clearer."

Pew notes it is difficult for people to shop for a checking account when the median length of an account agreement and fee schedule for the banks that Pew examined runs 43 pages. That led Pew in 2011 to develop and publish a summary checking account disclosure box that 18 institutions - including seven of the 12 largest banks and two of the three largest credit unions - have adopted as of April, according to Pew.

The box spells out fees and terms for checking accounts, so that banks that have adopted the box are deemed to be engaging in a best practice, according to Pew. "Ultimately these things will result in a better marketplace, similar to how consumers shop for a can of soup at the grocery store with a nutrition label," Weinstock says.

Bank of America, Capital One (COF), Citibank, Fifth Third Bancorp (FITB), JPMorgan Chase (JPM), TD Bank, Webster Financial (WBS) and Wells Fargo (WFC) all have adopted a disclosure box, according to Pew. These eight institutions also have spelled out overdraft options and disclosed overdraft and penalty fees clearly, Pew says.

The median overdraft penalty for the banks scrutinized for the report is $35, and account holders who amass five overdrafts a day over the course of five days risk incurring $887.50 in fees in a single overdraft period, Pew concluded.

Charles Schwab Bank has the most consumer-friendly overdraft policies, followed by Ally Bank, USAA, Citi, City National Bank (CYN) and First Republic, Pew said in the report.

Best practices, according to Pew, are not charging for overdrafts at automated teller machines or the point-of-sale, and not reordering transactions by from highest to lowest in order to maximize overdrafts. Of the 36 banks included in the report, 24 including have stopped processing transactions from highest to lowest.

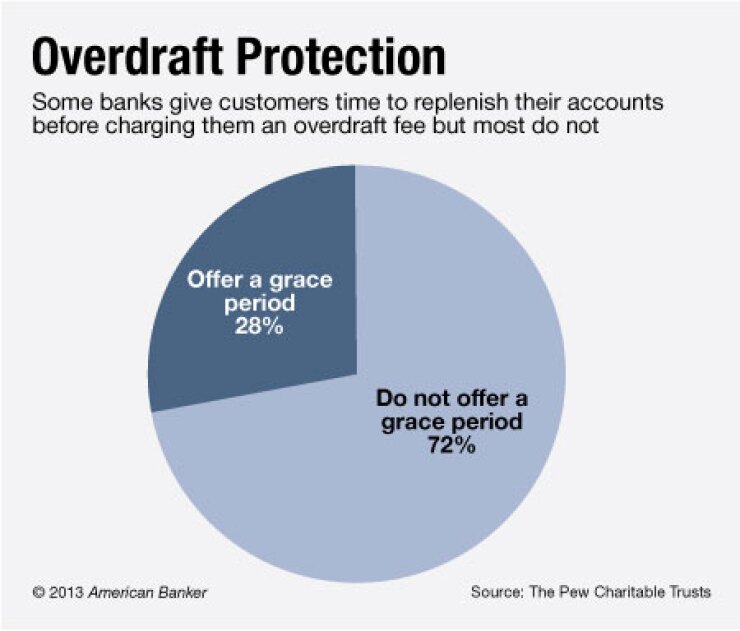

Good practices are: capping the number of overdraft fees charged per day; not charging extended overdraft fees; extending a grace period before charging an overdraft fee; putting in place a threshold amount to trigger an overdraft; and limiting reordering of transactions, Pew said.

Pew also recognized banks that do not require mandatory binding arbitration, do not bar bank customers from joining class-action lawsuits and that do not require reimbursement for costs and expenses relating to a legal dispute, regardless of the outcome.

Ally Bank, Commerce Bancshares (CBSH), RBS Citizens Bank, Bank of Hawaii (BOH), Comerica Bank (CMA), Signature Bank (SBNY) and TD Bank have adopted all three best practices, according to Pew.

RBS Citizens, Commerce and Ally also have adopted three good practices, which include allowing customers to opt out of binding arbitration, not requiring customers to waive their right a jury trial and allowing customers to bring disputes to small-claims court.

The Dodd-Frank Act directed the CFPB to study arbitration clauses with the goal of putting in place protections for consumers. The CFBP said in April it is looking into the prevalence and content of the clauses and the types of disputes consumers bring in both arbitration and the courts.