Thrifts have become more efficient than commercial banks, largely by taking a hard look at branch staffing.

Efficiency ratios at savings institutions fell to 52.67% on Sept. 30 from 60.43% four years earlier, according to the Federal Deposit Insurance Corp. The improvement outpaced commercial banks, which lowered their ratios to 56.08% from 59.95% over the same period.

While consolidation is a factor, research shows that thrifts are learning to do more with fewer employees.

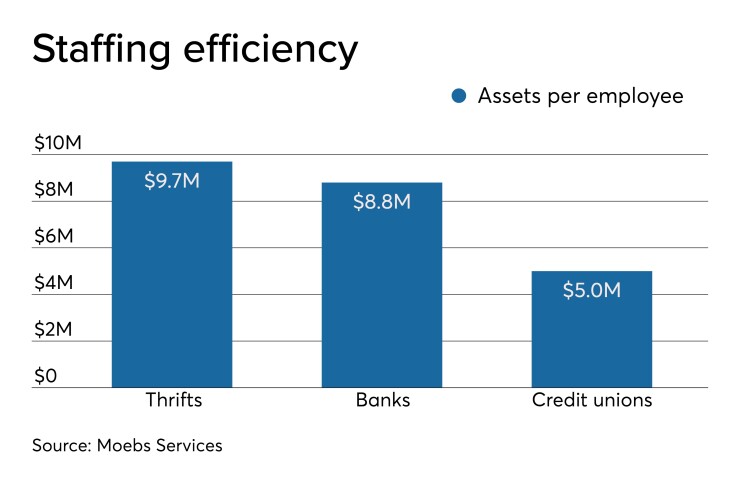

Thrifts, on average, have $9.7 million in assets per employee, according to data compiled by Moebs Services. The average at commercial banks is $8.8 million, while credit unions have about $5 million per employee.

Improved branch efficiency is helping thrifts in other ways, industry experts said.

Running leaner has allowed thrifts to pay, on average, 9% higher deposit rates than credit unions and 11% more than banks, said Michael Moebs, CEO of the Lake Forest, Ill., consulting firm that bears his name. They have also been able to retain more earnings, boosting capital levels.

"Of all noninterest expenses, employee cost is critical," Moebs added. "Having less employees, who are paid better, is the gold standard for success — now and in the future.”

Since late 2014, staffing at savings institutions has decreased by 11%, or roughly 15,400 jobs, according to FDIC data. Employment at commercial banks rose by 2% over the same period.

Union Savings Bank in Danbury, Conn., is among the thrifts trimming expenses.

The $2.2 billion-asset thrift has cut 29 jobs, or nearly 8% of its work force, since late 2015. Over that time, its efficiency ratio has improved from 73.97% to 67.46%. Retained earnings have helped boost its Tier 1 risk-based capital ratio from 13.54% to 16.47% over the same period.

"Good hiring practices, a culture focused on employee engagement, robust training, good communication, observational coaching and consistent recognition combined with better compensation will lead to better branch efficiency," said Cynthia Merkle, president and CEO of Union, which has 25 branches in western Connecticut.

Union also closed two branches and reduced its branch hours, Merkle said. The key has been to clearly define and communicate the customer service strategy, then use analytics and technology to execute.

"We pool resources in close geographic areas and use a simplified staffing model — streamlining the traditional branch manager/supervisor model," Merkle said.

Understanding customer behaviors is critical to staffing decisions, said Glenn Grau, a senior vice president of sales at PWCampbell in Pittsburgh. A branch with declining teller transactions but higher loan demand and a need for financial education would benefit from a universal banker model, which allows for fewer employees, he said.

Union has adopted the universal banker model, using service pods as part of its new branch design. It also allows for fewer managers and more customer service representatives.

To be sure, other financial institutions are making similar changes.

Though customers no longer need branches for most transactions, they still value a relationship with a banker to help with financial questions, said Brian Kreps, director of private and retail banking at the $365 million-asset InBank in Raton, N.M.

"The days of staffing to accommodate large levels of transactions are over, but staffing for interactions has grown in importance," Kreps said.

Knowledge of market's demographic composition, product needs and use of services should also determine a branch's size, design and staffing, Grau said.

Pay must be reevaluated when cuts occur, since the duties increase for the employees who remain, Merkle said. Conducting client surveys is another critical way to make sure that cuts aren't compromising the quality of customer service.

Ongoing training, along with career coaching, is another effective way to get the most from a smaller staff.

InBank has been working with its employees to develop broader skills so they can address more customer needs, Kreps said.

"A cross-functional team can step in and assist ... if a customer needs assistance making a deposit or applying for a loan," Grau said. Employees need to "do transactions, solve problems, offer advice and take a loan application."