-

Online borrowers are often hit with unauthorized charges and subjected to threats of arrests, according to a new report from the Pew Charitable Trusts.

October 2 -

California lawmakers have defeated a proposal aimed at reducing the size of the state's payday lending industry. A state Senate committee rejected the measure by a 5-3 vote Wednesday even after its author agreed to changes designed to soften the bill's impact.

April 18 -

California lawmakers are considering a bill that could potentially cripple profits for payday lenders in the nation's largest state.

April 16

California regulators want to make it awfully hard for online payday lenders to make loans in the nation's largest state.

Internet-based payday lenders, worried that online borrowers will stiff them, often make loans only to customers who provide electronic access to their bank accounts. But under a California proposal, those loans would be banned; instead, only loans secured by a paper check would be allowed.

The proposed change could be crippling to online lenders, while posing less of a threat to the old-fashioned business brick-and-mortar payday stores that still generally require borrowers to secure loans with paper checks.

Regulators in California are making no apologies for what would be a step backward in terms of technology, arguing that the move would protect consumers.

"It may not necessarily be a bad thing to reduce the amount of payday lending business that's conducted online," said Thomas Dresslar, a spokesman for the California Department of Business Oversight.

"The more the scope of payment instruments expands beyond paper, the more dangerous the market becomes for consumers," he added. "It's not the storefront operations that are the problem. It's the activity on the Internet."

The proposal, which was made public April 10, appears to have caught payday lenders in the Golden State by surprise. Last Thursday, in a letter to state regulators, an industry trade group asked that the deadline to provide comments be pushed back by six weeks. The current deadline for comment is May 25.

The California Financial Service Providers Association argued in the letter that the proposal "would have a high probability of forcing many or most" of the trade group's members out of the payday loan business. The group also warned of an "entire industry threatened with eradication."

State regulators took strong issue with that characterization, saying that their proposal aligns with the original intent of California's payday lending law, even though it reverses the state's prior interpretation of the law. That earlier interpretation, which is currently in effect, allows for the electronic repayment of payday loans.

"This proposal doesn't threaten the payday lending industry with eradication. Not even close. It brings the law back to its roots," Dresslar said.

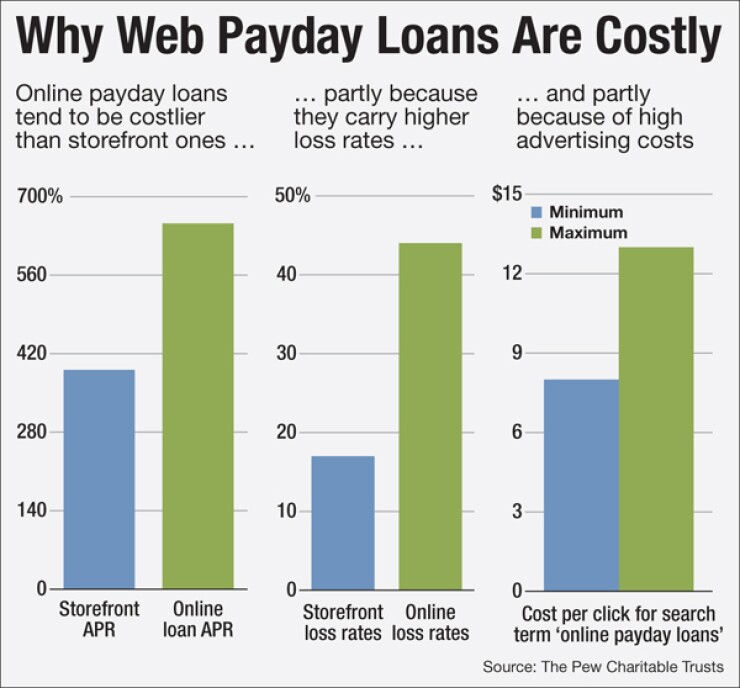

Online payday loans are typically more expensive than storefront loans, with annual percentage rates of 650%, according to a

But that report also concluded that the most objectionable practices nationally appear to be concentrated among the approximately 70% of online lenders that do not have state licenses. Unlicensed payday companies include offshore lenders and firms associated with Indian tribes, and

But it's the online lenders that are operating legally that would likely be hurt the most. Simply put, a borrower who applies for a loan online wants his funds immediately and won't want to wait the two or three days it may take for his paper check to reach the lender.

The entire California payday industry generated $3.17 billion in licensed transactions in 2013, the last year for which data is available.

The California Consumer Finance Association, an industry group, said that it is reviewing the proposed regulations, but also signaled its opposition.

"Rules that limit or make access more difficult for consumers to legitimate credit choices to not reduce demand for these services in any way, and can force consumers to turn to unregulated, dangerous and most costly options including many on the Internet," the trade group said in a written statement.

"We're surprised a state at the forefront of technology and innovation is asking consumers to revert back to paper checks," Lisa McGreevy, president of the Alexandria, Va.-based Online Lenders Alliance, said in an email.

Other state and national trade groups for the payday industry, including the California Financial Service Providers Association, did not respond to requests for comment.

The paper-check requirement may prove to be the most controversial element of the California proposal, but it's not the only part of the plan that seems likely to draw objections from the payday industry.

California officials are also proposing the creation of a state-administered database that would be used to track individual consumers' use of payday loans. Payday stores would be required to enter loan information into the database, and to check the computer to ensure that borrowers are eligible to receive a loan. Florida and Illinois are among the states that already have such databases.

Under current law in California, payday lenders cannot make a new loan to a consumer who has an existing balance outstanding. But without a database, "You can imagine how difficult that is to enforce," Dresslar said.

He emphasized that the payday industry will have multiple opportunities to comment on the proposed regulations before they're finalized.

For many years, consumer advocates in California

Consumer groups seem to have found a more sympathetic ear in Department of Business Oversight Commissioner Jan Lynn Owen, a former banker at JPMorgan Chase and Washington Mutual, who was appointed to the post by Democratic Gov. Jerry Brown in 2013. She wasn't made available for an interview.

"This is about a state regulator asserting its authority and enforcing what is existing law," said Paul Leonard, director of the Center for Responsible Lending's California office. "And that is certainly a welcome development."