Health care lending is tempting some banks.

The sector can be attractive since health care spending makes up a big portion of the U.S. economy. It also gives banks a chance to work with a variety of companies, including privately owned doctor offices, hospitals and medical-equipment manufacturers.

To be sure, risks abound. Lower Medicaid reimbursements and uncertainty around the Affordable Care Act have made many banks anxious about lending to health care providers.

“Right now, there’s an explosion of medical expansion with larger hospital systems buying smaller ones in an effort to drive scale … and through the ability to tailor their services per customer, banks can enter that healthcare lending industry,” said Mitch Siegel, the financial services strategy practice leader at KPMG.

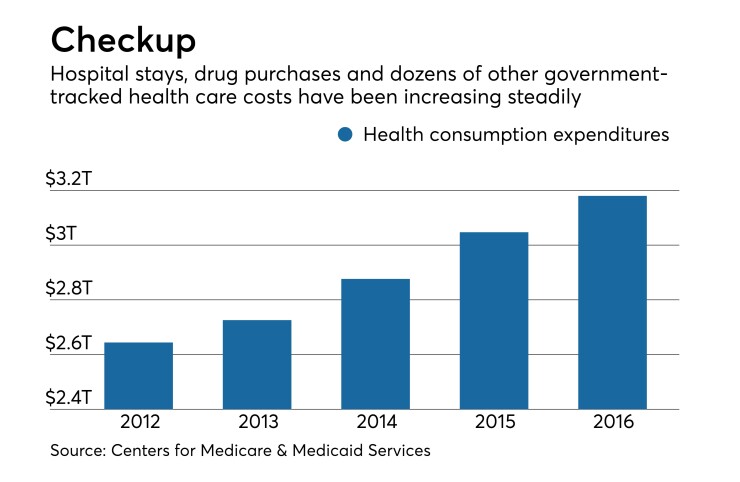

The overall share of gross domestic product tied to health care spending was almost 18% in 2016, according to the most recent data from the Centers for Medicare & Medicaid Services. Health care spending rose by more than 4% in 2016 from a year earlier, to nearly $3.2 trillion, the agency said.

Money spent on medical care is unlikely to decline any time soon as aging baby boomers require more services.

That creates lending opportunities for banks. Doctors may need loans to buy buildings for their practices. Hospitals need credit to purchase equipment or upgrade technology. Equipment manufacturers need lines of credit to pay for parts and labor.

On a broader scale, it makes sense for banks to target niche industries as long as they have develop a solid understanding of the sector they are targeting, industry experts said.

“I’m a big fan of niche lending,” said Tom Hall, president and CEO of Resurgent Performance in Alpharetta, Ga. Niche lending “allows a bank to become a trusted adviser for that market because it forces them to learn the intricacies of the industry.”

Still, there are nuances to the health care industry that lenders must be aware of. For instance, borrowers’ fortunes are closely linked to changes to key legislation and the size of Medicaid reimbursements.

“If you’re in the market, and you know your customers better, in theory you should be able to sell a relationship and add more value,” Hall said.

Many smaller health care operators have struggled with profitability, forcing some to seek bankruptcy protection and others to sell to larger competitors, said Timothy Lupinacci, a lawyer at Baker, Donelson, Bearman, Caldwell & Berkowitz. So problems can arise when a smaller bank tries to expand beyond its area of expertise

“It seems like the whole sector has little cracks in it,” Lupinacci added.

Expertise, particularly when it comes to underwriting, is critical for banks like Congressional Bank in Potomac, Md., which has been involved with health care lending since it formed a dedicated team about five years ago.

Congressional mainly lends to skilled nursing and assisted living facilities, though it will consider other borrowers. The bank modifies its underwriting criteria to take into account any key changes that could impact the sector.

Medicaid varies by state, so Congressional has a process to research anticipated changes and make underwriting adjustments, said Amy Heller, who oversees the $964 million-asset bank’s health care group. Congressional, in part, also focuses on borrowers with “stellar reputations,” she added.

“No bank should enter health care lending without having someone that has expertise in the field,” Heller said. “Prior to issuing a term sheet, we do as much upfront work as possible and look through various dynamics, ask for historical financial data and more.”

Opus Bank in Irvine, Calif., is once again lending to the health care industry after pulling back in the second half of 2016. The $7.3 billion-asset company expressed concern at that time that the niche wasn’t profitable enough. Since the end of 2016, the size of the bank's health care portfolio, including loans to practices and providers, has decreased by 45%, to $287 million.

Management is still interested in the industry because it represents such a large portion of the economy. As part of its return to the business, Opus has been hiring lenders from competitors such as Wells Fargo and Zions Bancorp.

Having expertise is critical and helps differentiate Opus from its competitors, said Brian Fitzmaurice, the bank’s senior chief credit officer. “Industry expertise is a positive differentiator versus the myriad of lenders who participate in the lending space but don’t always have deep healthcare experience,” he added.

The key this time around is increased discipline, said CEO Stephen Gordon.

Opus “has become extraordinarily … focused when it comes to risk management,” Gordon said.