2020 will be a good year for consumer credit, TransUnion’s researchers predict.

Delinquencies will be low and growth strong for most sectors, according to the credit bureau, which analyzed macroeconomic conditions and projected their impact on credit cards, personal loans, auto loans and mortgages in the coming year.

The forecast clashes with the views of some economists that the U.S. is headed into an economic downturn.

“The analysis we follow doesn’t indicate that a recession is on the horizon,” said Matt Komos, vice president of financial services research and consulting for TransUnion. “Given that, we feel the consumer credit market is going to continue in a healthy manner and continue a lot of the trends we’ve seen over the last couple of years. We’ve seen a consistent theme where lenders have been willing to provide access to credit in a measured way.”

This feel-good projection includes online fintech lenders, which own about 40% of all personal loan originations and balances.

“There have been new entrants every year,” Komos said. “They have been driving the unsecured personal loan market. But banks and credit unions have renewed focus in that area as well. Fintechs have cracked into something consumers are responding to, and it relates to what we call the ‘consumer first’ era — the idea that the consumer is in the driver’s seat today.”

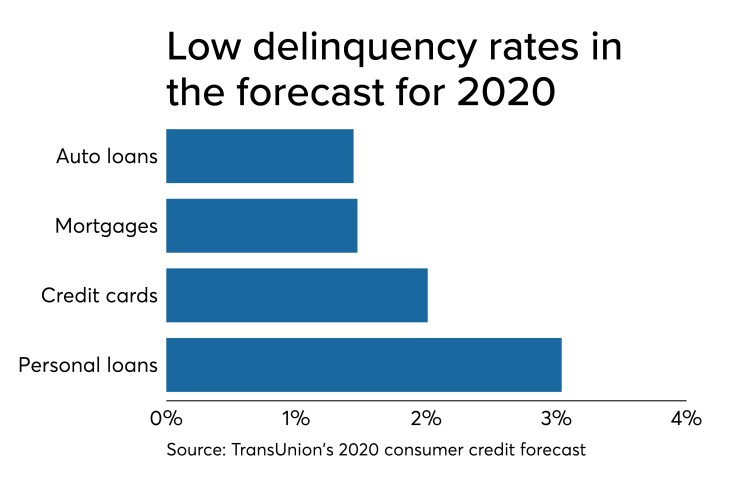

TransUnion expects unsecured personal loan originations to grow 8.4% in 2020. Meanwhile, the delinquency rate in the fintech-dominated space is expected to reach its lowest point in the past five years: 3.04%. This gives some credence to the idea that the fintechs, who tend to use alternative data and artificial intelligence in their lending decisions, are doing so responsibly.

The credit bureau expects to see total credit card balances increase 4% next year and finish the year at $864 billion. It anticipates credit card delinquencies to reach 2.01% in 2020, a slight uptick from this year’s rate of 1.99%.

“It’s been a competitive card market for the last couple of years,” Komos said. “There’s been a lot of growth on the super-prime side, but in the last four to five years we’ve seen more subprime players get into the market. So there’s been this dichotomy of focus on the most and least risky consumers. Some of that shift will drive delinquency rates up.”

TransUnion also expects first-time homebuyers will drive growth in mortgages over the next three years, as low unemployment, rising wages, low interest rates and slowing home price appreciation help affordability. Mortgage delinquencies will reach a five-year low next year of 1.47%, down from 2.28% in 2016, the company said.

Auto loan balances are expected to grow 1.6% next year, a slowdown from 2019's pace, because of issues concerning affordability. Some consumers may try to offset rising costs by obtaining longer-term loans. TransUnion predicts auto loan delinquencies will be 1.44% in 2020, a small decrease from the 1.47% expected for all of 2019.