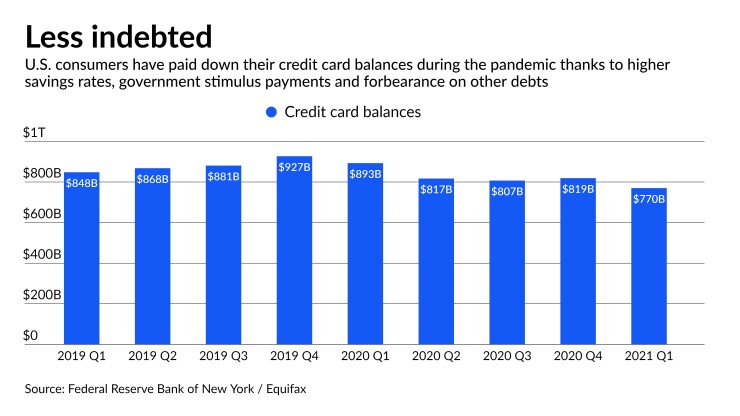

U.S. households again reduced their credit card balances in the first quarter, the Federal Reserve Bank of New York said Wednesday, even as vaccinations and reopenings were helping to rekindle consumer spending.

Card balances fell by $49 billion in the quarter, as stimulus payments and more limited travel and entertainment activities put Americans in better shape to pay off revolving debt.

The debt reduction was short of the $76 billion quarterly dive at the start of the pandemic but still marked the second largest decrease in the data. The New York Fed’s quarterly household debt and credit report uses figures dating back to 1999.

“The decline in the first quarter of 2021 is remarkable because it stands in sharp contrast to the recovery underway in the retail sector as the U.S. economy reopens and travel resumes,” a team of New York Fed officials wrote in a blog post.

Though credit card balances continued to drop, increases in mortgage, auto and student loan balances pushed overall household debt up by $85 billion. U.S. households had $14.64 trillion in total debt during the first quarter, up by nearly $500 billion since the end of 2019.

The trimming of credit card balances has been happening among residents of higher-income areas and lower-income ones, though members of the former group have paid down debt at the highest rates. The trend is evident among all age groups, with borrowers ages 20 to 29 accounting for the smallest share of the decline, but still showing decreases.

The paydowns have weighed on major banks’ card revenues, though the card issuers have also benefited from better credit quality.

Stimulus funds and elevated savings have been a “headwind against loan growth,” Discover Financial Services CEO Roger Hochschild told analysts last month. But Discover is not “overly alarmed about it,” he added.

Hochschild said that he expects debt repayments “to start drifting downward as we get further past the really extraordinary levels of government stimulus.”

JPMorgan Chase Chief Financial Officer Jennifer Piepszak also foresaw signs of a pickup in borrowing in the second half of 2021, with consumer spending already on the rebound. But she told analysts that the anticipated rise in borrowing “could come a little bit later given the amount of deleveraging we've seen.”

U.S. households continued to grow their mortgage balances, which jumped by $117 billion in the first quarter. Mortgage originations, including refinances, rose to $1.1 trillion and almost matched last year’s record highs. Most of the loans went to borrowers with higher credit scores. Those with scores above 760 accounted for a record 73% of balances.

Foreclosures fell to their lowest level stretching back to the data’s 1999 start, with roughly 11,000 consumers receiving a new foreclosure notice on their credit reports in the first quarter. Forbearance programs are helping keep a lid on delinquencies, with the share of mortgage balances that were at least 90 days past due declining to a historic low of 0.59%.

Delinquency rates across consumer asset classes kept falling during the quarter, with only about 3.1% of outstanding debt in some stage of delinquency as of late March, down 1.5 percentage points from the first quarter of 2020. Most of the $448 billion of delinquent debt is at least 90 days late or has been marked as “severely derogatory.”

The number of consumers who had a bankruptcy added to their credit report also reached a new historical low during the quarter, with 114,000 new bankruptcies.

Fewer people applied for new consumer credit, with the 116 million credit inquiries over the last six months marking a 3% decline from the previous quarterly report. Account openings fell by 1.4% from the previous quarter but were down 14% from the first quarter of last year.

Some lenders plan to boost their marketing efforts in an effort to reignite loan growth. Discover, which pulled back on marketing during the pandemic as it tightened up its underwriting criteria for loans, said last month that it was loosening again, even though its standards were not yet back to pre-pandemic levels.

“We feel good about the returns we'll generate from our marketing even in a more intense environment,” Hochschild said.