The surging use of automated clearing house transactions has been powered by tools that convert paper checks into electronic payments, a trend that is still gaining momentum, according to the Federal Reserve Board.

The 2007 Federal Reserve Payments Study, released Monday, shows that electronic payments now account for two-thirds of all noncash payments, up from just over half in the last such report, in 2004. The bulk of the gains came from ACH, which has become a widely used alternative to checks, and debit, which has become the most common electronic payment mechanism because it can be used to replace both cash and checks.

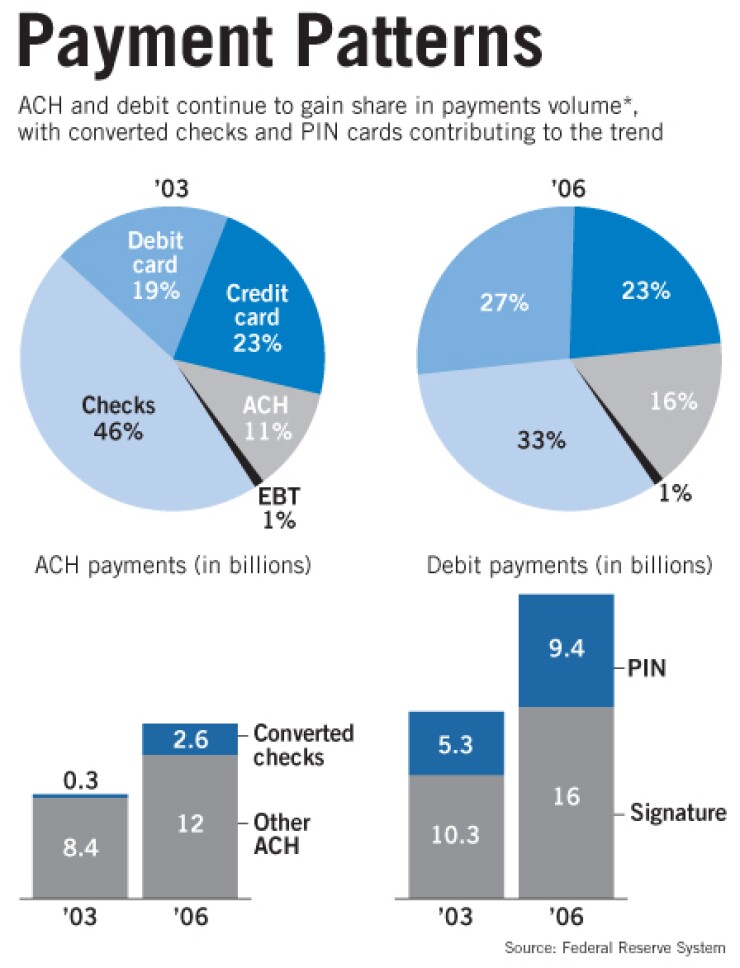

The Fed report found that while a total of 33.1 billion checks were written in 2006, only 30.6 billion of those checks were paid as checks; 2.6 billion were converted into ACH transactions and paid electronically. So, while the number of checks that entered the banking system last year was down by 12% from 2003, the number that reached paying banks fell even faster, by 18% over the same period.

"You're probably going to see a lot more check conversions in 2007 and beyond," Rich Oliver, an executive vice president and retailer payments product manager for the Federal Reserve System, said in an interview Monday. "The trend that's indicated in the study is likely to continue for some period of the time."

Mr. Oliver said that when the 2003 report was done, only a handful of banks had begun to use ACH conversion tools, such as the accounts receivable format. Since then, demand for such mechanisms has exploded as banks found more ways to take paper out of the system and more large retailers began to to use them.

For example, in March, Nacha, the electronic payments organization, authorized merchants to convert checks in back offices, and Wal-Mart Stores Inc. is now using scanners at most stores to convert checks at the point of sale.

Elliott C. McEntee, Nacha's president and chief executive, said there are no signs that check conversion will decline anytime soon. "We're estimating that the peak in check conversion volume is going to be someplace out in the four-to-six-year time horizon because of a combination of two factors — the number of checks being written is declining, and you're getting a bigger and bigger percentage of checks that are still being written being converted to ACH transactions," he said.

The Fed plans to release additional data next quarter, categorizing the use of checks by payer, payee, and purpose. Mr. McEntee said he "wouldn't be surprised if the decline in check volume at the point of sale will be greater than the decline in other kinds of checks that consumers are writing, because of the huge increase in debit card transactions."

ACH payments showed the highest growth rate of all electronic payments, rising by 18.6% a year, to a total of 14.6 billion transactions worth a total of $31 trillion. About 38.4% of all ACH transactions were converted checks.

Debit transactions were a close second, gaining by 17.5% a year, to a total of 25.3 billion payments worth $1 trillion. The average debit transaction fell slightly, from $40 in 2003 to $39 in 2006.

Mr. McEntee said that one key to debit's growth is acceptance; debit has become a common payment tool in places that once took only cash, such as fast-food restaurants.

"Debit cards can not only replace the check, but also replace cash payments," he said. "Fast-food payments are cash payments, not checks, but for the most part ACH payments are replacements of transactions made only by checks, not cash."

Mr. Oliver said the increase in debit acceptance is driving down the average transaction size.

"More and more venues are offering the capability to use debit cards for low-dollar transactions, and that makes a lot of sense," he said. "The dollar values on debit transactions, both signature and PIN, went down,"he said. "That would lead you to believe they're being used for a lot more micropayments, which you would never use a credit card for.."

Checks accounted for 46% of all noncash payments in 2003, but that figure fell to 33% in 2006.

ACH payments increased from 11% to 16% over the same period, and debit from 19% to 27%.

Credit card payments increased by 4.6% a year, to a total of 21.7 billion payments. The average credit card purchase increased slightly, from $89 in 2003 to $98 in 2006.

Tony Hayes, a director specializing in payments with Oliver Wyman Financial Services, said that debit transactions in 2007 will likely "exceed the number of checks for the first time," making debit "the most common noncash payment in the U.S., mirroring the dynamic in most other developed countries."