-

As investor Jay Sidhu and Atlantic Coast Financial intensify their fight over the Florida company's deal to sell to Bond Street Holdings, the market has priced a higher deal value into the stock. Atlantic Coast warns that no such bump-up is coming.

May 17 -

Ameris Bancorp in Moultrie, Ga., has agreed to buy Prosperity Banking Co. in St. Augustine, Fla.

May 2 -

HCBF will merge BSA Financial's $168 million-asset Bank of St. Augustine into Harbor Community Bank when the deal closes, the companies said Friday.

April 26 -

Regulators seized two banks in Florida, and one in Kentucky, in a trio of failures Friday.

April 19 -

FirstAtlantic Bank in Jacksonville, Fla., has acquired a branch from Prosperity Bank in St. Augustine, Fla.

December 10

If cash is king, then FirstAtlantic Bank is well positioned to build an empire in northeast Florida.

The Jacksonville, Fla., bank serves a market where three banks have lined up buyers in recent months. It is backed by private equity and eager to take advantage of any disruptions.

"There are a lot of community bank boards that have asset quality or other regulatory challenges and they have gotten tired," says Mitchell Hunt, FirstAtlantic's president and chief executive.

"It's hard to raise capital," Hunt adds. Some bankers "share our view that you have to get much larger. If they don't have the capability to get larger themselves, then selling becomes an attractive option."

FirstAtlantic has assets of $447 million. Its management wants it to reach $1 billion. The bank recently bought

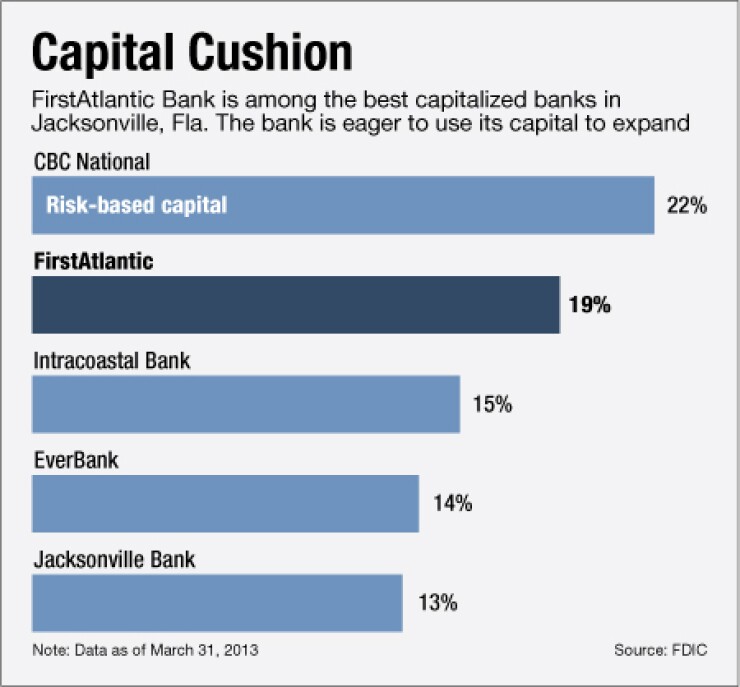

FirstAtlantic is well capitalized, a fact that sets it apart from other smaller banks in Florida and opening up its options, says Benjamin Bishop, chairman of Allen C. Ewing in Jacksonville. (The bank's risk-based capital ratio was 18.73% at March 31, according to the Federal Deposit Insurance Corp.)

In late 2010, an affiliate of Hovde Private Equity Advisors

"The FirstAtlantic folks have the benefit of knowing that they have someone who is willing to invest in them," Bishop says. "The fact that they have a large investor should persuade others to invest as well."

That war chest should help lure experienced lenders and customers away from competitors, particularly as Jacksonville banks are sold. Ten banks are based in the area, but

Consolidation around Jacksonville comes as no surprise to industry experts. Home to a professional football team, the city flourished in the 1990s, only to stumble when the real estate downturn hit, Bishop says.

Low interest rates and stiff competition are also forcing banks to think more about scale, says Joseph Thomas, managing director at Hovde Private Equity Advisors and a FirstAtlantic director.

"There are fewer of what we think of as traditional commercial banking opportunities in Florida," Thomas says. "There has been a historical reliance on tourism and real estate. That puts a premium on scale."

FirstAtlantic bought its charter from another company in late 2007 with a strategy of focusing on residential construction. But the financial crisis struck and housing prices tumbled, making it a "terrible time to get into that," Hunt says. Instead, it shifted its sights on other types of loans.

"I think maybe the best lesson we learned is that if the world changes then you need to change as well," Hunt says. "You can't force a strategy that the economy won't give you."

Organic growth has been slower than Hunt had anticipated. The downturn lasted longer than expected and banks continue to spar over loans. But the bank has been able to hire staff and add loans at a time when others are trimming costs. Total loans at FirstAtlantic rose 2.4% in the first quarter compared to a year earlier, to $215 million.

"We've never had to curtail our lending because of regulatory issues," Hunt says. "That makes us attractive to bankers."

The bank continues to look for acquisitions failures, open banks and branches that are within a "half a day's drive" from Jacksonville, Hunt says. FirstAtlantic is open to buying banks that share its focus on lending to small- and midsize businesses, he adds.

FirstAtlantic is also increasing its commercial lending and looking to expand around Jacksonville. That city "is attractive and has always been a major draw for larger corporations," says Bill Massey, a shareholder at Saltmarsh, Cleaveland & Gund. The city has a port and is home to a number of large companies and vendors that support those businesses, industry experts say.

Of course, there is the potential that FirstAtlantic could eventually sell. Hovde will eventually "seek liquidity in our shares but it's not in the immediate future," Thomas says.

For now, FirstAtlantic is focused on maintaining "good profitability and excellent customer relationships," Hunt says.

"If we do that, we will create value for our shareholders," Hunt adds. "What will happen down the road is just speculation, but we know if we are larger in size and highly profitable our shareholders will be rewarded one way or another."