Flagstar Bancorp in Troy, Mich., has agreed to buy 52 branches from Wells Fargo in San Francisco.

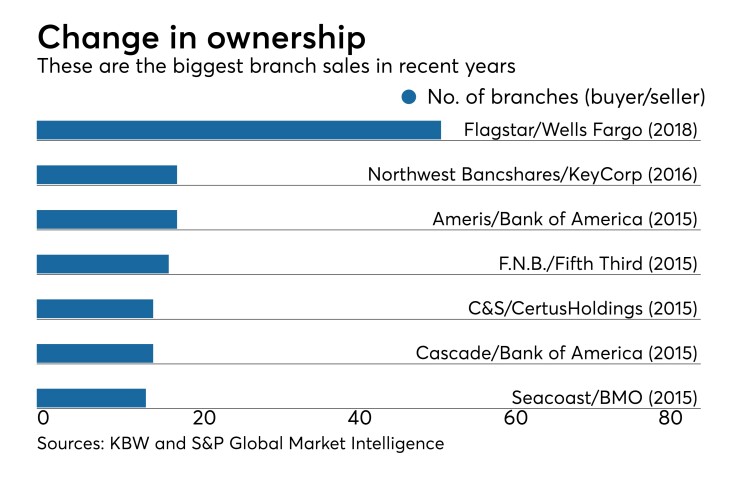

The $17.7 billion-asset Flagstar said in a press release Tuesday that the deal, which is the largest branch sale recorded in years, would provide it with it liquidity it could use to repay short-term Federal Home Loan Bank advances. Having a larger branch network would also expand its access to core deposits and other business opportunities.

The deal includes $2.3 billion in deposits and $130 million in loans, along with certain related assets, Flagstar said.

Flagstar has been working to

Wells Fargo had previously announced plans to reduce its retail network by roughly 5,000 branches by the end of 2020. It currently has almost 6,000 branches, according to the Federal Deposit Insurance Corp. The banking giant has

Flagstar was eager to increase its presence in the Midwest, a market that it knows well and finds “very attractive," Alessandro DiNello, the company's president and CEO, said in the release. The deal includes 33 branches in Indiana, 14 in Michigan, four in Wisconsin and one in Ohio.

Once this deal closes, Flagstar will have about 150 branches in the Midwest and eight in California. Most of its locations are in Michigan, according to the FDIC.

Flagstar will pay a deposit premium of roughly 7%, based on Dec. 31 balances, and management expects the deal to be moderately accretive to next year's earnings per share. Flagstar said it should take "significantly less" than five years to earn back any dilution to its tangible book value.

The branches would be rebranded. Flagstar plans to keep all of the branches and their roughly 490 employees. The deal is expected to close in the fourth quarter.

Flagstar was advised by Skadden, Arps, Slate, Meagher & Flom. Sandler O'Neill advised Wells.