The types of incentives that went awry at Wells Fargo appear to be the exception rather than the rule in retail banking, according to a new report from SourceMedia Research.

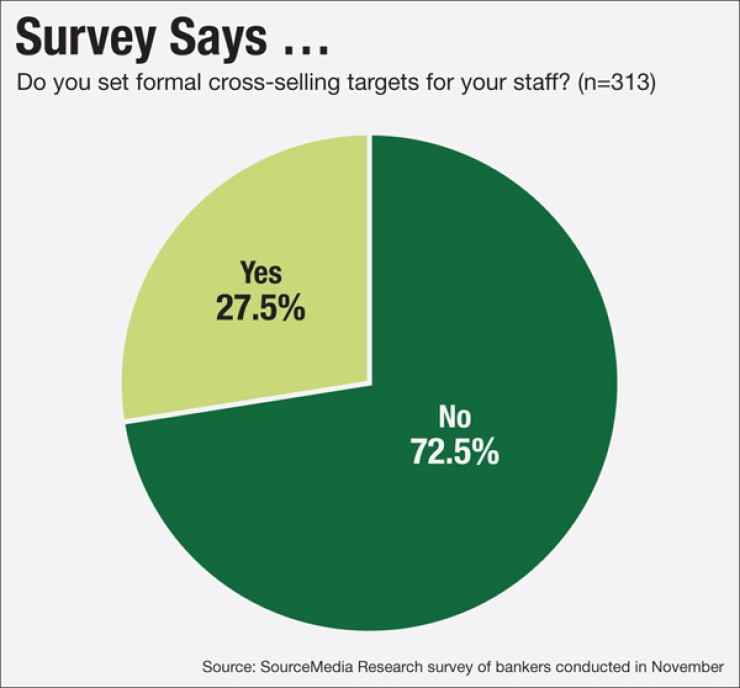

Just 27.5% of the more than 300 bankers surveyed in November said their institutions set formal cross-selling targets for their staff. Among those that do, about half aim for a specific number of products per customer relationship.

Of the group with hard targets, the vast majority said they had formal incentive programs to encourage cross-selling. But close to half of those executives said their companies either have changed or are planning to change their practices and policies.

The report comes at a time when regulators are

The full SourceMedia Research report, entitled "Cross-Selling: What's Really Going On?," can be found