WASHINGTON — Bankers are already beginning to worry that an increasingly likely Donald Trump presidential nomination could threaten GOP control of the Senate and key industry priorities.

Early analysis suggests that a Trump choice could galvanize the Democratic base, leading to record turnout that may spill over to other races on the ballot. With Republicans already facing an uphill struggle to retain the Senate, many projections show Trump helping to tip Senate control to the Democrats. That would undoubtedly hamper bankers' agenda, according to observers.

"At a bare minimum, the Republican agenda for changes to the Consumer Financial Protection Bureau, changes to Dodd-Frank and their kind of regulatory relief push they had last year is dead on arrival," said Ed Mills, an analyst with FBR Capital Markets. "If Democrats have the Senate, the regulators are going to have the ability to continue with what is pretty tough and impactful legislation."

-

In almost any other election cycle, bankers would be celebrating the fact that a Republican candidate has emerged so far in front of the pack and would quickly fall in line behind him. But this has been anything but a normal election cycle, and there are a whole host of reasons that bankers will be at least as reluctant to embrace the outspoken businessman Donald Trump as the Republican establishment has been.

March 1 -

Senate Banking Committee Chairman Richard Shelby's easy victory in his primary battle in Alabama is fueling hopes he may soon move forward on a number of key financial nominations.

March 2 -

Love him or hate him, Trump provokes strong reactions from much of the electorate, bankers included. His volatile temperament and penchant for showmanship have left many skeptical, but some see his business experience and dealmaking savvy as a positive.

February 26

To be sure, the election is nearly eight months away and the race seems to change by the hour. Former Secretary of State Hillary Clinton appeared close to locking up the Democratic nomination until late Tuesday, when rival Sen. Bernie Sanders, D-Vt., barely won the primary in Michigan.

Trump, meanwhile, racked up three more victories in the Michigan, Mississippi and Hawaii primaries on Tuesday, while coming in second in Idaho. Despite a burgeoning Stop Trump movement from some Republicans, he remains the front-runner to win the nomination.

What happens after that is unclear. Assuming that Trump faces Clinton in the general election — which is still the most likely outcome — political forecasters' best guess right now is that the New York billionaire would hurt the Republicans in key races.

Larry Sabato, the director of the Center for Politics at the University of Virginia, said Democrats are in decent position to make gains regardless of which Republican is on the main ticket.

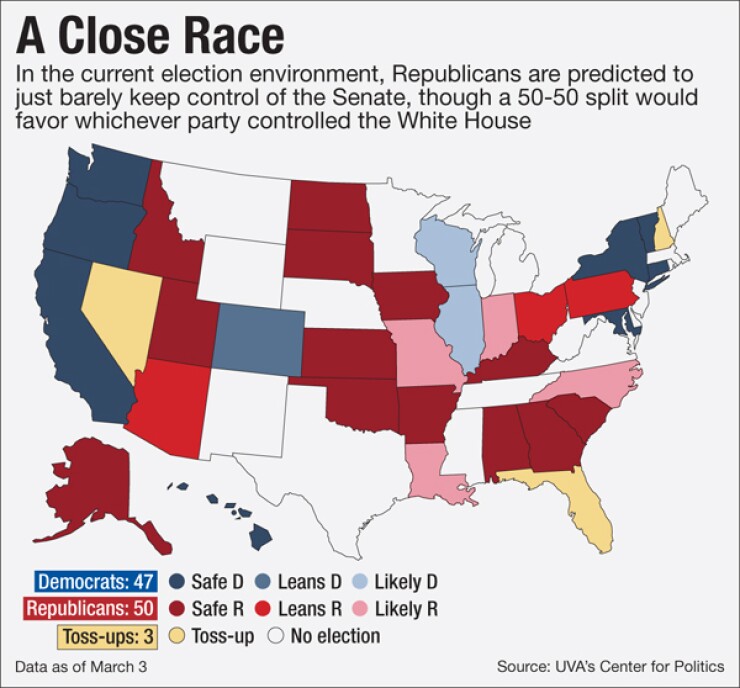

"Democrats have better-than-even odds of recapturing Republican-held Illinois and Wisconsin, and they have several other targets, while Democrats are defending an open seat in Nevada and another potentially competitive seat in Colorado," Sabato

Ultimately, Sabato projects Republicans keeping 50 seats, while Democrats have 47 and three races are toss-ups.

But Democratic odds of capturing the Senate go up significantly if Trump is the GOP nominee, he wrote. Although he cautioned that it is still early, he sees five seats going to the Democrats if Trump is the nominee, enough to give them at least 51 seats in the Senate, guaranteeing them control no matter who wins the presidential race. (In a 50-50 Senate split, the tie goes to the party that controls the White House.)

"This moves four additional Senate races — Florida, Nevada, New Hampshire and Pennsylvania — toward the Democrats, and others would become more competitive," wrote Sabato. "Ohio would be a toss-up, while Democratic odds could also improve in places like Indiana, Missouri, and North Carolina." (See maps attached to this story for a better look at what states would be in play.)

Some political forecasters disagreed with this analysis, arguing it's too early to tell — particularly in a race that has consistently produced surprises. It's possible that Trump could end up bolstering Republican turnout or that his nomination is so unusual it doesn't affect the down-ballot races in a predictable fashion.

"The conventional wisdom has been absolutely wrong 100% of the time this year when it comes to Donald Trump," said Keith Frederick, owner of FrederickPolls, an issue and political campaign polling company. "We might want to wait to rush to judgment on how [the presidential race] will affect the down-ballot races."

For bankers, however, the stakes are high.

If Democrats control the Senate, Sen. Sherrod Brown of Ohio is poised to take control of the Senate Banking Committee. Brown is a progressive Democrat who has called for significantly raising capital requirements on the biggest banks, enough so that they would be effectively forced to break themselves up. He has also been aligned with fellow progressive Sen. Elizabeth Warren, D-Mass., on key financial issues.

Brown has opposed Senate Banking Committee Richard Shelby's regulatory relief bill, arguing it goes too far, and put forward his own vision of relief which many bankers see as inadequate. (Some have speculated that Brown could also be Clinton's pick for a vice presidential candidate, which would shake up control of the Banking Committee if she won the race.)

Ultimately, Democrats' Senate agenda would be shaped by the race for the White House.

"A Republican administration and a Democrat led Senate may put the potential chairman in a more defensive posture of defending what the current administration put in place related to Dodd-Frank and other things," said James Ballentine, executive vice president of congressional relations and political affairs at the American Bankers Association. "A Democratic chairman's agenda would change considerably if a Democrat occupied the White House and would likely focus on the items outlined in their parties respective presidential platforms."

Clinton has said she plans to increase regulatory oversight for hedge funds and private equity firms, often referred to as the "shadow banking" sector. Mills said if the Democrats win both the Senate and the White House "there will be a joint effort … to move to the next level of regulatory oversight of the areas that have not been directly impacted by the legislation, regulation that has been passed to date."

It's unlikely that Democrats would have enough seats to pursue an ambitious Wall Street reform plan such as another Dodd-Frank-type bill, but they could keep the pressure on bankers while pursuing other regulatory initiatives.

“You have had fundamental reform of the banking system due to Dodd-Frank, and a Democratic Senate ensures that those regulations are going to continue to go forward and regulators have good political coverage to implement pretty tough regulations as a result of Dodd-Frank and Basel III,” Mills said. “A Congress that does nothing on legislation is kind of a support for strong regulation of Wall Street and banks generally.”