An investment fund with about 100 community banks as limited partners closed its first fund.

BankTech Ventures, in Sandy, Utah, announced on Monday that it gathered more than $115 million in committed capital.

Like

In a 2021 interview, Carey Ransom, managing director of the investment fund, highlighted the structure of BankTech Ventures as an asset. For example, portfolio companies can go through the ICBA's accelerator, while the two community bank general partners can pilot products and collaborate with management teams.

"It's a unique combination that will help us both in vetting and determining which companies to invest in and our ability to help those companies be successful," he said.

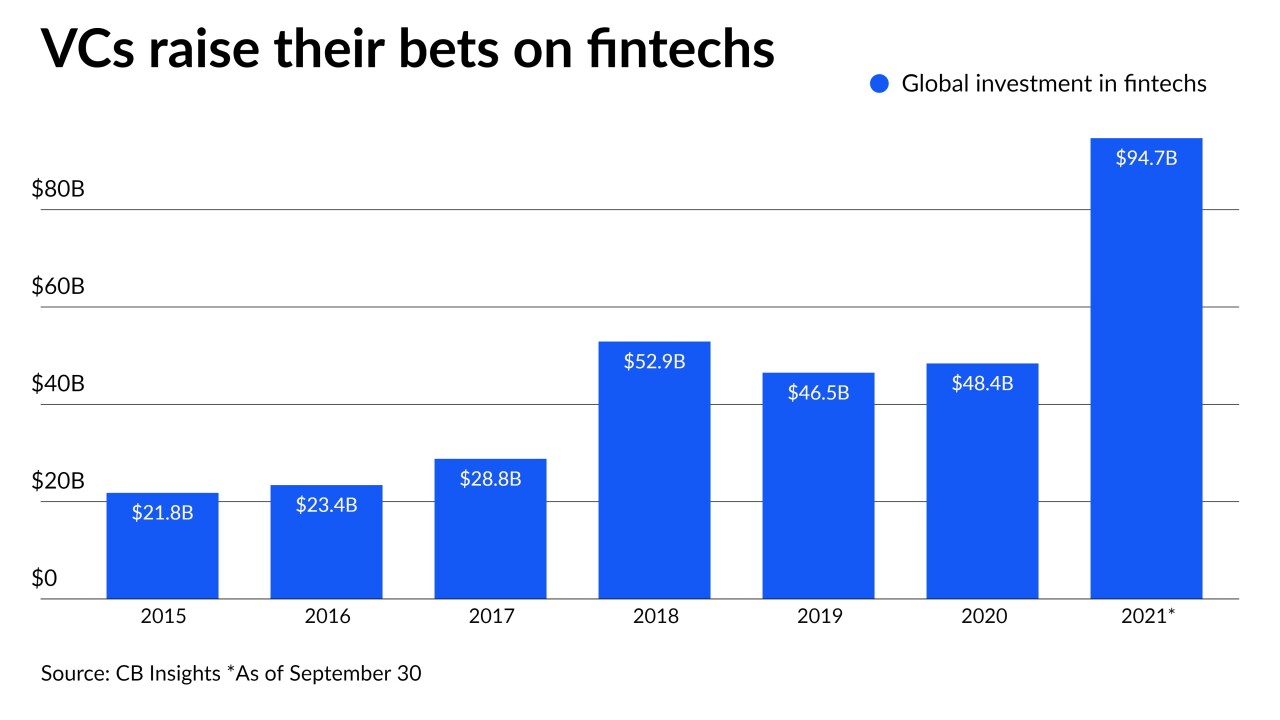

These venture capital firms are investing in young companies that could help small financial institutions meet their growing technology needs.

The investment fund has attracted more than 100 limited partners, which are largely community banks, including

"Johnson Financial Group had never made a prior venture capital fund investment before BTV," Mark Behrens, chief financial officer at Johnson Financial Group in Racine, Wisconsin, said in a press release that publicized the closing. "We've already learned a lot and met many exciting new companies through this partnership." Johnson Bank has $6.1 billion of assets.

Since November 2021, the fund has made eight investments. They include Fintel Connect, which

Another of the portfolio companies, infrastructure and integration firm ModusBox, has seen value in being one of those select companies. In the first few months "we've already tripled our pipeline of potential customers," David Wexler, co-founder and CEO of ModusBox, said in the release. "We've gotten input and value from them in every part of our business, from hiring to messaging to contracts, pricing and strategy."