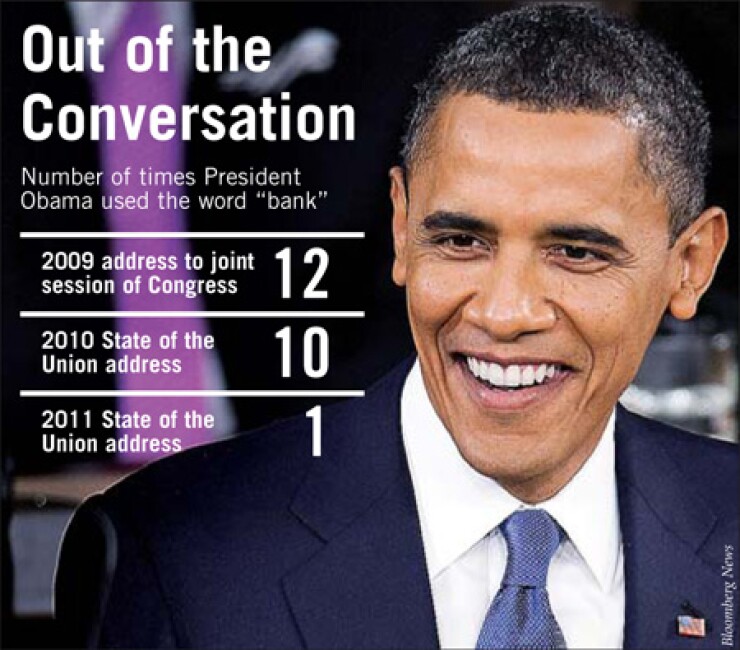

WASHINGTON — The absence of banking issues from the State of the Union speech was logical two years after the crisis, but lawmakers were disappointed that President Obama was silent on areas still in turmoil.

Chief among those are the persistent foreclosure crisis and the future of the government-sponsored enterprises, which got zero attention in the speech.

"Not a whole lot about financial issues, … and obviously I would have liked to have heard more of that, a recognition of what a problem that remains to the economy and for the middle class," said Rep. Brad Miller, D-N.C., a member of the financial services committee.

Obama's focus on nonfinancial issues Tuesday reflected the shift in climate since just last year, when the administration was campaigning for financial reform, and the year before that, when the financial crisis loomed large. But this time, with most banks profitable again and the Dodd-Frank Act in law, he only touched briefly on financial services, citing legislative accomplishments, such as Dodd-Frank and student-loan reform, and suggesting a streamlining of the agencies dealing with housing as part of a broader discussion on government bureaucracy.

"Two years after the worst recession most of us have ever known, the stock market has come roaring back. Corporate profits are up. The economy is growing again," Obama said.

In interviews, lawmakers said that, though they were not surprised by the shift, they wanted more on issues like mortgage servicing improvement and the GSEs. The administration's Home Affordable Modification Program, intended to direct federal resources to helping troubled borrowers avoid foreclosure, has been deemed a failure. And there is no clear route on the future of Fannie Mae and Freddie Mac, which are still being run by the government.

"There was no talk about the housing crisis and the stalemate we have in loan modifications," said Rep. Maxine Waters, the No. 2 Democrat on the Financial Services Committee. "We know that there are a lot of Americans who are losing their homes, and we have not come up with a formula … to protect them.

"We expect that there are going to be some attempts to try and work out a way by which we get a handle on servicers. … So he didn't talk about it, but I think he's going to have to deal with it."

Republicans, meanwhile, homed in on the zero mention of a GSE plan. The Treasury Department has been working on a report either to propose concrete steps for Fannie and Freddie's future, or to at least weigh up the pros and cons of various options for the GSEs. But the report's release has been delayed several times, and lawmakers said the speech suggested that the issue is not high on the White House agenda.

"It's the largest issue that has been unaddressed in our financial regulatory legislation, and so I think it was highly disappointing," said Rep. Jeb Hensarling, R-Texas, the vice chairman of the House panel. "I think it says a lot. They continue to kick the can down the road. They continue to ignore what will prove to be the biggest mother of all bailouts."

Sen. Saxby Chambliss, R-Ga., said that he inferred from Obama's speech that reforming the GSEs is not a priority. "I have said from day one that we are going to come out of this financial crisis when we fix that aspect of our economy that got us in the crisis, and that's the housing industry, and if you don't reform the GSEs and you don't get Fannie Mae and Freddie Mac straightened out, the recovery is going to happen, but it is going to be much, much slower."

"So I had hoped to hear something from the president along the lines of what we are going to directly do regarding both the residential and the commercial real estate industry," Chambliss said, "but we didn't hear that."

To be sure, the speech's focus on broader economic principles like expanding jobs and opportunities for business innovation left some lawmakers more satisfied that banking-related issues were included, though indirectly.

At one point, while expressing support for streamlining regulatory overlap, Obama indicated that this would include housing-related agencies. "There are at least five different agencies that deal with housing policy," he said.

Republicans said they hoped Obama would apply his commitment to reducing unnecessary burdens on business to revisiting the financial reform law.

The regulations in Dodd-Frank are "going to be expensive on the financial industry, and who is going to pay for them at the end of the day? Customers are going to pay for it," said Chambliss. "And there is not going to be any additional protection given to the customer by virtue of having to do that, so I would hope again that the president means he truly wants to look at regulations or changes in the law that will be beneficial to end-users."

Others said Obama's jobs focus relates to the foreclosure issue.

"What he tried to talk about was in broader strokes. He also was giving a large message about moving forward, and my reaction is, the best way to prevent foreclosures is to get individuals a job because a lot of the foreclosure situation is with individuals who became unemployed," said House Financial Services member Greg Meeks, D-N.Y.

"He was talking more about how do we get America back on track, and if we can do those things then I think you'll see foreclosures down, homes going up and banks able to lend," Meeks said.

Several agreed that a speech like the State of the Union does not offer the kind of format to explore details like GSE oversight.

"I didn't really expect to hear that kind of detail tonight," said Tennessee Republican Sen. Bob Corker, a member of the Banking Committee. "It was more like a 40,000-foot kind of speech. … I still expect him to come to us with a [GSE] plan."

Many lawmakers said they hope the administration soon devotes more attention to housing. "You can't mention everything," said Sen. Sherrod Brown, D-Ohio. "But yeah, I think the president needs to reorder the Hamp program. It's not what we need. We need more federal assistance for local counselors to keep people in their homes. We need to work with the banks better than we have."

Also prominent in the speech was a push for more bipartisanship in Washington, in reaction to what many say was overly rancorous debate in the last Congress. Key members of both financial services committees participated in a popular exercise unseen in recent congressional sessions — in which some lawmakers chose to sit with someone from the opposing party during the speech.

Sen. Richard Shelby, R-Ala., the ranking Republican on the Banking Committee sat next to Sen. Tim Johnson, D-S.D., the panel's chairman. Sen. Jack Reed of Rhode Island, the panel's No. 2 Democrat, was sitting in a row with Corker and Rep. Scott Garrett, R-N.J., the House Financial Services Committee's capital markets subcommittee chairman. Republican Rep. Judy Biggert, the chairman of the Financial Services Committee's insurance and housing subcommittee, sat with fellow Illinois lawmaker Rep. Luis Gutierrez, the subcommittee's ranking Democrat.