Small businesses and community banks need one another, and can have a mutually beneficial relationship - with much-needed capital on one end and fee income on the other.

But new research from Aite says small-business customers are community banks' least satisfied customers, in part because of everyday problems that could be lessened or eliminated with improved automation - application paperwork, long loan-approval decision times and the lack of a dedicated relationship manager or knowledgeable staff.

"One of the first things community bankers have to do is look at their product set and make sure they have the right tech in place that allows them to give answers on credit - one way or another - in a timely or efficient matter," says Christine Pratt, a senior analyst at Aite Group.

Pratt is also co-author, with Christine Barry, of "Commercial Loan Processing Solutions and Analytics: Community Banks Weigh In," a report issued in late 2011 on a survey of 100 community banks. The small-business loans that the survey looked at were for less than $1 million.

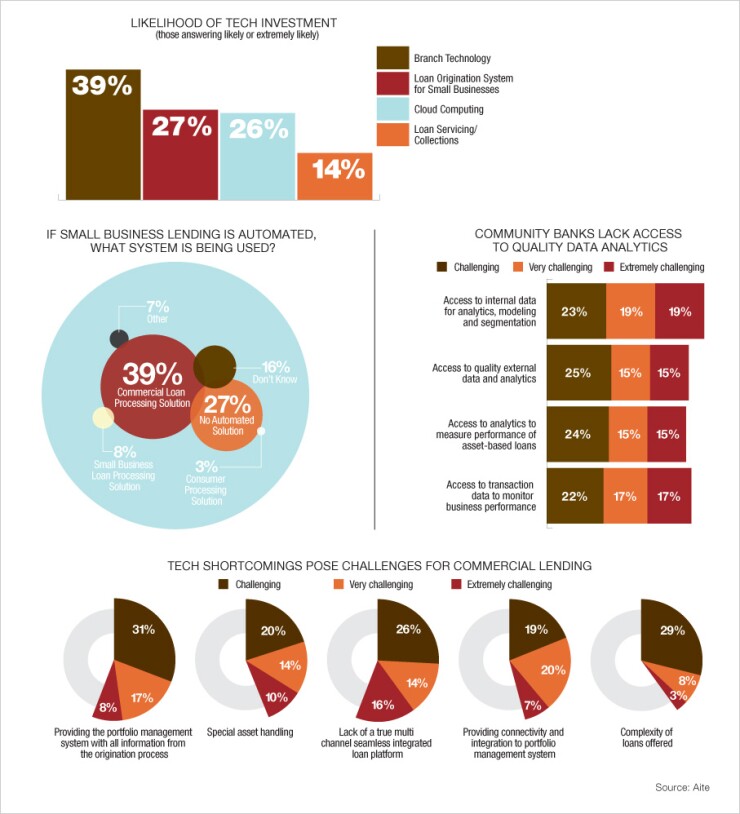

Aite says the community banks tend to lack several critical pieces of technology: a multichannel, seamlessly integrated loan platform; a means of providing the portfolio management system with all information from the origination process; and connectivity and integration to the portfolio management system for automated loan origination, which reduces redundant data entry and manual errors.

These shortcomings are leading to churn. Aite predicts that around 20% of small businesses will look for a new bank in the next two years.

That would put severe pressure on community banks, which say small businesses make up 50% of their customer base.

"The banks really want to be able to get answers quickly to their customers," Pratt says.

Pratt recommends automating loan processes and branches.

She says tablets, with their larger screens, can be useful in small-business lending.

"You can go out and take an application right in the small business' office, and you can not only offer account opening, but credit card approval as well."