-

Southern Missouri Bancorp in Poplar Bluff, Mo., has agreed to buy Ozarks Legacy Community Financial in Thayer, Mo.

June 24 -

The Bellevue, Wash., bank has done fine on its own, but decided to buy a smaller version of itself in hopes of boosting market value. And its CEO says he's not done dealing.

April 11 -

Stieven, who has followed banks 30 years, managed a portfolio teeming with bank buyers. Still, he cautions against deals that only build scale.

April 10 -

Regulators let Synovus acquire a failed bank its first deal in four years though it still owes Tarp $968 million. A surprising number of similar deals have occurred in recent years.

May 16 -

Southern Missouri charges ahead with a stock offering, while South Valley of Oregon pulls back an IPO. The divergent decisions say everything about the tough calls that small banks face in dealing with volatile stock markets.

November 7

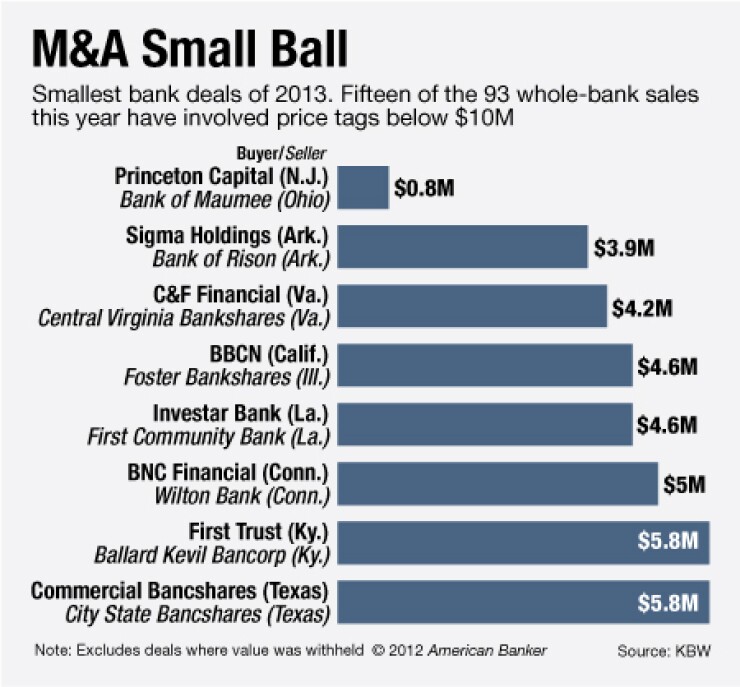

If the porterhouse is unavailable, think about getting a couple of filets to fill your belly.

That's the logic bank buyers are employing as the bigger targets they would typically prefer are staying off the market, and smaller banks are more eager to sell.

Targets with assets of less than $100 million, particularly in the Midwest, are attracting heavy interest. Buyers had once envisioned deals that moved the needle, but more modest ones provide a way for acquirers to deploy excess capital and inch toward asset-growth goals. Most importantly, the smaller banks are available and willing to accept an affordable price.

"If you offered me something around $200 million, sure, I'd look at it, but half a loaf is better than none," says Matt Funke, the chief financial officer of Southern Missouri Bancorp (SMBC) in Poplar Bluff, Mo. "I don't know if the $200 million bank is under the same sort of pressure as the smaller banks, or if their boards are unwilling to market them at this pricing level."

The $794 million-asset company announced late Friday it would pay roughly $6.5 million in cash to

The deal

"Banks under $100 million feel it will be hard for them to survive. We know that, but in the Midwest states, there is a dual thought, 'The long term looks really tough, but we look pretty good today. Let's sell,'" Brown says.

For Southern Missouri, the Ozarks Legacy deal brings it some much needed liquidity. Southern Missouri runs at a high loan-to-deposit ratio, whereas Bank of Thayer's is closer to 55%. The deal also would give Southern Missouri four branches in a new market. Bank of Thayer Chief Executive Roger Lonon has agreed to stay on as market president.

"It allows us to continue to build scale, we get to acquire long-term core deposits and it effectively leverages our capital base," Funke says.

Smaller acquisitions are often criticized because they take the same amount of work to negotiate, but observers say that is shortsighted.

"Maybe it is the same amount of work before, but after the deal closes there is less risk," says Andrew Liesch, an analyst at Sandler O'Neill. Integrating a bigger acquisition "could be more work than the buyer expected."

Liesch liked Southern Missouri's deal, particularly because it deploys some of the $20 million in equity Southern Missouri raised a year and a half ago.

In the last year, Funke says, he has taken a look at eight to 10 banks and conducted due diligence on half of them but done only the one deal. The rest of the banks sold to others or disliked the offers they were receiving and decided to remove themselves from the market. The hunt continues.

"We have a little bit more room to run," Funke says. "We'd like to land another one shortly, but we'll have to see what is available."

Bank of Thayer was marketed to buyers by CrossFirst Advisors, and Lonon said the bank decided to sell because of the tough regulatory climate.

"Many banks have come forward over the years with an offer, but the ownership was always adamant that the bank was not for sale," Lonon says. "But the passage of Dodd-Frank, the implementation of the Consumer Financial Protection Bureau and the continued barrage of new regulation began to influence our ownership to consider the future."

Added regulatory burden was straining the bank's compliance officer, who had to delegate responsibilities to various staffers, Lonon said. Uncertainty over when, or if, the burden would ease compounded the pressure, he said.

Perhaps that uncertainty has begun to trump the yearning of many sellers to recoup precrisis valuations.

"Pricing is definitely becoming more reasonable," Funke says. "We are not hearing people talking about what they could have had five years ago."