-

WomenVenture, a Minneapolis-based Community Development Financial Institution, was already under strain from stalled federal CDFI funding. The recent immigration crackdown added significant uncertainty for its customers as well.

February 4 -

President Donald Trump's support of legislation that would cap credit card interest rates at 10% has flagged in recent weeks, but experts say that the debate has highlighted significant gaps in regulators' understanding of the credit card market and how its risks are priced.

February 3 -

When the Swiss banking giant bought rival Credit Suisse in 2023, it inherited an investigation over money the Nazis looted from European Jews. The issue now seems to be coming to a head in Washington.

February 2 -

Legal experts say the underlying economics of stablecoins mean that banning yield payments — banks' top priority in upcoming crypto market structure legislation — may not be as simple as banks had hoped.

January 29 -

As the Federal Open Market Committee announces its near-term interest rate plans Wednesday, market watchers expect the central bank to hold interest rates steady as policymakers seek greater clarity on the health of the economy.

January 28 -

State regulators say proposed changes by the Federal Reserve that would make state bank examiners the primary boots on the ground will make bank examinations faster, but could cause some issues to go overlooked.

January 27 -

The Consumer Financial Protection Bureau has backed off enforcement and supervision of consumer protection laws, leaving states to fill the void — and potentially creating a "patchwork" of state laws that banks will have to comply with.

January 21 -

Cryptocurrency has traditionally been an investment product more than a way to make purchases, but fintechs are betting there's a future for digital assets at the point of sale.

January 20 -

Howard Green's new book Gimme a Crisis offers a deep dive into the former Scotiabank CEO's career, from bringing the NBA to Toronto to navigating 2008.

January 20 -

The payments firm is hoping that planting a flag in merchant stablecoin payments now will be accretive as stablecoins gain greater adoption.

January 19 -

Stablecoin yield has continued to be a flashpoint as bank groups look for a blanket ban on crypto exchanges and other nonbanks offering yield-like rewards for holding crypto.

January 14 -

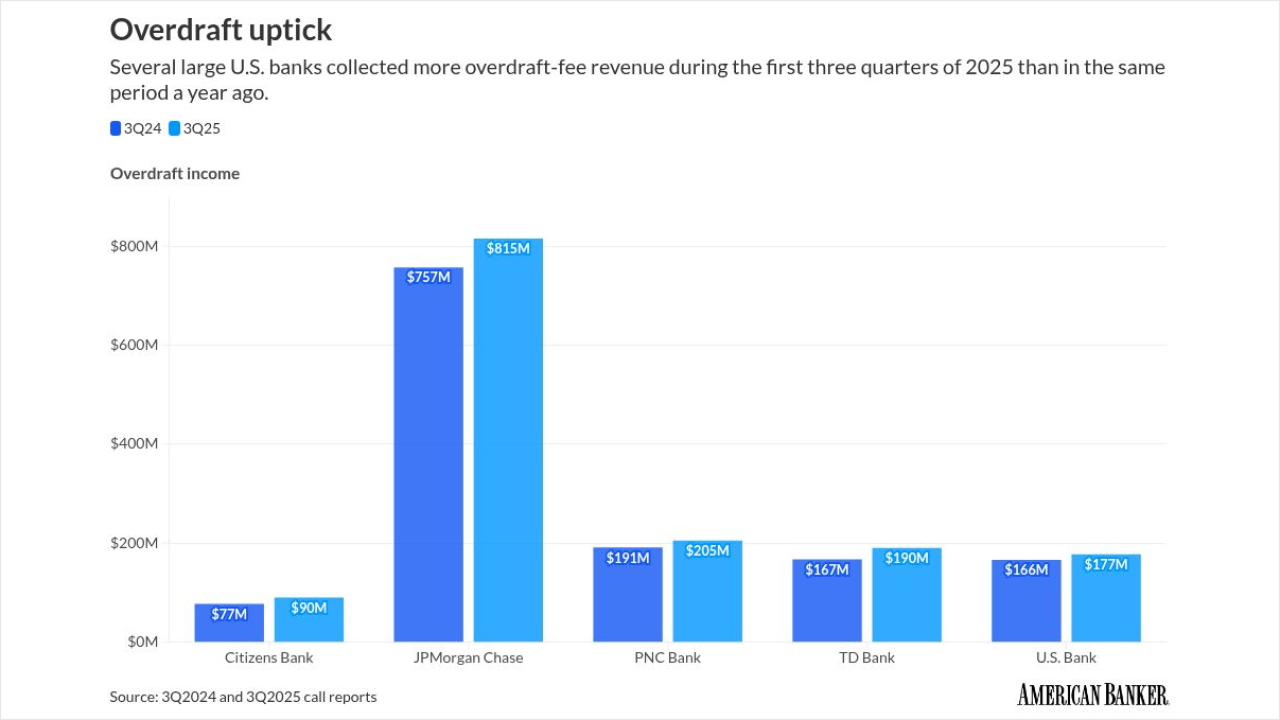

Several large U.S. banks reported an uptick in overdraft-related income for the first three quarters of 2025. Economic pressure on consumers may be to blame, some banks and industry observers say.

January 9 -

One of the leading makers of pre-packaged salads has acquired a 16.3% stake in Salinas, California-based Pacific Valley Bank. "It's a real vote of confidence," the bank's CEO said.

January 8 -

The Kansas City, Missouri-based bank completed its first bank acquisition in 12 years on New Year's Day. Now it's focused on retaining and growing FineMark Holdings' high-net-worth clients in markets such as Southwest Florida, South Carolina and Arizona.

January 7 -

Donald Trump, Taylor Swift and the CEOs of the biggest banks: We checked back to see if our predictions were correct about whether these bankers, regulators and payments execs made an impact on the industry this year.

December 23 -

Nine banks and lenders were impacted by the yearslong, $923 million fraud enterprise, according to an indictment of top Tricolor executives. The banks were not publicly named, but JPMorganChase, Fifth Third, Barclays, Louisiana-based Origin Bancorp and Texas-based Triumph Financial have said they would take write-downs.

December 17 -

Bank groups, crypto firms and regulators are divided over whether fiduciary digital-asset custody fits naturally within the national trust charter model — or whether, as critics argue, the agency is quietly reinventing the charter.

December 17 -

These are the executives, regulators, investors, disruptors and firebrands who will have the biggest impact on bankers in the coming year.

December 16 -

HoldCo Asset Management says that shareholders should reject Fifth Third's proposed acquisition of Comerica during a Jan. 6 vote due to what it calls an "unacceptable" negotiation process and the possible upside from another deal.

December 15 -

The largest bank deal to be announced in 2025 is still on track to close in the first quarter of next year, Fifth Third CEO Tim Spence said. His comments came amid opposition to various aspects of the deal, as well as how it came together and the timeline for closing the transaction.

December 11