Having built its U.S. retail business around catering to a mostly affluent and international clientele, HSBC is now trying to appeal to a broader base of customers, including those with low and moderate incomes.

The U.S. unit of the London-based HSBC plans to open as many as 50 branches and hire more than 300 new bankers in new and existing markets as it looks to boost deposits, ramp up its home lending and sell more consumer loan products, including credit cards.

The plan, announced Monday, is a continuation of HSBC USA’s strategic shift under Pablo Sanchez, the head of retail banking and wealth management for North America.

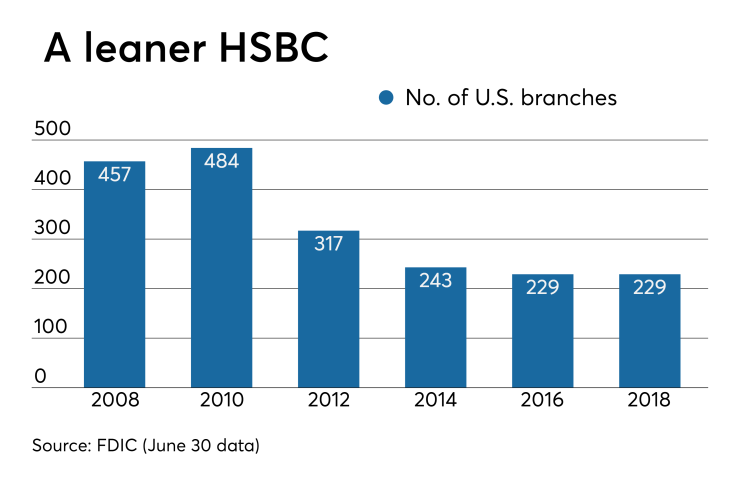

It was only a few years ago that the $177 billion-asset bank was shrinking its branch count and de-emphasizing consumer lending to cater to wealthier, globe-trotting customers out of offices in New York, California and other coastal markets. But with competition for deposits and loans only intensifying, Sanchez said that the bank needs to be casting a wider net.

“Almost 70% of our customers are domestic customers who don’t necessarily travel internationally,” Sanchez said. “It’s important that if we’re in a market then we’re in that market fully.”

HSBC is hardly alone among large banks looking to gain new consumer business by opening more branches. JPMorgan Chase

Ed Firth, an analyst at Keefe, Bruyette & Woods, said it wasn’t immediately clear to him how HSBC would differentiate itself from the local competition. HSBC doesn’t have any particular disadvantages in the U.S. market, but it also doesn’t have any distinct advantages, he said.

“If you’re an overseas bank trying to make progress in a domestic market, then in my experience, you have to bring something to the party; you have to share why you’re different, what you’re offering that local banks can’t,” he said. “If I’m sitting in the [United Kingdom], my instinct is always going to be to go with a U.K. bank that I’ve known for many years, and I imagine that U.S. customers are exactly the same.”

Sanchez said that HSBC is targeting a combination of new and existing markets, and it’s strongly considering adding new branches in areas where it already has operations centers, such as Chicago. He said that HSBC is opening a new branch in Depew, N.Y., largely because it already has customers and employees in the Buffalo region.

The new branches will be opened over the next three to four years, and 40% of them will be located in low- to moderate-income neighborhoods.

He also added that HSBC plans to work with community development financial institutions, developers and investors in some of those low- to moderate-income communities to increase the housing supply in those areas.

Under Sanchez, HSBC is also investing heavily in technology to develop products and services that will appeal to a wider base of consumers.

The bank is offering consumer loans of up to $30,000 in

Sanchez says that all of these capabilities, to go along with an expanding array of credit cards and deposit products, will help HSBC win over mass-market consumers.

Like its competitors, HSBC plans to build branches that are smaller than its legacy branches, but don’t expect the bank to experiment much with new design concepts, Sanchez said.

“There are lots of banks out there trying these novel ideas around cafes or cashless branches or what have you and I quite frankly don’t believe in any of that,” he said. “I believe that if somebody’s going to take the trouble to walk into one of our branches, then they expect full service from the bank that they’re going to.”