There is a lot of public confusion over a possible U.S. central bank digital currency and the FedNow real-time payments network, some of it a result of disinformation.

This confusion about the two distinct initiatives creates a burden on the financial sector that goes beyond the complexity of managing traditional automation.

"I've heard a fair number of customers calling FedNow by its name," said Scott Anchin, vice president of senior operational risk and payments policy for the Independent Community Bankers of America. "That's very different when these other payment rails are discussed and they go unnamed. I think it's very interesting that FedNow has reached that level of name recognition. But I think as a result of that, it has become increasingly important for banks to educate their customers on what it is and what it isn't."

NBC News, for example, posted a 44-second video on YouTube titled "Debunking '#FedNow' and '#digitaldollar' conspiracies." The post uses a clip of Florida Gov. Ron DeSantis warning that the Federal Reserve would use a digital dollar to control everyday purchases. It also describes FedNow as "basically an update that's meant to move money from bank to bank as fast as Venmo does."

The Federal Reserve's website shows the result of these misunderstandings. "Is the FedNow service replacing cash? Is it a central bank digital currency?" one frequently asked question section on its website asks. The response: "No. The FedNow service is not related to a digital currency."

"Will FedNow replace cash?" asks a Forbes article from July. "No, the FedNow system won't replace the dollar, or digital currency for that matter." The article goes on to note: "And while there have been claims on YouTube and TikTok and other social media that FedNow will replace the dollar with a new digital currency, these claims are false."

There is a lot of information — and misinformation — about the real-time payments system, FedNow, and how it differs from a central bank digital currency, which is a digital form of a country's currency. Experts said that the interest from the general public in both of these concepts is unusual since how payment rails work can be highly technical and many consumers are generally unconcerned with how their money moves from point to point as long as it arrives.

That interest can be beneficial, but also potentially harmful to the banking industry if the information that consumers have is wrong.

Conflating the two

There are likely a few reasons that the everyday consumer has confused FedNow and a CBDC, or digital dollar. The Federal Reserve has spearheaded both, and these two technological developments have been discussed in close proximity to each other. FedNow launched in July after being in the works for several years. And although a CBDC is only being considered right now in theory, at least in the U.S., the Federal Reserve released earlier this year a summary of public comments on a paper from January 2022 titled "Money and Payments: The U.S. Dollar in the Age of Digital Transformation."

In addition to that, prominent political figures on both the left and the right have publicly railed against a CBDC in particular.

In April, Robert F. Kennedy Jr., who initially was running for president as a Democrat but has since declared himself an Independent, wrote, inaccurately, on the social media website X that "the Fed just announced it will introduce its 'FedNow' Central Bank Digital Currency (CBDC) in July. CBDCs grease the slippery slope to financial slavery and political tyranny."

DeSantis, a Republican candidate for president, has been a vocal opponent of a CBDC. During a speech earlier this year, he claimed that a digital dollar would allow the federal government to block purchases by consumers that it doesn't like. Later on X, he wrote that "unaccountable institutions cannot impose a CBDC on Americans," in response to a thread from the Federal Reserve explaining what FedNow is.

He added: "They will tell us that CBDC won't be abused but we are wise enough to know better. This wolf comes as a wolf."

Proponents of a CBDC argue that this is misinformation. If a digital U.S. dollar was ever created, banks would likely be involved in managing the program technology so the federal government would have no more control over Americans' spending then it does today. Visa and Mastercard, for example, have pitched the U.S. government to play a role in aiding distribution of a digital dollar — a move that would involve card-issuing banks

Regardless, all of this has contributed to a greater level of recognition — or perhaps notoriety — for both FedNow and a CBDC.

"The public is more engaged than ever before," said Nicholas Anthony, a policy analyst for the libertarian think tank Cato Institute's Center for Monetary and Financial Alternatives and a fellow at the Human Rights Foundation. "We are seeing more people wonder what is exactly going on here. Most of the time people are mainly thinking about how do I get more money and how do I spend less of it."

A digital dollar has proven to be unpopular within the financial services sector and the general public. Anthony completed a study of the comment letters that the Fed had received regarding that January 2022 paper about creating a digital dollar. This research estimated that more than 66% of the more than 2,000 comments were "concerned or outright opposed to the idea of a CBDC" in the U.S. Financial privacy, risk of disintermediating the traditional banking sector and financial oppression were the most commonly raised issues, Anthony noted. Some of these themes were clearly hit upon by the comments from both Kennedy and DeSantis.

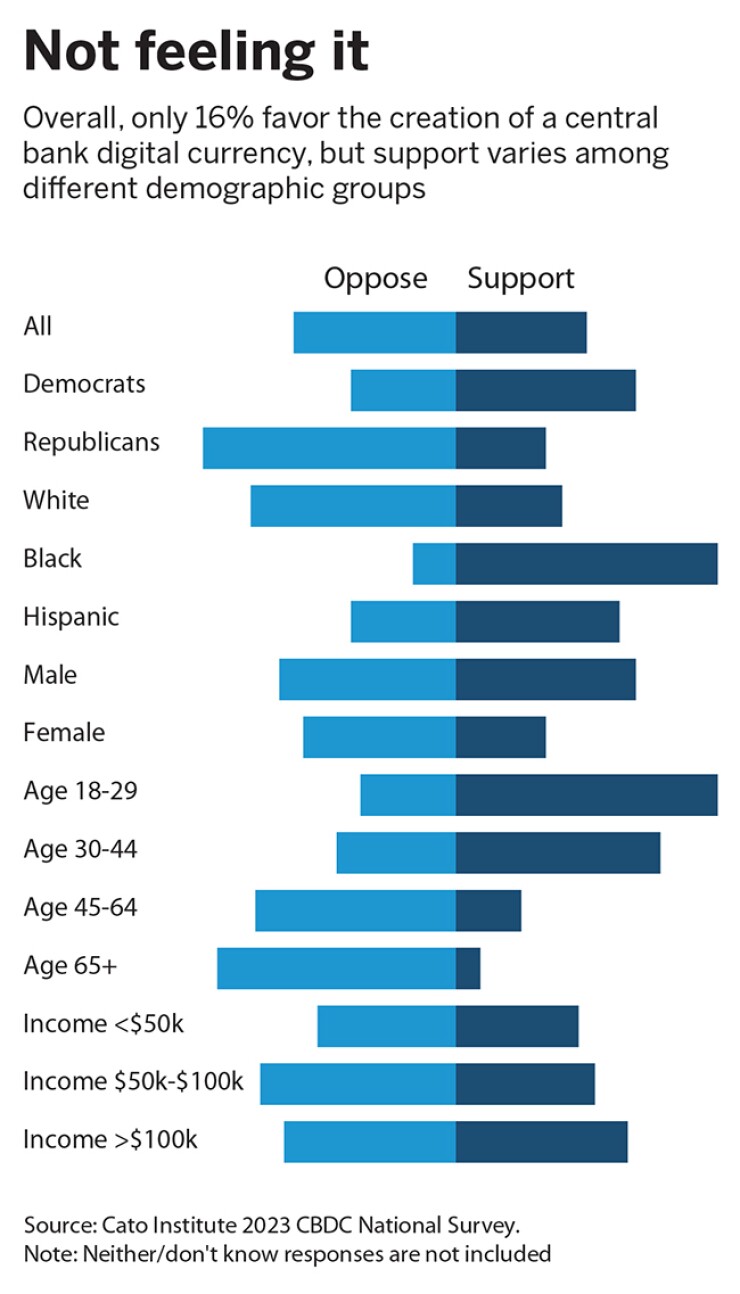

A public opinion poll from Cato found that only 16% of Americans supported the creation of a CBDC. In contrast, many other countries are more open to the idea of a digital form of their central currency. As of October 2023, 130 countries, or 98% of global GDP, are investigating a CBDC, according to the Atlantic Council's CBDC tracker, which notes that's up from 35 countries in May 2020. Thirty-two countries have launched a digital dollar or are in the pilot stage. The Atlantic Council tracker listed the U.S. as in development with a digital dollar.

Americans' resistance to a CBDC fits with the nation's overall distrust of centralized economic and political power, experts said. Alex Jimenez, a managing partner in financial consulting at engineering and technology company EPAM Systems, pointed to the U.S.'s refusal to adopt a national identity card as analogous to the country's resistance to a digital dollar given the fear that the federal government could use the technology to track and control purchases.

"We have pushed back on having a national ID. If you go anywhere else they have that," he added. "It's very difficult to explain the U.S. to someone else from another country."

Collateral damage?

At least for now, the concept of a digital dollar has not been met enthusiastically in the U.S. And given that some portion of the general population think that a CBDC is the same thing as FedNow, could this distrust bleed into and hurt the adoption of real-time payments?

Right now the banking industry is hopeful opposition to a CBDC won't slow FedNow's advance but experts also note that consumer education will be required. And financial institutions must have a hand in helping to clear up the misinformation.

"The central bank digital currency is a digital form of currency, which is something different from FedNow, which is a payments rail. The Fed currently facilitates other payments rails," said Melissa Ashley, president and CEO of Corporate One Federal Credit Union in Columbus, Ohio. "I think there will be some education based on the confusion and misinformation on the internet. Financial institutions should be prepared for that. Their frontline staff, tellers and member service representatives will need to be well versed so they can help their members feel comfortable."

The $4.4 billion-asset Corporate One has been at the forefront of adopting real-time payments through the Clearing House's network, RTP, and FedNow. That's due to it serving as a financial institution to other credit unions. Ashley noted that Corporate One has always been an early adopter of new payments technology, including offering early on wire transfers and ACH transactions.

"We've made it a strategic imperative to make sure credit unions could leverage any new payment rails," she added. "We knew we needed to be involved with FedNow, just as we knew we needed to be involved with RTP. We've put time and money behind it, and we feel passionate about it."

FedNow might be saved, at least in part, because the current applications of real-time payments lie more with commercial customers rather than consumers. Businesses tend to be more sophisticated when it comes to payment options and are motivated for better ways to manage their cash flow. Given that, business customers are likely to be mostly concerned with using the payment rail that makes the most sense from a practical and cost perspective. In the end, they may not even always be aware if their bank has used FedNow, RTP or another payment rail for every transaction that's completed, leaving little room to protest.

"From a consumer perspective, it may not be obvious to them where the backend functionality comes from," said Judy Mok, of counsel at the law firm Covington & Burling. "Only banks can connect to FedNow. A normal mom-and-pop shop will never interact with FedNow."

Still, education is needed, observers emphasized, if nothing else to ensure continued trust in the U.S. financial system. For instance, Corporate One has

UMB Bank in Kansas City, Missouri, offers educational webinars on real-time payments and has spoken at industry events about the technology. The $41.2 billion-asset bank is looking to be a part of both FedNow and RTP. Right now it can only receive payments through RTP but will expand that to sending funds in early 2024. After that, it will roll out FedNow next year, said Uma Wilson, chief information and product officer.

Banks need to be thoughtful about how they break down real-time payments into digestible terms so that everyday consumers can understand how the technology works, Wilson said. Still, regardless of the early confusion with a digital dollar, Wilson believes that real-time payments will eventually become ubiquitous.

"I think payments are shifting to more digital," she added. "As today's young people grow up and become young adults, I'm very certain they will transact differently than our parents. It's a progression."