“We wanted to have that branchlike experience digitally, showing our customers we know and care about them like a banker would within a branch,” said James Roy, senior vice president of digital marketing at the $64.2 billion-asset People’s, which

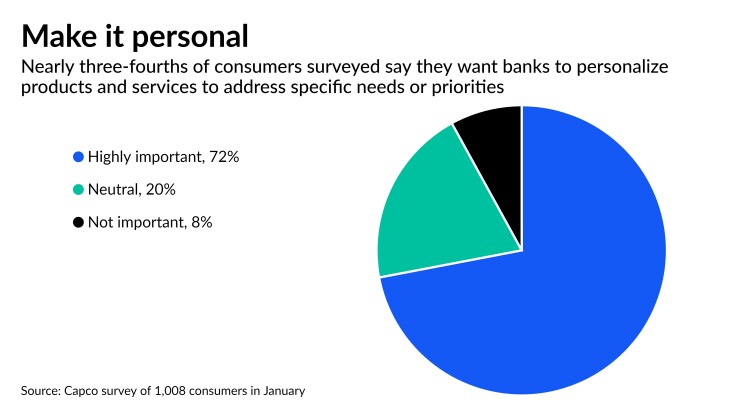

Personalization in banking, which technology and management consultancy Capco describes as “providing the customer with real-time access to preferred products, services, and capabilities based on changing goals and evolving priorities” in a recent report, can strengthen customer loyalty and differentiate the brand. In Capco’s report, 72% of respondents rate personalization as “highly important” to them, compared with 20% who were neutral on the idea and 8% who rated it unimportant.

At the same time, many financial institutions have struggled to compile and act on their stores of customer data. Unlike large banks, regional banks have only ramped up their experiments with personalization relatively recently.

People’s United turned to Virtusa Corp., a digital business strategy firm in Southborough, Massachusetts, that it had worked with for years, most recently with the rollout of People’s new website built on Adobe software, to improve its personalization efforts. Over the course of 23 weeks, Virtusa conceptualized and packaged a personalization engine called vEngage using Adobe Experience Manager to handle digital content and the Customer Decision Hub from software company Pega to predict customer needs.

People’s, which is the first bank to deploy vEngage, launched the tool in March. vEngage uses Adobe Experience Manager to design and generate web and email content. It also relies on Pega’s Customer Decision Hub, which uses artificial intelligence to analyze customer data points piped in by People’s data warehouse, including demographics, buying patterns, digital behavior and responses, to recommend next steps to customers. For example, someone with a lot of cash in checking may be better off with a savings or money market deposit account. By layering on additional demographic data and details on how much cash the customer is holding, the engine might recommend them as a good candidate for a wealth account.

“While you have not spoken to anyone, the experience is like you have asked for a very specific offer,” said Sanjay Deshpande, head of banking and financial services, Americas, at Virtusa.

For People’s, the goal is less about increasing business and more about demonstrating value to current customers, by feeding relevant and timely reminders or recommendations onto a customer’s homepage or email inbox.

“We create not only that ‘wow’ factor that oh, they get me, but they are looking out for me,” said Roy.

The initial use cases are about encouraging customers to activate and use People’s digital offerings. If vEngage detects that a customer frequently visits the branch to deposit checks, it will push suggestions for that person to explore mobile deposit, perhaps through a message on the homepage or an email that talks up the benefits of mobile deposit. Or a customer who recently signed up for online banking may see messages about the benefits of mobile banking.

These types of interactions will initially take place on the website and over email, the channels that Roy predicts will make the most positive impact to customers. Eventually, he hopes to expand the same interactions across branches, the call center, mobile banking and more.

People’s has served more than 4 million personalized interactions to date. Although the artificial intelligence is still maturing, Roy said the results are promising so far, in that People’s customers are receptive to receiving and acting on relevant offers and guidance.

Kevin Miologos, a managing principal at Capco, says the vEngage approach is more comprehensive than what he has seen to date. He sees the product as a foundational technical library that provides capabilities that could be applied to different channels and functions of the bank.

“Usually technologies that provide decisioning and personalization with AI are application-specific, like for a contact center,” he said.

He noted that regional and superregional banks have been more substantially investing in personalization in the past 12 to 18 months.

“To see Adobe being applied like this in the small regional space is a big deal,” he said. “Usually these banks are buying something out of the box that is rigid or doesn’t have a lot of ability to customize.”