The use of synthetic identities is causing more credit card losses than ever. However, the rate of growth of this type of fraud is slowing, according to an analysis of card transactions TransUnion released Wednesday.

Outstanding suspected synthetic fraud balances rose 5.2% between the fourth quarter of 2016, when it was $276 million, and the fourth quarter of 2017, when it was $290 million, according to the credit bureau’s analysis. During the previous year, such balances rose 68.5%.

The rate of synthetic fraud incidents has stayed fairly steady. It was 0.60% of credit card applications in 2017 and 0.59% in 2016, TransUnion said.

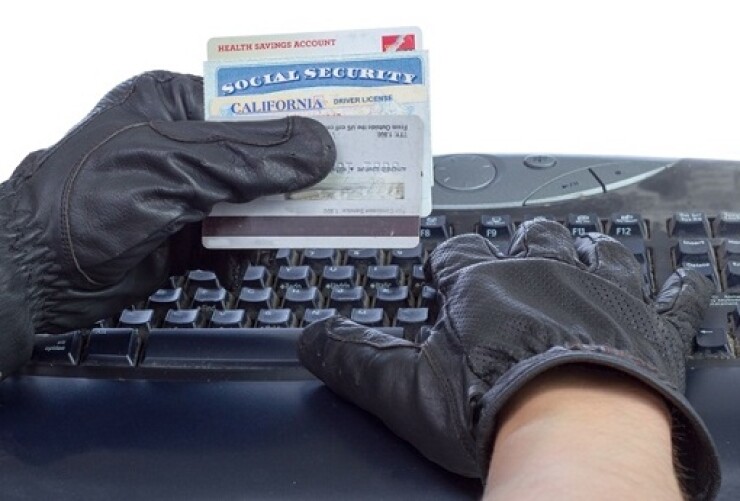

Synthetic identities are fake IDs created by combining someone's personally identifiable information with made-up details. A real Social Security number might be mixed with a false name and address, for instance.

There is usually no individual victim and no reported fraud; the primary victims are financial institutions. A credit card account created with a synthetic ID, in which the card gets used but the bill never paid, usually makes for a mysterious chargeoff for the bank. Attempts to collect fail.

Meanwhile, many banks are trying to encourage customers to apply for cards online or on mobile apps, and they are streamlining the steps for authentication and verification. Those trends make it easier for tricksters to obtain credit with fake IDs.

Synthetic IDs are notoriously hard to detect. So how does TransUnion do it?

“It’s definitely been a challenge to confidently say what is identity fraud,” said Lee Cookman, director of product strategy at TransUnion.

TransUnion' s investigations unit analyzed known cases of synthetic identity fraud and built a probabilistic model that can be applied to find the patterns of behavior that are consistent with synthetic IDs used in the past.

If a cardholder’s credit profile was created after age 30, for instance, that’s unusual and could be a red flag.

“A lot of synthetic identities are created with an age of 25 or older, a time when a person should already have some credit history,” Cookman said.

A single identity connected to hundreds of addresses is also abnormal and suspicious behavior.

“No one criterion tells you if it's synthetic identity or not, but the convergence of multiple factors raises that level of confidence,” Cookman said.

Card issuers have large “bust-out teams” and operations staff to combat fraud, Cookman said. They can also manage this risk by restricting the credit limits of cardholders that raise red flags.

“They’ve been on the leading edge of trying to figure out how to deal with this kind of fraud,” he said.

Synthetic identities are also being used for quicker and higher-dollar transactions such as personal loans and auto loans. The outstanding balances of suspected synthetic fraud identities increased 6.6% to $885.42 million in the fourth quarter of 2017, up from $830.25 million in the fourth quarter of 2016 for auto loans, credit cards, personal loans and retail cards combined, according to TransUnion’s data.

“As they’ve gotten better, fraudsters have started migrating to bigger-ticket items,” Cookman said. People even occasionally use false identities to take out mortgages.

On Wednesday, the company introduced 25 new alerts, including some that signal possible synthetic fraud and compromised Social Security numbers, under its IDVision Alerts service. It now offers 65 different kinds of fraud alerts.