It pays to have an open mind.

Patriot National in Stamford, Conn., had a plan to expand its fledgling Small Business Administration lending business that included hiring lenders to grow throughout New England and into New Jersey, New York and Pennsylvania.

Management was willing to scrap that playbook when it saw an opportunity to buy the SBA lending unit of Hana Financial in Los Angeles for $83 million. The $858 million-asset Patriot now stands to gain a national lending platform with the potential to earn fee income by selling a portion of the unit's 7(a) originations.

Hana SBL closed nearly $134 million in loans during the SBA's fiscal year that ended Sept. 30. Since 2012, the business has securitized the unguaranteed portion of its 7(a) production, selling $119 million in credits over three transactions.

“We were looking to grow, mostly organically, but Hana aligns itself so well with our ultimate objectives in the SBA space,” said Richard Muskus, Patriot's president.

Patriot has other options. It could open branches on the West Coast or market its remote-deposit capabilities to Hana's clients.

“There’s a massive amount of opportunity to accrete this business going forward,” Muskus said.

Patriot entered the 7(a) field last year, but its in-house operation is a neophyte compared to Hana, which has closed nearly $1 billion of loans, Muskus said. Before entering talks to buy Hana SBL, Patriot’s plan was to add business development officers, gradually expanding its reach throughout New England and into New York, New Jersey and Pennsylvania.

Muskus' new plan is to fold his company's existing SBA operations into Hana, which will eventually rebrand with the Patriot name.

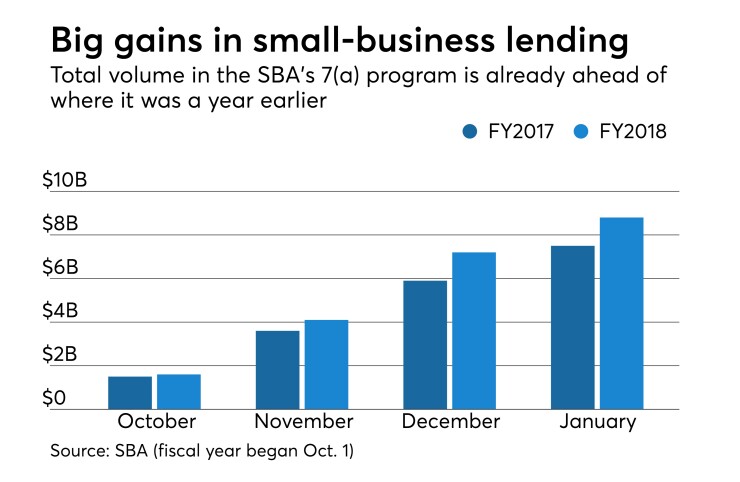

The deal, which is expected to close in the second quarter, comes at a time when several small 7(a) lenders are moving aggressively to take more share.

The top executive at the $939 million-asset Seacoast Commerce Banc Holdings said earlier this month that the San Diego company

The $1.6 billion-asset Gulf Coast Bank & Trust in New Orleans has bought two Dallas lenders: American Business Lending in December and

Gulf Coast folded its own government-guaranteed lending operation into CapitalSpring, rebranding the business as Gulf Coast SBA lending while keeping all of the acquired company's employees.

Patriot plans to chart a similar course.

Patriot has made employment offers to the entire Hana SBL team, said Patrick Shim, the company's senior vice president of corporate strategy and administration.

“We’re going to assist Patriot on retaining them,” Shim added.

“Hana’s reputation drove this initiative very far for us,” Muskus said. “It’s a seasoned team with years and years of experience."

Banks seeking to do more 7(a) lending frequently confront a choice of buying scale or growing it organically, said Arne Monson, president of Holtmeyer & Monson, the nation's largest SBA servicing firm. While Seacoast Commerce and Celtic Bank in Salt Lake City have chosen organic growth, buying Hana appears to be a solid choice for Patriot.

"Hana is a good, legitimate, high-volume producer," Monson said. "If they want to gain a national scope, this is a good way to do it."

Hana's management began re-evaluating its business model three years ago, Shim said. The leadership decided to focus on core businesses such as factoring and asset-backed lending. Hana was one of the 10 biggest factoring service providers in the country last year, generating $1.5 billion in volume.

Hana sold its mortgage-lending business in 2016 and its decision to sell the decade-old SBA-lending business followed, Shim said. The proceeds from the sale of the SBA unit will allow Hana to expand its core businesses organically and with acquisitions, he said.

Hana is Patriot’s second acquisition in the last six months. It agreed in August to buy the $73 million-asset Prime Bank, which has a single branch in Orange, Conn., for about $10.4 million. That deal is expected to close before the end of March.

“The desire of the bank is to grow exponentially over time,” Muskus said.