It's easier than ever for consumers to take out personal loans to pay down high-cost debt or fund big-ticket purchases, and two new studies show that they are taking full advantage of their options.

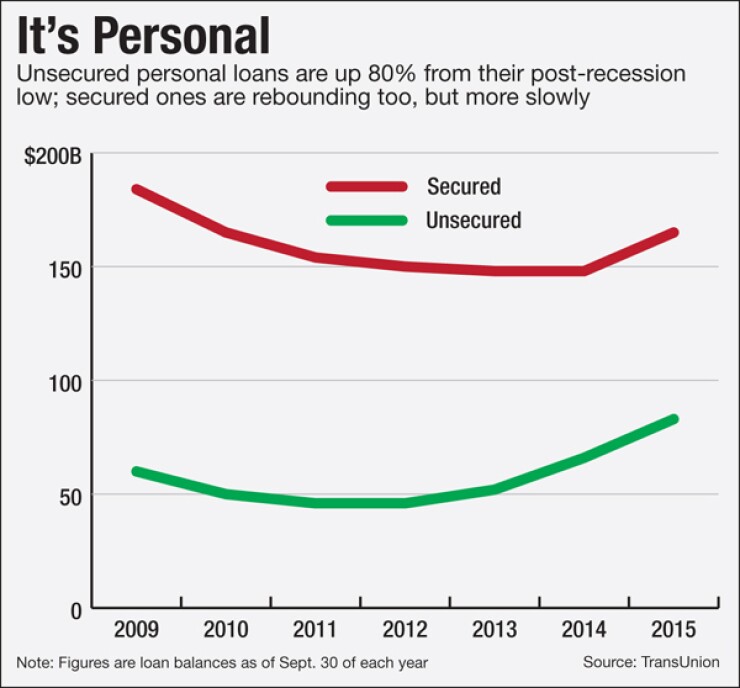

A report from TransUnion found that the dollar volume of unsecured personal loans is growing at a rate of 25% a year and that the number of Americans currently paying off a secured or unsecured loan increased 18%, to 27.3 million, between the third quarter of 2013 and the same period in 2015.

A separate survey from Bankrate.com found that roughly 24 million Americans, or 10% of the U.S. population, expect to take out a personal loan in the next 12 months.

-

Moven, the digital-only "neobank," is partnering with online lenders as part of an effort to differentiate its services and become its users' go-to app for financial transactions of all sorts. Banks ought to pay close attention to this rebundling effort.

January 27 -

Santander Consumer USA Holdings on Wednesday reported a sharp drop in profits, due to losses tied to its exit from personal lending.

January 27 -

Consumer credit is better than ever before, even as Americans households have started levering up. But the big question for banks looking to re-commit to consumer lending is how.

January 5 -

California regulators on Monday identified 14 companies that the state is targeting as part of its recently announced inquiry into the marketplace lending industry.

December 14

An improving economy partly explains why Americans are willing to take on additional debt. Consumers have enjoyed better-than-expected job and wage growth in the past year. Yet three out of 10 Americans still have no "rainy-day fund" to tap when a financial calamity strikes, so personal loans are particularly attractive to younger consumers who have the income to make monthly payments, said Todd Albery, the CEO of Quizzle.com, a unit of Bankrate.

But the bigger reason for the surge in borrowing is the sheer availability of credit, particularly on the Internet. As banks scaled back their consumer lending following the financial crisis, dozens of online players stepped in to fill the void. Many will approve loan applications in minutes.

"Personal loans are super easy to get, they're fast, you can do it all online, there's transparency and you don't have to talk to anybody," Albery said.

The most established players are Lending Club and Prosper Marketplace, both in San Francisco, but the field also includes newer upstarts such as Avant in Chicago, which dips into subprime credit, and Social Finance, a San Francisco lender known as SoFi that targets "super-prime" consumers.

The interest rates on personal loans can vary widely. Lending Club charges annual percentage rates between 5.32% and 28.99%. SoFi charges APRs of between 4.73% and 12.49%. Avant's APRs range from 9.99% to 36%. Consumers applying for personal loans often qualify for lower rates than they are being charged on their credit cards.

Personal loans have filled a gap created by the dearth of home equity loans, which virtually disappeared in 2008 and 2009 when home prices tanked and many homeowners found themselves underwater on their mortgages.

Unsecured personal loans jumped 25.3% to $85.5 billion in the third quarter of 2015 from a year earlier, TransUnion found. Secured personal loans rose 10.6% to $165.5 billion year over year in the third quarter, the first major increase since the downturn.

Unsecured loans, as the name implies, have no collateral attached to them and typically have fixed rates and are repaid over one to five years. Secured loans have an asset like a car or boat pledged as collateral.

Discover Financial has also ramped up its marketing of personal loans.

Discover's personal loan business, which focuses on borrowers with high credit scores, grew by 10% in 2015. Chief Executive David Nelms said in a recent interview that he expects that growth rate to remain steady in 2016.

Though many consumers take out a personal loan to pay off high-balance credit card debt, Nelms said personal loans are not eating much into Discover's credit card balances. The Riverwoods, Ill., company originally marketed personal loans only to its existing credit card customers but has more recently started selling them to noncustomers.

"There's a good portion of broad-market customers now coming to personal loans," Nelms said. "I would say that we don't see much cannibalization at all."

More than half of all personal loans are used to consolidate existing debt, particularly high-balance credit card debt.The average balance on an unsecured personal loan is expected to increase 5% this year to roughly $7,599, and on a secured loan to rise 2.8% to $17,904.

TransUnion said it expects delinquency rates to remain stable at around 3.5%.