Want unlimited access to top ideas and insights?

Neighborhood National Bank courts clients that other banks see as too risky.

The San Diego bank is tiny (it has assets of just $56 million) but it has a bold strategy of serving immigrants to Southern California and mom-and-pop retailers — clients that frequently raise red flags tied to the Bank Secrecy Act and anti-money-laundering laws.

The model isn’t cheap. Payroll for the bank’s BSA/AML compliance staff exceeded $1.1 million last year, a big jump from just $385,000 a year earlier. Investments in systems have also been substantial.

Neighborhood, which recently raised $6.4 million, is filling a need while showing other banks that it is possible to work with customers that bring added regulatory scrutiny.

The bank, fresh capital in hand, is “in a position to start bringing in new clients on a selective basis,” CEO Dan Yates said.

Many of Neighborhood’s clients operate cash-intensive businesses, Yates said, pointing to a niche of working with small grocery and convenience stores owned by Chaldean Christians who have fled Iraq. Those businesses often provide check-cashing services to attract customers.

“You don’t have to cash very many payroll checks to be designated … as a money-service business” by the Financial Crimes Enforcement Network, Yates said.

That reality creates a regulatory headache.

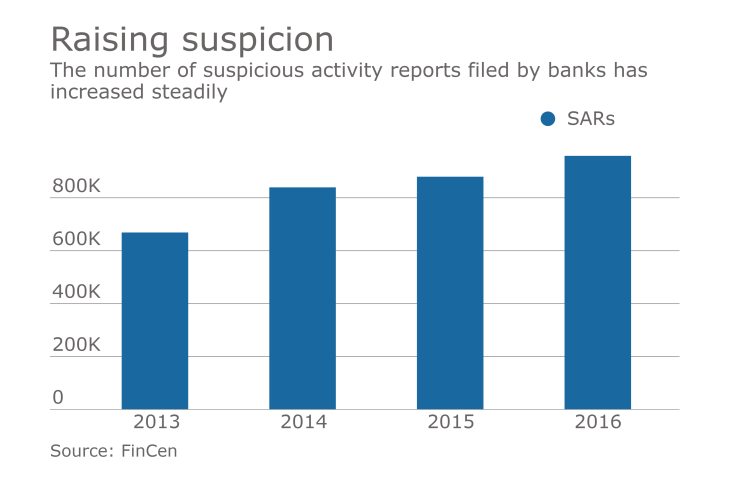

By law, money-services businesses must register with the federal government, implement effective anti-money-laundering programs and report all suspicious transactions. Failure to do so can cause trouble for those businesses and their banks.

Several banks in San Diego have stopped serving cash-heavy small businesses to avoid shouldering added regulatory burdens. Those banks often call Neighborhood to see if it can step in, Yates said, noting that it was difficult to meet the demand until it raised capital.

Neighborhood’s experience highlights an issue often overlooked when discussing AML risk, said Liat Shetret, a senior financial integrity adviser and anti-money-laundering expert with the Global Center on Cooperative Security in Washington.

While foreign correspondent banking relationships and remittance providers get a large amount of attention, BSA and AML enforcement has left many communities cut off from mainstream financial services, said Shetret, who

“Smaller banks are … de-risking to protect themselves,” Shetret said. “If they go, money is still going to circulate. It’ll just be outside the system. … Illicit cash couriers and high-interest lenders will spot the vacuum and they’ll move in.”

Neighborhood has a simple explanation for why it is still working with high-risk clients. The bank, founded as a community development financial institution in 1997, has deep roots with San Diego’s Chaldean community.

Chaldeans "make up probably half of our clients,” Yates said. “It’s a very important niche and it’s been a very loyal client base for the bank.”

To management's frustration, Neighborhood was unable to meet much of the demand within the Chaldean community, said Stephen Taylor, chairman of Taylor Asset Management and the

Still, sticking with its customers came at a steep cost in the wake of the financial crisis. When Yates joined Neighborhood in 2013, about 8% of the bank’s assets were nonperforming. The bank was also operating under a 2010 consent order that ordered management to address credit quality issues.

Yates chipped away at the bad assets, which now total less than 1% of all assets. The bank, which ended seven years of losses by eking out a slim profit in 2015, earned $610,000 over the first nine months of last year. The Office of the Comptroller of the Currency replaced the 2010 order in March with a directive to enhance capital levels and strengthen BSA compliance.

“Our goal has been to create a BSA program that we refer to as the platinum program standard,” Yates said, noting that the bank hired a former FBI agent as part of its upgrades.

“We have hired experts formerly with Homeland Security and other BSA experts recruited from significantly larger banks,” Yates said. “These skill sets are in high demand … by other banks and regulators. Banks need them, particularly if they elect to do business with money-service or cash-intensive businesses, which is our niche.”

Neighborhood, which operates just miles from the border with Mexico, is also watching how Washington handles concerns about cross-border transactions.

A bipartisan group of lawmakers representing five states, including California,

Also, several members of Congress late last year pressed

Yates, who devoted much of last year to upgrading Neighborhood’s BSA compliance, is hopeful that 2017 will be more about growth.

“In 2016, I spent a disproportionate amount of my time addressing the consent order,” he said. “I really got into the weeds. Now I can see … where a significant amount of my time will be free, allowing me to focus more on gaining new relationships.”