-

Treasury Secretary Scott Bessent said Tuesday morning that banks should focus on the sweeping deregulation the administration has enacted as the industry pushes back on President Trump's proposed 10% credit card interest rate cap.

January 20 -

Efforts to exclude crypto firms from the provision of a number of different core financial services are doomed to fail. The only correct response is to provide the prudential regulation necessary to assure safe and sound operation.

January 20

-

Cryptocurrency has traditionally been an investment product more than a way to make purchases, but fintechs are betting there's a future for digital assets at the point of sale.

January 20 -

Comptroller of the Currency Jonathan Gould said Friday afternoon that regulators should scale back what he characterized as costly and ineffective bank-prepared resolution plans and shifting resolution responsibility onto bank regulators.

January 16 -

The Huntsville, Alabama-based regional bank is well positioned to defend its Southeast footprint, according to CEO John Turner. It's hiring more bankers in growth markets, it has strong brand recognition and it has a long history in its core markets, he said.

January 16 -

"We're coming into your market," PNC Chief Executive Bill Demchack said Friday. "If you're not coming into our market to come fight us, we're coming to your market to come fight you, and we're going to get some percentage of your market."

January 16 -

During the fourth quarter, the Buffalo, New York-based bank reported its lowest ratio of nonperforming loans to total loans since 2007.

January 16 -

Federal Reserve Vice Chair for Supervision Michelle Bowman warned that labor market conditions could weaken further and said the central bank should avoid signaling a pause in monetary policy.

January 16 -

Community Financial in Syracuse has agreed to purchase a small bank that's built its business model around end-of-life planning.

January 16 -

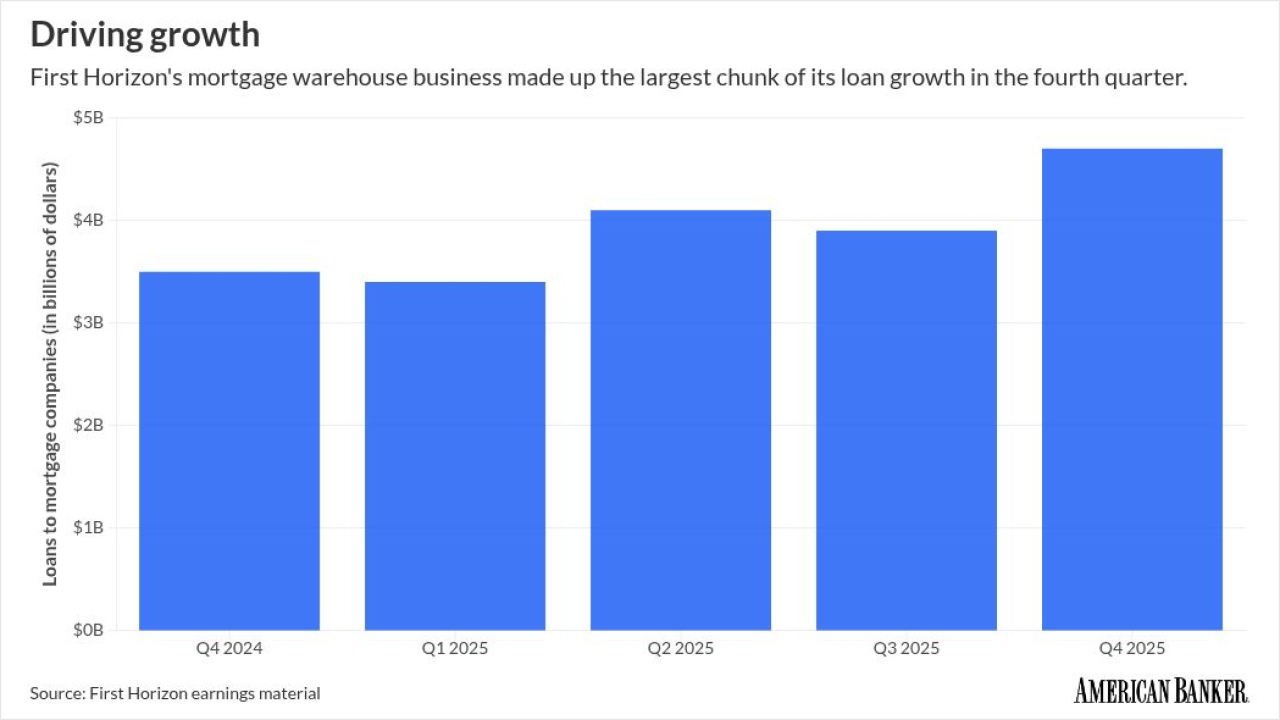

First Horizon's loans to mortgage companies in the fourth quarter rose at the fastest clip in more than two years, as the housing market showed small signs of revival.

January 15 -

Goldman Sachs' fourth-quarter earnings far exceeded analysts' forecasts, overcoming losses from its consumer-focused Platform Solutions unit.

January 15 -

A handful of former Fed officials noted that the markets' measured response to a probe into Fed Chair Jerome Powell was a result of pushback from Trump allies.

January 15 -

The crypto lender issued over 5,000 loans to residents without a license and failed to assess repayment ability, the DFPI said.

January 15 -

The investment banking giant reported an 18% increase in net income for the fourth quarter and stuck to its 2-year-old financial targets, even as it exceeded some of them.

January 15 -

The new developer assistant helps corporate clients and partners find and integrate the bank's APIs into their programs and websites.

January 15 -

A week after President Trump demanded a 10% cap on credit card interest rates, top executives at big banks protested the idea in blunt terms.

January 14 -

The San Francisco-based banking giant reported solid gains in credit card and auto lending as credit remained in check and quarterly operating costs declined from a year ago.

January 14 -

Federal Reserve Gov. Stephen Miran said he doesn't "really buy" the view that a potential indictment of Fed Chair Jerome Powell would affect the central bank's monetary policy.

January 14 -

The megabank's net income declined by 13% during the fourth quarter as a result of a $1.2 billion pretax loss on sale related to the divestiture of its remaining operations in Russia.

January 14 -

The Federal Reserve announced it had approved the merger, marking the final regulatory hurdle the banks needed to clear. But a lawsuit seeking to stop the deal is still ongoing.

January 14