Citi

Citi

Citigroup is a global financial services company doing business in more than 100 countries and jurisdictions. Citigroup's operations are organized into two primary segments: the global consumer banking segment and the institutional clients group.

-

An all-virtual future remains far off, as conversational programs still aren’t capturing the nuance of speech and chatbots have disappointed many customers.

September 27 -

The nation's largest bank overtook PNC Bank to snag the top spot in an annual study that evaluates satisfaction levels at the nation's six largest retail banks.

September 27 -

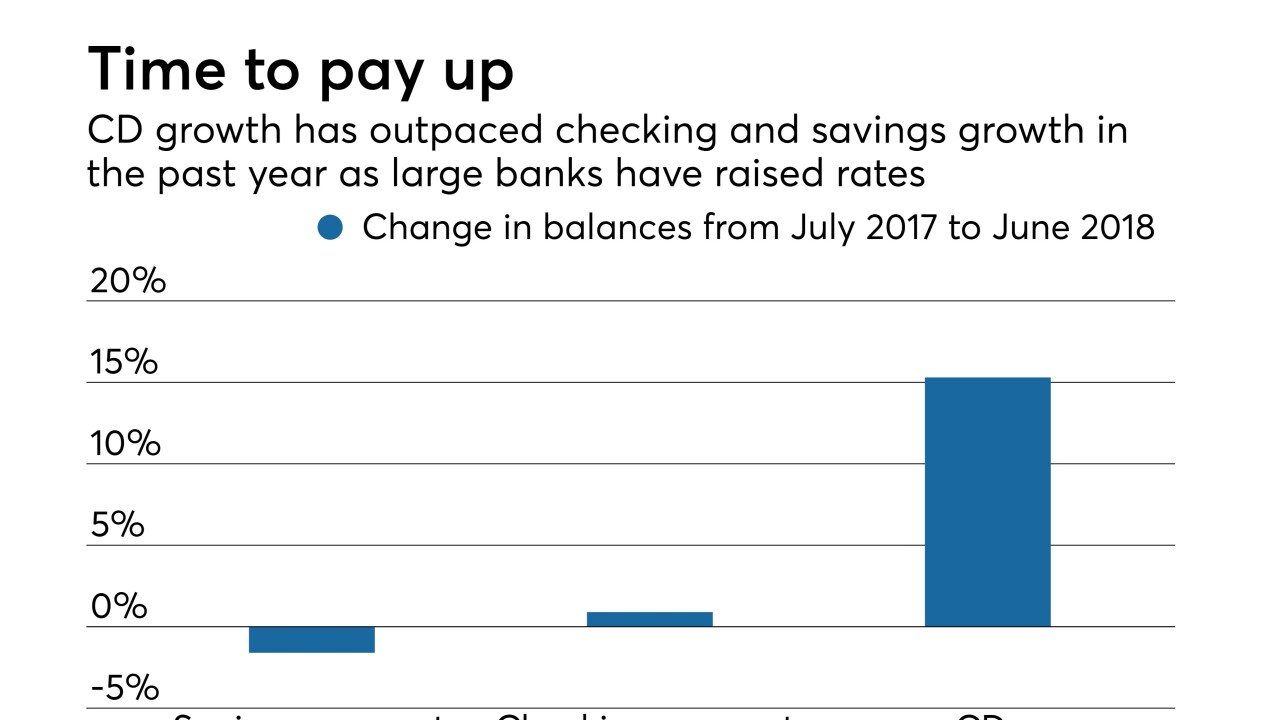

New data from the FDIC shows that banks with less than $10 billion of assets are ceding deposit share to their larger rivals. What can they do to keep pace?

September 25 -

Elinor Hoover's passion for helping women-run firms raise capital goes hand in hand with her mission to increase women's visibility within the upper ranks of Citi's management.

September 23 -

As the chief auditor at Citigroup, McNiff leads the industry's largest auditing staff, with more than 1,800 employees scattered across dozens of countries where Citi does business.

September 23 -

Citi FinTech, Citigroup's innovation lab, has on Piazza's watch continued to roll out groundbreaking technology.

September 23 -

Even with more than 30 years of experience in banking, Julie Monaco still finds value in the advice a mentor passed on to her as a young, rising executive.

September 23 -

Strong leadership requires not only having the best data available — it also involves “connecting the dots,” according to Barbara Desoer, CEO of Citibank.

September 23 -

A string of natural disasters in Mexico and the Carribean offered a rare test of leadership for Jane Fraser, Citigroup's top executive in the region, but she faced it head-on.

September 23 -

Citi Private Bank has enjoyed double-digit growth in every year since Tracey Brophy Warson took the helm in 2014.

September 23 -

At this year’s Swift Business Forum in New York, executives said banks can build "more intelligent routing" to speed up payments and reduce the cost of processing and delivery.

September 13 -

Bullish update by the accomplished Citi CFO boosts shares; credit bureau may have been distracted by prior incident.

September 13 -

The bank raised its forecasts for profitability and expense reductions, facing down skeptics who have doubted the firm can achieve its financial targets.

September 12 -

Some are relying on a national, digital strategy. Others say the right balance of costs and growth comes from more traditional means such as targeted branch openings and out-of-market expansion.

September 12 -

The "digital asset receipt," similar to ETFs and ATRs, aims to expedite investing in cybercurrencies; CFO is taking the hit for the Dutch bank's lax anti-money laundering controls.

September 11 -

Citigroup is developing a new mechanism for trading cryptocurrencies such as bitcoin that would put it at the forefront of Wall Street's efforts to let clients bet on the largely unregulated market, according to a person with knowledge of the plans.

September 10 -

Agency’s first supervisory report under Mulvaney finds little change; the nonbank lender surpasses Citigroup and Bank of America in home loans.

September 7 -

Citigroup promoted bankers Tyler Dickson and Manolo Falco to run a reconstructed version of its investment banking operations.

September 6 -

Just before the end of summer, several major banks have put new faces in key executive positions.

September 6 -

Mark Mason, the incoming chief financial officer at Citigroup, cut his teeth on the sale of Citi's unwanted assets after the financial crisis.

September 5