Citi

Citi

Citigroup is a global financial services company doing business in more than 100 countries and jurisdictions. Citigroup's operations are organized into two primary segments: the global consumer banking segment and the institutional clients group.

-

The monitoring, which is already in place in the U.S. came after a month-long consultation with U.K. employees.

July 27 -

The license allows New York-based Citigroup to separate the institutional and private bank businesses from its consumer, small-business and middle-market operations in Mexico.

July 24 -

Higher interest rates and larger card balances set the stage for an 11% jump in revenue from U.S. personal banking in the second quarter. That blunted the impact of a 78% surge in write-offs tied to consumer loans.

July 14 -

"I got cut," he told The Bond Buyer. "I'm looking for a new job now."

June 26 -

While the vast majority of staffers are following the firm's rules for hybrid work, the moves are focused on those employees with persistent, unexplained absences.

June 23 -

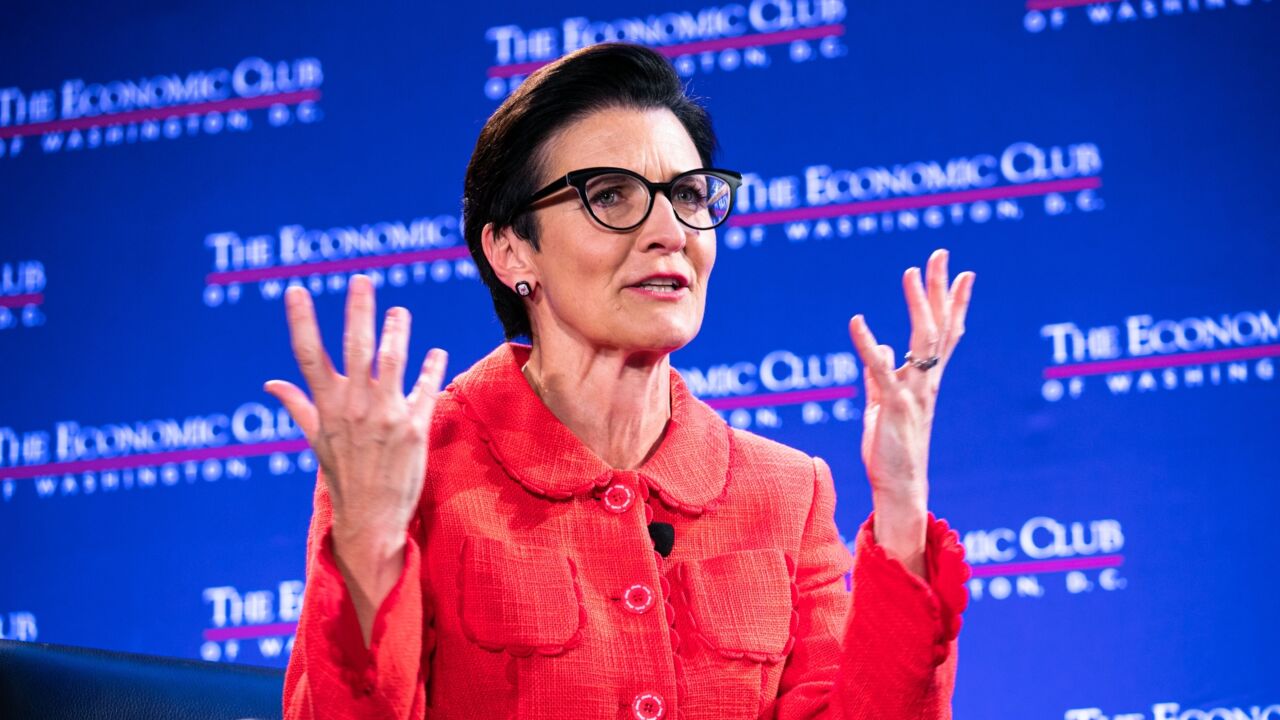

Citigroup CEO Jane Fraser says the company's abrupt decision to abandon a long-running sales process of its Mexican retail operations won't change its medium-term guidance nor the eventual plan to exit the unit and allows stock buybacks to resume.

June 2 -

Citi was unable to reach a deal despite more than a year of talks with a long list of suitors for its consumer, small-business and middle-market banking divisions across Mexico.

May 24 -

The move threatens to upend efforts by the billionaire German Larrea's Grupo Mexico to purchase the retail operations of Banamex, one of the country's oldest banks, from Citigroup.

May 19 -

As fintechs struggle, the bank is introducing a line of credit and plans new installment lending products shortly after launching its buy now/pay later product on Amazon Pay.

May 16 -

Last year, Citi announced that it was looking to dispose of the consumer, small-business and middle-market banking divisions in Mexico, while holding on to the institutional operation.

May 10 -

Citi and many large rivals have already begun trimming positions as they cope with the dealmaking drop that's cut into fees across Wall Street.

May 1 -

Amazon Pay — which provides one-click checkout on thousands of e-commerce sites — has added support for Citi Flex Pay, Citigroup's point-of-sale credit card loans, as competition for buy now/pay later customers expands to digital wallets.

April 27 -

The bank continues to relocate staff following a pause during Covid-19 and is also in the process of moving some products, she said.

April 19 -

Though revenue growth remains a challenge, Citigroup is still committed to its global wealth management expansion plan, CEO Jane Fraser said Friday. Andy Sieg is joining the bank from Merrill Lynch in September as head of global wealth management.

April 14 -

Revenue from fixed-income, currencies and commodities trading unexpectedly rose 4% to $4.5 billion in the first quarter, as clients reacted to changing interest rates, the company says. Net income rose 7% to $4.6 billion.

April 14 -

In a sudden shift, Merrill's leader of the past six years is heading back to rival Citi, where he will be head of global wealth and drive its expansion.

March 30 -

The move comes after rivals Bank of America and Goldman Sachs Group cut CEO pay, while JPMorgan Chase and Wells Fargo left theirs unchanged.

February 22 -

Citigroup has one of the more flexible policies on Wall Street when it comes to remote work. But if a worker's productivity dips, they can expect to spend more time in the office.

January 17 -

-

A hard-fought battle between Citigroup and creditors of Revlon over an epic blunder in which the bank accidentally sent the lenders almost a billion dollars was finally capped with a legal pronouncement: Case dismissed.

December 19