-

Rep. Blaine Luetkemeyer, R-Mo., said Congress has "got to be pushing back" against the Current Expected Credit Losses standard, while Rep. Steve Stivers, R-Ohio, indicated that not all Republicans view the cannabis banking issue the same way.

February 26 -

The banking group issued lawmakers a guide on questions to ask as credit union executives visit Capitol Hill for two days.

February 26 -

The third credit union-related bill introduced this week would cut credit unions’ annual required board meetings to just six times per year.

February 26 -

The debate centers on whether guidance on credit union-bank mergers is necessary.

February 26 -

ICBA outlined a series of questions for lawmakers that would force credit unions to defend the industry's practices during meetings with local representatives.

February 26 -

Recent political controversies are forcing credit unions and industry groups to reconsider their support for lawmakers they previously endorsed.

February 26 -

The regulator completed a thorough process, which included ensuring investors would treat borrowers well, before settling on a buyer.

February 25 -

NCUA board member Mark McWatters defended the agency's position on credit union-bank purchases and called out the ongoing sniping on both sides of the argument.

February 25 -

The Credit Union National Association is submitting a FOIA request to get more information about the National Credit Union Administration's recent portfolio sale, but further action could be necessary if those answers aren't satisfactory.

February 24 -

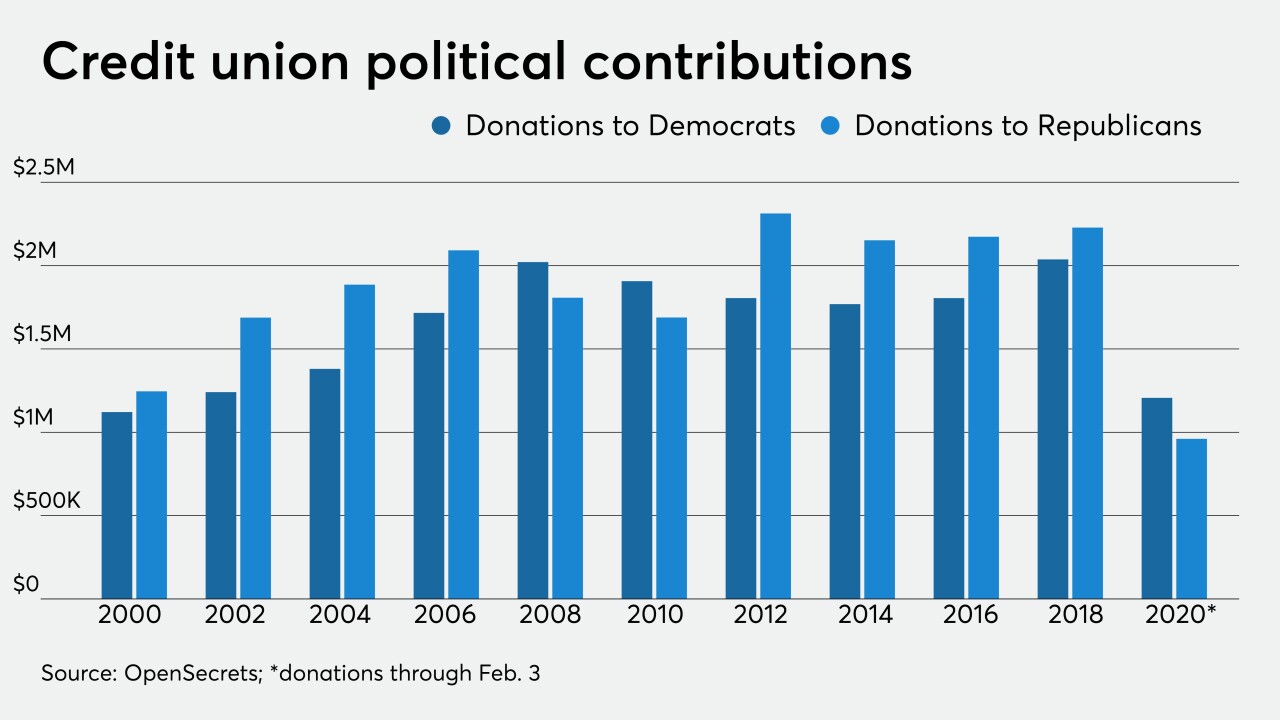

The industry loves to tout its bipartisanship, but it has very publicly embraced the Trump administration at times.

February 24 -

Cybersecurity experts said the trade group's description of the event bears the hallmarks of a ransomware attack, which CUNA subsequently confirmed.

February 6 -

A letter from the Independent Community Bankers of America calls on lawmakers to curtail credit unions' bank-buying spree or at least take measures to ensure parity between the two sides.

January 30 -

Data from the Credit Union National Association indicates the rule has decreased lending and increased costs as institutions work to stay compliant.

January 23 -

In partnership with state leagues, the credit union trade group is committing to $7 million in campaign contributions for the upcoming presidential and congressional contest.

January 16 -

The community bank lobby has said the recent deals are another reason to rein in the credit union sector. Some House members are beginning to take notice.

December 22 -

An appeals court on Thursday denied bank groups an en banc hearing from all 11 appellate judges, but bankers said Friday that they're considering taking the case to the Supreme Court.

December 13 -

House and Senate lawmakers have denied a push by banking groups to grant banks the rent-free access to military installations that credit unions have.

December 10 -

The National Credit Union Administration board pushed back against criticisms about its rising budget by noting its oversight is still cheaper than that provided by other financial agencies.

November 20 -

A similar bill was introduced into the House earlier this year and both pieces of legislation have have bipartisan support.

November 13 -

As Cybersecurity Awareness Month draws to a close, Credit Union Journal queried industry leaders about the biggest threats facing their institutions.

October 29