-

Coca-Cola Co.’s ‘Share a Coke’ campaign saw the beverage maker turn to Experian to help it pick the most popular names among likely soda drinkers in Britain, and printed them where its iconic logo is usually placed.

December 3 -

A new credit score that includes consumers' cash flow alongside their credit score is winning praise for its potential to help expand access to credit, but some worry it gives the credit bureaus even more data that could be compromised.

October 23 -

In a move designed to improve access to financial products for consumers with low credit scores and short credit histories, Experian, FICO and Finicity are developing an "UltraFICO" score that lets individuals share checking and savings account data and help lenders better assess risk.

October 22 -

Even as online shoppers demand the best security, they demonstrate an astonishingly low tolerance for inconvenience.

September 12 -

The charge calls into question the speed of the turnaround under CEO Brian Duperreault; the payout will be the Scottish bank’s first since the financial crisis.

August 3 -

Allowing alternative data such as rent and utility payments has bipartisan support, but some say it could create more problems than it solves.

July 30 -

As smaller screens and internet-of-things devices become more prominent, credit providers will have to find a way to accept personal information without the convenience of a terminal and keyboard.

July 30 -

Senators at a hearing Thursday discussed a bill establishing an online portal for consumers to monitor their credit reports free of cost.

July 12 -

Terms on car loans continue to lengthen in an attempt to keep monthly payments manageable for consumers, but one expert warns that at some point they're going to impact affordability.

June 4 -

Supporters say pending legislation would help consumers with little or no credit history. But the bill would instead roll back key consumer protections.

May 15 Pennsylvania Utility Law Project

Pennsylvania Utility Law Project -

Some speculate that the banks who do business with credit reporting agencies may be looking for alternatives after mounting concerns about their ability to keep information private. But breaking up is hard to do.

April 4 -

Some fear that the removal of such data from individual credit reports could lead lenders to believe a consumer is a better bet than they really are.

April 2 -

Legacy financial firms like the big credit bureau are seeking out financial technology to diversify themselves, bring new products to market faster and meet the needs of global customers.

March 15 -

Use of alternative data in traditional credit scoring would help consumers access the banking system and lower their cost of credit.

March 15LendUp -

Calls for less reliance on credit bureaus and Social Security numbers for verification are leading many to envision a future of identity on a distributed ledger.

October 30 -

Sen. Elizabeth Warren, D-Mass., called for bipartisan action against Equifax during a Senate floor speech on Tuesday, criticizing the credit bureau for waiting several weeks after a massive data breach to reveal it to the public.

September 19 -

The Equifax breach has millions of Americans now thinking about freezing their credit to guard against identity theft. But those who act could be cutting themselves off from the nation's vast credit economy.

September 19 -

Efforts to persuade regulators to allow Fannie Mae and Freddie Mac to use alternative credit scores would stifle competition between the credit bureaus and FICO and do little to expand access to credit, according to industry analyst Chris Whalen.

September 18 -

Rep. Carolyn Maloney, D-N.Y., sent a letter to the top executives at TransUnion and Experian on Wednesday asking them what steps they are taking to safeguard consumer data in light of the Equifax breach.

September 13 -

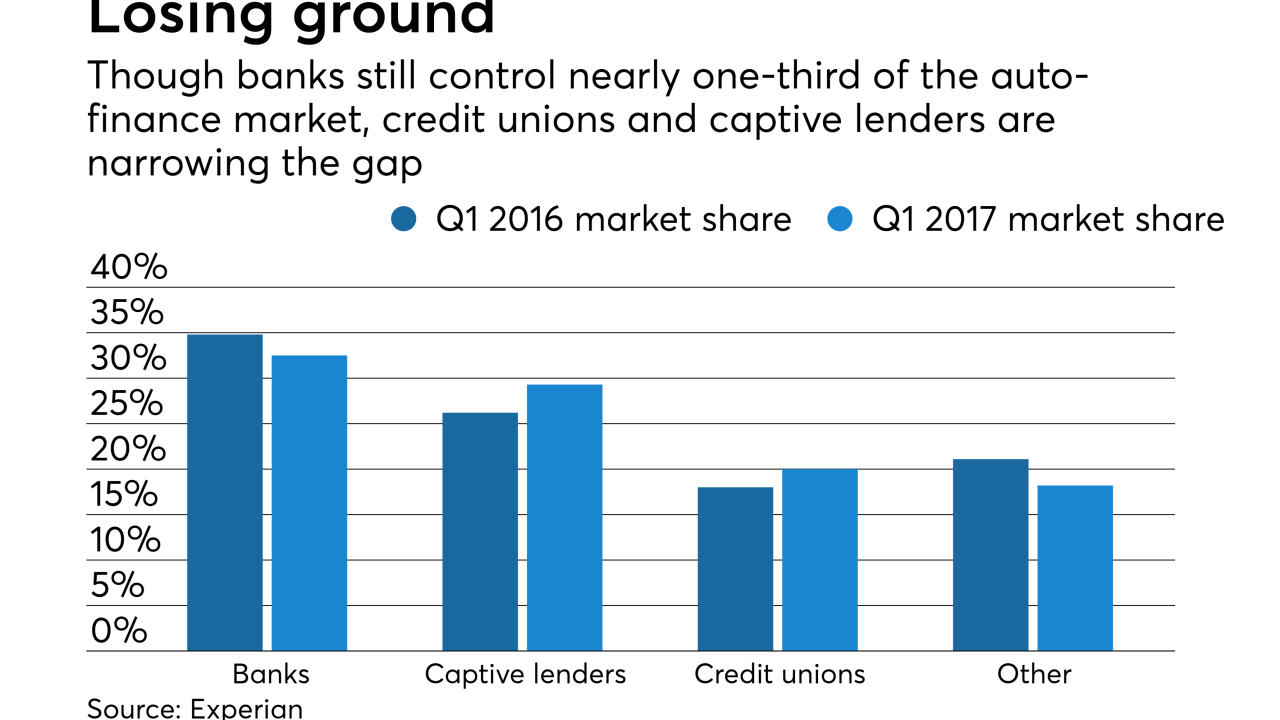

Large banks have scaled back lending as competition has intensified and credit unions and financing arms of car manufacturers are picking up the slack.

June 8