-

The e-commerce leader’s return to the drawing board alleviates immediate concerns about its banking plans. But the company intends to reapply, and it will be harder for the industry to persuade policymakers to block industrial loan companies more broadly.

August 26 -

The agencies completed steps to ease a community bank capital measure temporarily and to delay a new credit-loss accounting standard.

August 26 -

The $18.8 billion in net income was 70% less than a year earlier as the uncertain economic picture and new accounting rules drove a sharp rise in provisions for future losses.

August 25 -

A group of eight Attorneys General filed suit against an FDIC final rule related to ‘rent-a-bank’ partnerships, mirroring a similar suit filed against the Office of the Comptroller of the Currency last month.

August 20 -

The Japanese conglomerate first applied for deposit insurance in July 2019 and again in May 2020.

August 18 -

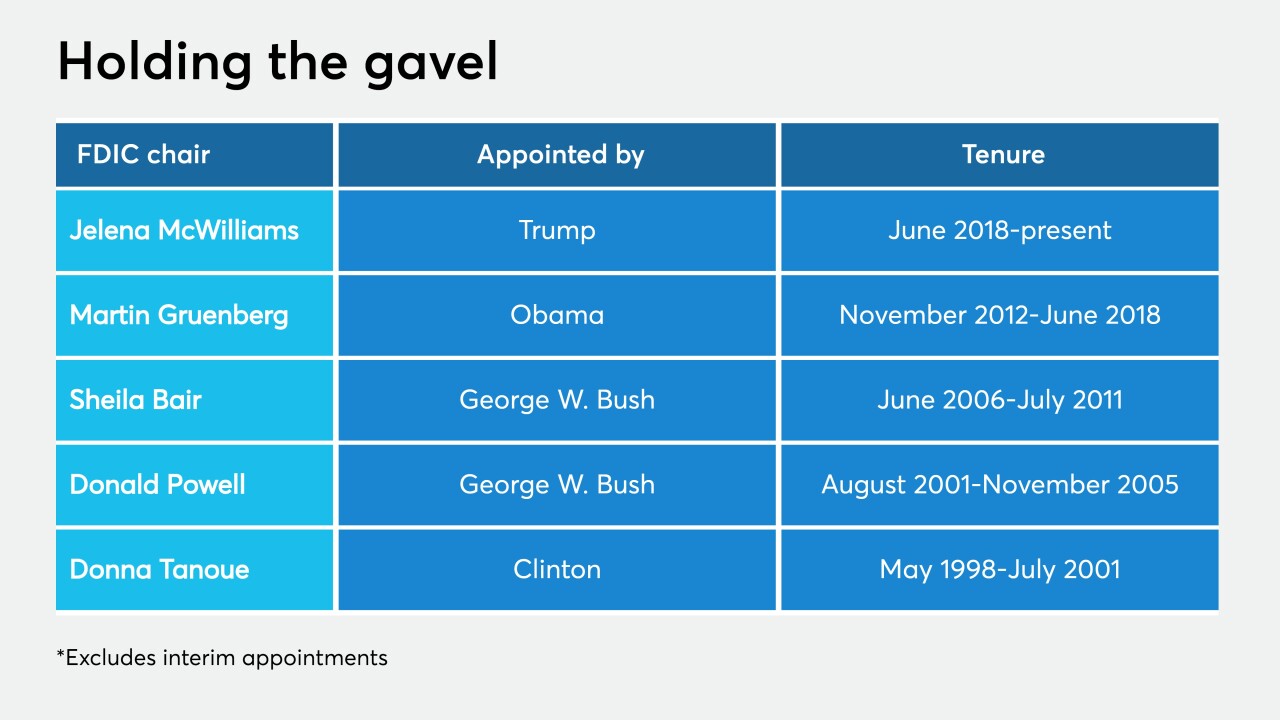

Jelena McWilliams's term as FDIC chair expires in 2023, and she cannot be removed by an incoming president. But if Joe Biden prevails, he may ask her to stay — and if she does, governing a Democratic-majority board would be a very different proposition.

August 18 -

The federal banking agencies clarified that minor violations of Bank Secrecy Act rules will typically not result in a cease-and-desist order.

August 13 -

As more consumers do business online, some deposits are being unfairly categorized as brokered, inviting burdensome regulatory scrutiny.

August 7 American Bankers Association

American Bankers Association -

Whoever wins the White House in November may have immediate agency openings to fill, while a key decision looms about who will run the Federal Reserve after Jerome Powell’s term expires in 2022.

August 7 -

First Bank of Central Ohio would be based near Columbus, where another group opened a bank last year.

August 4