-

Backers of lawsuits challenging federal charter and interest rate policies for nonbanks say states are sticking up for consumer protection. Others say the legal quagmire could slow efforts to improve the regulatory framework.

September 1 -

The division asked for public feedback as it weighs changes "to reflect emerging trends in the banking and financial services sector."

September 1 -

The Justice Department alleges that the bankers worked with “higher-ranking bank officials” at Washington Federal Bank for Savings in Chicago to falsify records and hide funds before the bank's December 2017 collapse.

August 29 -

The e-commerce leader’s return to the drawing board alleviates immediate concerns about its banking plans. But the company intends to reapply, and it will be harder for the industry to persuade policymakers to block industrial loan companies more broadly.

August 26 -

The agencies completed steps to ease a community bank capital measure temporarily and to delay a new credit-loss accounting standard.

August 26 -

The $18.8 billion in net income was 70% less than a year earlier as the uncertain economic picture and new accounting rules drove a sharp rise in provisions for future losses.

August 25 -

A group of eight Attorneys General filed suit against an FDIC final rule related to ‘rent-a-bank’ partnerships, mirroring a similar suit filed against the Office of the Comptroller of the Currency last month.

August 20 -

The Japanese conglomerate first applied for deposit insurance in July 2019 and again in May 2020.

August 18 -

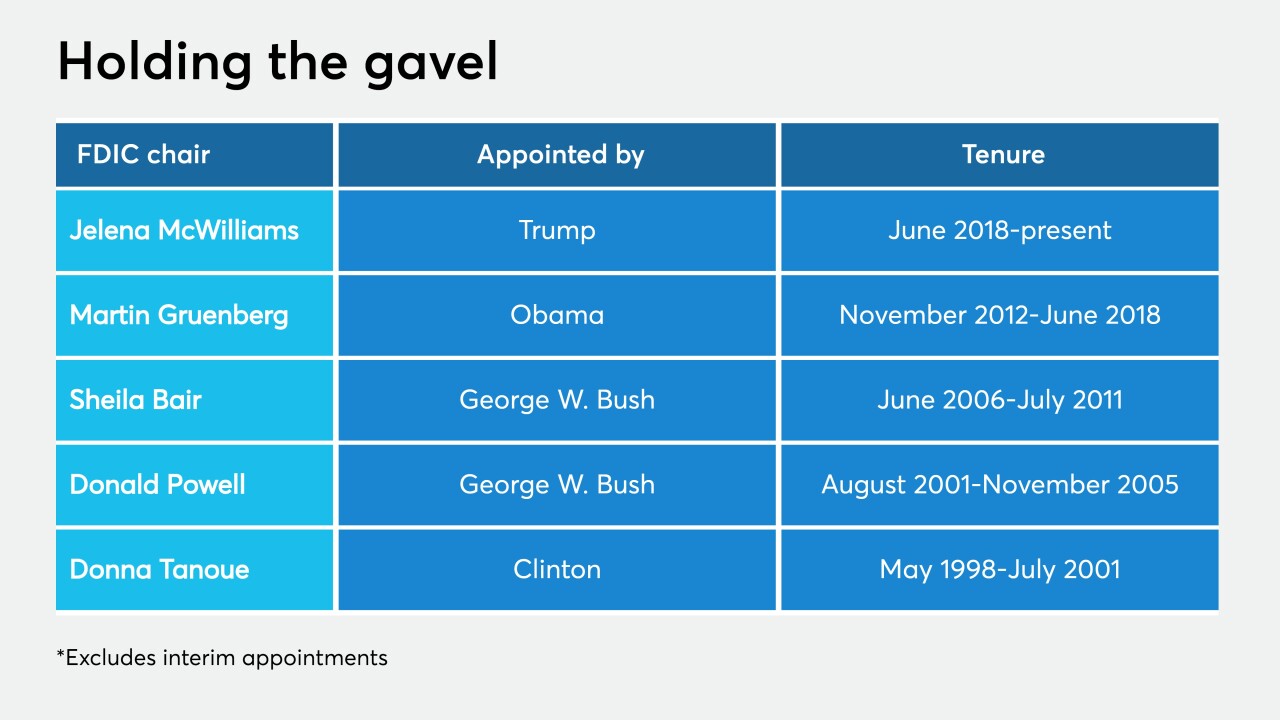

Jelena McWilliams's term as FDIC chair expires in 2023, and she cannot be removed by an incoming president. But if Joe Biden prevails, he may ask her to stay — and if she does, governing a Democratic-majority board would be a very different proposition.

August 18 -

The federal banking agencies clarified that minor violations of Bank Secrecy Act rules will typically not result in a cease-and-desist order.

August 13 -

As more consumers do business online, some deposits are being unfairly categorized as brokered, inviting burdensome regulatory scrutiny.

August 7 American Bankers Association

American Bankers Association -

Whoever wins the White House in November may have immediate agency openings to fill, while a key decision looms about who will run the Federal Reserve after Jerome Powell’s term expires in 2022.

August 7 -

First Bank of Central Ohio would be based near Columbus, where another group opened a bank last year.

August 4 -

For too long, nonbanks have been allowed to form industrial loan companies to operate as banks without Fed oversight. This regulatory pass should not be given during a crisis.

July 31 Calvert Advisers LLC

Calvert Advisers LLC -

Two trade organizations and a consumer group urged lawmakers to establish a three-year moratorium to block the charter bids of companies that they said were attempting to skirt regulatory requirements.

July 29 -

The regulation allows banks to add employees with past convictions for trivial crimes after the industry complained the prior rules were too severe.

July 24 -

Peoples Bank in Arkansas once used brokered deposits to fund more loans to underserved borrowers. It could do so again if Congress loosens restrictions, says CEO Mary Fowler.

July 22 Peoples Bank

Peoples Bank -

The agency's request for information seeks comment on the idea of the FDIC partnering with a standards-setting organization to develop best practices for technology firms, among other things.

July 20 -

The White House's efforts to loosen equality requirements in lending run counter to the widespread demand for racial justice. Congress must act.

July 20 George Washington University

George Washington University -

The proposed Chicago de novo would focus on serving female entrepreneurs.

July 16